PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766192

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766192

Europe Pickup Truck Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

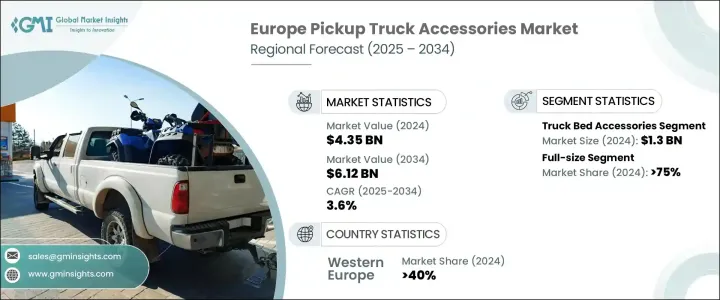

Europe Pickup Truck Accessories Market was valued at USD 4.35 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 6.12 billion by 2034. The market is evolving as industry players continue to adapt to regulatory shifts, new vehicle technologies, and shifting consumer expectations. Automakers are rolling out updated pickup models equipped with more configuration options, built-in charging solutions, and enhanced storage systems. These developments open doors for accessory makers to design products compatible with next-generation drivetrains and vehicle architectures. As more hybrid and electric pickups hit the road, demand for innovative, environmentally friendly accessories is climbing.

Companies are taking this opportunity to develop product lines tailored specifically to electric and hybrid platforms. Enhanced emissions regulations, improvements in battery tech, and broader environmental concerns are contributing to the ongoing transition toward electric-powered vehicles. Accessories such as lightweight covers, energy-efficient bed lighting, wind-reducing designs, and battery-integrated systems are in high demand. Consumers are also increasingly focused on sustainable upgrades that align with the low-emission profile of modern pickups, creating strong momentum for green-focused accessory offerings throughout Europe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.35 Billion |

| Forecast Value | $6.12 Billion |

| CAGR | 3.6% |

In 2024, the truck bed accessories category brought in USD 1.3 billion. Rising demand from sectors like logistics, field services, and construction is encouraging more buyers to invest in practical bed enhancements, including toolboxes, bed liners, storage drawers, and cargo management systems. These upgrades help protect equipment and ensure better utility and efficiency. The growing interest in recreational travel across Europe is also a contributing factor. Many pickup owners are adding camping gear, rooftop racks, and modular storage to adapt their trucks for leisure and adventure use. As small and medium-sized businesses continue to turn to pickups for both daily work and transportation needs, maximizing bed functionality has become a top priority for both commercial and private users.

The full-size pickups segment held a 75% share in 2024, and this segment is projected to maintain strong momentum. Increasing investment in EV infrastructure and battery development is transforming these trucks from conceptual models into everyday road-ready vehicles. Enhanced performance capabilities like fast charging, long-range capacity, and instant torque are making full-size electric trucks a viable alternative. These features, along with financial incentives and regulatory pressure for cleaner fleets, are driving the shift toward low-emission pickup solutions. Many urban and commercial users are now adopting electric full-size pickups as they deliver both power and sustainability without compromising hauling capabilities or operational range.

Western Europe Pickup Truck Accessories Market held a 40% share in 2024, driven by strong regional supply networks and the presence of major vehicle manufacturers. Countries such as France, Germany, and the Netherlands benefit from advanced logistics and production systems, making them well-positioned to support the rapid development and distribution of accessories. The established industrial infrastructure also accelerates product innovation and ensures quicker response to market trends. Strict regulatory frameworks surrounding emissions, safety, and weight capacity in this region are boosting demand for functional accessories such as reinforced bed liners, load management tools, and towing systems built for compliance and durability.

Key players in the Europe Pickup Truck Accessories Market include Mountain Top Industries, RealTruck, Stellantis, Truckman, GM, BEDSLIDE, Aeroklas Europe, Ford, Rhino Products, and Carryboy. To secure and strengthen their market position, companies in the Europe pickup truck accessories sector are actively engaging in strategic collaborations, acquisitions, and product launches. Many are focusing on expanding product compatibility with electric and hybrid trucks by investing in R&D that emphasizes energy efficiency, modularity, and environmental responsibility. Businesses are also scaling their presence through regional partnerships that improve supply chain efficiency and accelerate product delivery. Innovation is key, with companies integrating advanced materials and digital technologies into their offerings to enhance performance and aesthetics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Size

- 2.2.4 Sales Channel

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing customization trends among European pickup owners

- 3.2.1.2 Expanding leisure and adventure tourism using pickups

- 3.2.1.3 Rising adoption of electric and hybrid pickup trucks

- 3.2.1.4 Technological innovations in vehicle accessory design

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Strict EU regulations on vehicle modifications

- 3.2.2.2 High cost of premium aftermarket accessories

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for EV-compatible pickup accessories

- 3.2.3.2 Expansion of e-commerce platforms for aftermarket sales

- 3.2.3.3 Collaboration with OEMs for accessory co-branding

- 3.2.3.4 Demand for multifunctional, modular accessory systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Western Europe

- 3.4.2 Eastern Europe

- 3.4.3 Southern Europe

- 3.4.4 Northern Europe

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Western Europe

- 4.2.2 Eastern Europe

- 4.2.3 Southern Europe

- 4.2.4 Northern Europe

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Truck bed accessories

- 5.2.1 Tonneau covers

- 5.2.2 Bed liners

- 5.2.3 Toolboxes

- 5.2.4 Bed racks and extenders

- 5.2.5 Tailgate seals & mats

- 5.3 Exterior accessories

- 5.3.1 Grille guards & bull bars

- 5.3.2 Bumpers

- 5.3.3 Running boards & nerf bars

- 5.3.4 Fender flares

- 5.3.5 Bug deflectors

- 5.3.6 Light bars & auxiliary lighting

- 5.4 Interior accessories

- 5.4.1 Floor mats

- 