PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741028

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741028

Oil Immersed Fixed Shunt Reactor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

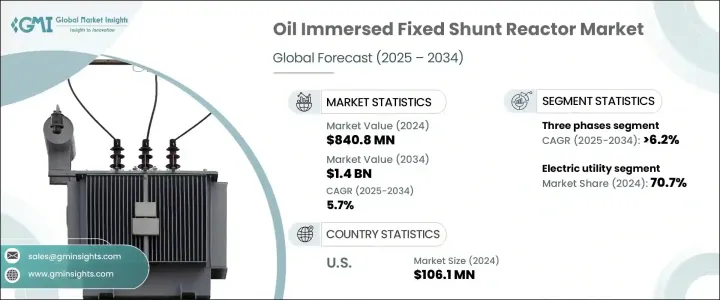

The Global Oil Immersed Fixed Shunt Reactor Market was valued at USD 840.8 million in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 1.4 billion by 2034, driven by the ongoing pace of industrialization and urban development in rapidly emerging nations fueling a surge in electricity consumption. The global power grid is undergoing a major transformation, where rising urban populations, expanding infrastructure, and accelerated economic activities are putting immense pressure on energy systems. Governments and private stakeholders are focusing on modernizing and expanding transmission and distribution networks to meet growing power demands without compromising stability or efficiency. Oil-immersed fixed shunt reactors are becoming a fundamental part of this evolution, as they offer a cost-effective solution to maintain voltage levels, limit over-voltages, and manage reactive power across the grid. As industries shift toward high-voltage transmission and interconnection of renewable energy sources, the demand for shunt reactors is witnessing a noticeable upswing. These devices play a vital role in minimizing losses and enhancing grid reliability, which is crucial for meeting the power quality expectations of modern economies.

You're looking at a market that's not only growing due to increased energy consumption but also evolving in response to how power is being generated and distributed. As countries scale up their economic and urban infrastructure, they require robust and efficient power transmission systems. That rising energy demand, especially across manufacturing hubs and new urban settlements, is pushing serious investment toward reactive power compensation equipment-driving the adoption of oil-immersed fixed shunt reactors across utility-scale projects. Industry players are witnessing strong tailwinds as power grids increasingly integrate variable energy sources like solar and wind, which often cause voltage and reactive power fluctuations. This makes fixed shunt reactors essential for voltage control, making them a core part of future-ready grid systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $840.8 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 5.7% |

One of the major growth drivers here is the global shift to renewables. With clean energy sources like wind and solar being added to national grids, their intermittent nature often results in instability. That's where oil-immersed fixed shunt reactors come in-they provide a much-needed balancing mechanism by correcting voltage swings and reactive power variations. As more countries aim for carbon-neutral targets, these reactors are securing their position as mission-critical assets in grid modernization strategies. Developed and developing nations alike are recognizing the need to replace or upgrade aging power infrastructure, and fixed shunt reactors are front and center in these capital-intensive upgrade plans. Utilities are deploying them to ensure uninterrupted energy transmission and enhanced operational stability in a dynamically evolving grid environment.

The three-phase segment is expected to post a strong CAGR of 6.2% through 2034, thanks to its unmatched utility in stabilizing voltage across long-distance, high-voltage transmission lines. As power grids grow more interconnected and are required to manage higher loads from variable renewable sources, three-phase oil-immersed shunt reactors are becoming indispensable for optimizing power flow and preventing energy losses. These reactors are specifically engineered to handle complex load patterns and help maintain continuous operation of transmission systems in high-demand scenarios. Utilities are integrating them as part of smart grid initiatives and infrastructure expansion projects, viewing them as essential tools to future-proof their networks.

Looking at applications, the electric utility segment led the global market with a commanding 70.7% share in 2024, and that dominance isn't going away anytime soon. This momentum is being fueled by increasing energy requirements driven by industrial growth, urban sprawl, and the ongoing digitization of power systems. Electric utilities are investing in solutions that reduce transmission losses, stabilize voltage levels, and maintain grid efficiency-and fixed shunt reactors check all those boxes. These components support the safe, stable, and uninterrupted operation of energy distribution, which is why they've become a top priority for grid operators.

The United States Oil Immersed Fixed Shunt Reactor Market reached a valuation of USD 106.1 million in 2024, and the growth trajectory remains steady as innovation in product design and technology continues to pick up pace. Key manufacturers are rolling out next-gen reactor models with enhanced thermal efficiency, reduced operational noise, and extended service life. This product advancement is also getting a boost from both federal and state-level programs aimed at upgrading the country's aging transmission infrastructure. With growing investments in smart grid projects and sustainability-focused energy reforms, the US is solidifying its role as a major contributor to global market growth.

Leading players in the global oil-immersed fixed shunt reactor market include Hitachi Energy Ltd., GE, Siemens Energy, NISSIN ELECTRIC Co., Ltd., GBE S.p.A, Toshiba Energy Systems & Solutions Corporation, CG Power & Industrial Solutions Ltd., HYOSUNG HEAVY INDUSTRIES, Fuji Electric Co., Ltd., SGB SMIT, GETRA S.p.A., Shrihans Electricals Pvt. Ltd., TMC TRANSFORMERS MANUFACTURING COMPANY, and WEG. These companies are expanding their global manufacturing footprints, accelerating R&D to deliver advanced and grid-specific reactor designs, and partnering with utilities and EPC firms to drive tailored solutions in regional markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Single phase

- 5.3 Three phase

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Electric utility

- 6.3 Renewable energy

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 CG Power & Industrial Solutions Ltd.

- 8.2 Fuji Electric Co., Ltd.

- 8.3 GBE S.p.A

- 8.4 GE

- 8.5 GETRA S.p.A.

- 8.6 Hitachi Energy Ltd.

- 8.7 HYOSUNG HEAVY INDUSTRIES

- 8.8 NISSIN ELECTRIC Co., Ltd.

- 8.9 Shrihans Electricals Pvt. Ltd.

- 8.10 Siemens Energy

- 8.11 SGB SMIT

- 8.12 TMC TRANSFORMERS MANUFACTURING COMPANY

- 8.13 Toshiba Energy Systems & Solutions Corporation

- 8.14 WEG