PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750554

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750554

Cement Waste Heat Recovery System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

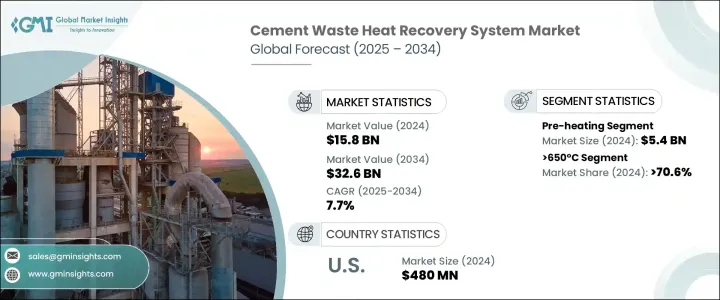

The Global Cement Waste Heat Recovery System Market was valued at USD 15.8 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 32.6 billion by 2034. The cement manufacturing process is one of the most energy-intensive industrial operations, with massive quantities of heat generated and often lost during production. Waste heat recovery systems are emerging as an essential solution to capture this unused thermal energy and redirect it toward power generation or process heating, resulting in substantial cost savings and reduced reliance on external energy sources. As cement manufacturers continue to face pressure to optimize energy consumption, minimize emissions, and increase profit margins, the demand for energy-efficient systems is experiencing steady growth. These recovery solutions play a critical role in improving plant efficiency by reducing the amount of fuel needed for operations while enhancing overall sustainability metrics. Their adoption is being further boosted by environmental mandates and regulatory frameworks encouraging the use of cleaner technologies in heavy industries.

Waste heat recovery systems find application across several stages of the cement production process. Key application areas include pre-heating, electricity and steam generation, and other process enhancements. Among these, the pre-heating segment accounted for USD 5.4 billion in 2024. This segment involves recovering high-temperature exhaust gases to heat raw materials before they enter the kiln. Utilizing this approach significantly cuts down on fuel consumption, shortens production times, and improves operational efficiency. By optimizing energy reuse at earlier stages of production, manufacturers are able to maintain consistent output while trimming down overall production costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $32.6 Billion |

| CAGR | 7.7% |

In terms of temperature categories, the market is segmented into systems operating at 230°C, between 230°C and 650°C, and those above 650°C. The segment capturing temperatures greater than 650°C held the largest revenue share in 2024, accounting for more than 70.6% of the global market. These high-temperature systems are particularly effective for cement plants due to the extreme heat levels generated during the clinker production stage. Meanwhile, systems that operate at lower temperatures are generally implemented for tasks such as material pre-drying or ambient space heating within facilities. While they do not offer the same level of energy recapture as high-temperature systems, they are relatively simple and budget-friendly, making them a practical option for smaller-scale cement operations that still aim to reduce energy costs without undertaking large capital expenditures.

In North America, the United States has shown a steady increase in the adoption of cement waste heat recovery systems. Market valuation in the country grew from USD 440 million in 2022 to USD 460 million in 2023 and reached USD 480 million in 2024. A growing emphasis on reducing carbon emissions, along with aging cement infrastructure, is encouraging companies to upgrade to more energy-efficient systems. Federal support and incentives are also playing a vital role in driving the integration of heat recovery technologies into older plants. As companies strive to meet energy compliance requirements and enhance operational output, the adoption of advanced thermal energy recovery systems continues to rise.

The global cement waste heat recovery system market is moderately consolidated, with a few key players holding a significant portion of the industry share. Leading companies such as Siemens Energy, Mitsubishi Heavy Industries, Ltd., Thermax Limited, and Kawasaki Heavy Industries Ltd. collectively accounted for approximately 30% of the market share in 2024. These companies focus on delivering high-efficiency systems capable of converting heat generated from cement kilns into usable electricity or steam. Their offerings support cement producers in minimizing energy waste while helping them meet international standards for energy efficiency and emissions reduction. Through technological innovation and customized solutions, these manufacturers are instrumental in shaping the future of energy use in the cement industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Industry impact forces

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Pre-heating

- 5.3 Electricity & steam generation

- 5.3.1 Steam rankine cycle

- 5.3.2 Organic rankine cycle

- 5.3.3 Kalina cycle

- 5.4 Other

Chapter 6 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 230°C

- 6.3 230°C - 650 °C

- 6.4 > 650 °C

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 AURA

- 8.2 Bosch Industriekessel GmbH

- 8.3 Climeon

- 8.4 CTP TEAM S.R.L

- 8.5 Cochran

- 8.6 Forbes Marshall

- 8.7 IHI Corporation

- 8.8 John Wood Group PLC

- 8.9 Kawasaki Heavy Industries Ltd.

- 8.10 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 8.11 Promec Engineering

- 8.12 Sofinter S.p.a

- 8.13 Siemens Energy

- 8.14 Turboden S.p.A.

- 8.15 Thermax Limited