PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755244

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755244

U.S. Pick-up Trucks Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

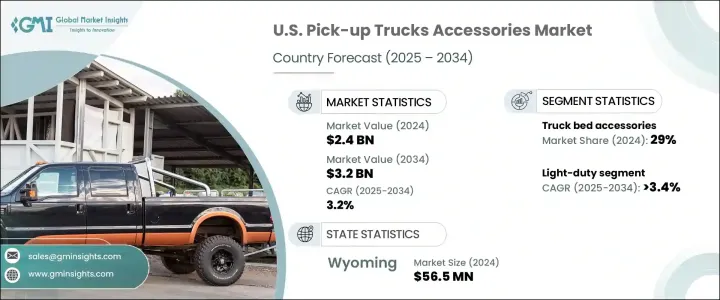

U.S. Pick-Up Trucks Accessories Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 3.2% to reach USD 3.2 billion by 2034. The market growth is fueled by the increasing popularity of off-roading and outdoor recreational activities, which drive demand for accessories that enhance vehicle performance in tough environments. Products like lift kits, all-terrain tires, roof racks, and skid plates are especially popular among consumers who use their trucks for activities such as camping and trail driving. Pickup trucks are favored for their robustness and adaptability, making them ideal for rugged landscapes.

The market also benefits from the rising sales of full-size models, including popular trucks that offer both personal and commercial use, prompting more consumers to customize their vehicles. Tech-integrated accessories, such as backup cameras, Bluetooth-enabled towing aids, and smart lighting systems, are also gaining traction, particularly among tech-savvy truck owners. These products cater to consumers seeking convenience, safety, and improved connectivity, with modern full-size truck buyers expecting these high-tech features as part of their vehicle upgrades.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 3.2% |

In 2024, the truck bed accessories segment accounted for the largest share, with 29%, and is projected to continue growing at a CAGR of 3.5% through 2034. The popularity of bed accessories, such as tonneau covers, bed liners, and cargo racks, can be attributed to their practical benefits, which enhance the truck's functionality and protection. These accessories are essential for truck owners who use their vehicles for work and recreation, including those in construction, farming, and outdoor activities. The versatility of these products, ranging from budget-friendly options to premium, weatherproof covers, broadens their appeal across different consumer segments.

The light-duty truck segment dominated the market with a 77% share in 2024 and is expected to grow at a CAGR of 3.4% during 2025-2034. Light-duty trucks, including popular models, are typically used for both personal and light commercial purposes, driving demand for a variety of accessories such as towing kits, running boards, and bed liners. Their versatility, better fuel efficiency compared to heavy-duty trucks, and suitability for both urban and rural use make them a favored choice for consumers. The growing popularity of light-duty trucks, especially among those seeking recreational options such as camping and commuting, has spurred the demand for customization options that reflect individual styles and preferences.

Wyoming Pick-Up Trucks Accessories Market held a 2.3% share and generated USD 56.5 million in 2024. The state has the highest per capita pickup truck ownership, driven by its rural landscape and the presence of industries such as agriculture, mining, and outdoor recreation. Due to these factors, Wyoming residents frequently use their trucks for hauling, towing, and off-roading activities. In this region, durability and functionality take precedence over aesthetics, with a focus on heavy-duty bed liners, weather-resistant covers, and off-road lighting. Local retailers and specialized dealerships dominate distribution, although e-commerce is gaining traction among remote buyers who seek convenience.

Key players in the U.S. Pickup Trucks Accessories Market include WeatherTech, Husky Liners, A.R.E. Accessories, Dee Zee, Extang, Bilstein, RealTruck, LEER, Rough Country, and WARN Industries. To strengthen their position in the U.S. pickup truck accessories market, companies are adopting several key strategies. They are focusing on expanding their product offerings, with innovations that cater to the growing demand for tech-integrated, high-performance accessories, such as smart lighting and Bluetooth-enabled systems. Additionally, they are leveraging e-commerce platforms to reach a broader consumer base, particularly in rural and remote areas where access to physical retail stores may be limited. Collaborations with major truck manufacturers to offer bundled accessories or aftermarket upgrades are also becoming increasingly popular. Companies are focusing on sustainability by incorporating eco-friendly materials in their products and packaging, which resonates with the growing trend of environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product

- 2.2.2 Vehicle

- 2.2.3 Sales channel

- 2.2.4 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing popularity of off-roading and outdoor activities

- 3.2.1.2 Rising popularity of vehicle personalization

- 3.2.1.3 Increasing pickup truck sales, particularly full-size models

- 3.2.1.4 Expansion of e-commerce platforms for aftermarket accessories

- 3.2.1.5 Technological advancements in accessories

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of premium accessories

- 3.2.2.2 Skilled installation requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Electrification of pickup trucks

- 3.2.3.2 Integration of IoT-enabled and connected accessories

- 3.2.3.3 Ongoing demand for rugged and durable accessories in rural and adventure travel

- 3.2.3.4 Offering bundled accessory packages or subscription models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Truck bed accessories

- 5.2.1 Tonneau covers

- 5.2.2 Bed liners

- 5.2.3 Toolboxes

- 5.2.4 Bed racks and extenders

- 5.2.5 Tailgate seals & mats

- 5.3 Exterior accessories

- 5.3.1 Grille guards & bull bars

- 5.3.2 Bumpers

- 5.3.3 Running boards & nerf bars

- 5.3.4 Fender flares

- 5.3.5 Bug deflectors

- 5.3.6 Light bars & auxiliary lighting

- 5.4 Interior accessories

- 5.4.1 Floor mats

- 5.4.2 Seat covers

- 5.4.3 Dashboard covers

- 5.4.4 Infotainment systems

- 5.4.5 Storage organizers

- 5.5 Performance accessories

- 5.5.1 Suspension & lift kits

- 5.5.2 Air intakes

- 5.5.3 Exhaust systems

- 5.5.4 Tuners & programmers

- 5.5.5 Braking systems

- 5.6 Towing & hauling accessories

- 5.6.1 Trailer hitches

- 5.6.2 Tow hooks

- 5.6.3 Weight distribution systems

- 5.6.4 Brake controllers

- 5.7 Wheels & tires

- 5.7.1 Off-road tires

- 5.7.2 Custom wheels/rims

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Light-duty

- 6.3 Heavy-duty

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM (Original Equipment Manufacturer)

- 7.3 Aftermarket

- 7.3.1 Online retailers

- 7.3.2 Direct stores

- 7.3.3 Dealerships

- 7.3.4 Specialty installers

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Individual consumers

- 8.3 Commercial users

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Alabama

- 9.3 Alaska

- 9.4 Arizona

- 9.5 Arkansas

- 9.6 California

- 9.7 Colorado

- 9.8 Florida

- 9.9 Georgia

- 9.10 Idaho

- 9.11 Illinois

- 9.12 Indiana

- 9.13 Iowa

- 9.14 Kansas

- 9.15 Kentucky

- 9.16 Louisiana

- 9.17 Maine

- 9.18 Michigan

- 9.19 Minnesota

- 9.20 Mississippi

- 9.21 Missouri

- 9.22 Montana

- 9.23 Nebraska

- 9.24 Nevada

- 9.25 New Mexico

- 9.26 North Carolina

- 9.27 North Dakota

- 9.28 Ohio

- 9.29 Oklahoma

- 9.30 Oregon

- 9.31 Pennsylvania

- 9.32 South Carolina

- 9.33 South Dakota

- 9.34 Tennessee

- 9.35 Texas

- 9.36 Utah

- 9.37 Virginia

- 9.38 Washington

- 9.39 West Virginia

- 9.40 Wisconsin

- 9.41 Wyoming

- 9.42 Rest of U.S.

Chapter 10 Company Profiles

- 10.1 A.R.E. Accessories

- 10.2 Bilstein

- 10.3 Borla Performance Industries

- 10.4 Dee Zee

- 10.5 EGR USA

- 10.6 Extang

- 10.7 Fab Fours

- 10.8 Husky Liners

- 10.9 LEER

- 10.10 LINE-X

- 10.11 MBRP

- 10.12 Ranch Hand

- 10.13 RealTruck

- 10.14 Retrax

- 10.15 Rhino Linings

- 10.16 Rough Country

- 10.17 Thule Group

- 10.18 WARN Industries

- 10.19 WeatherTech

- 10.20 Westin Automotive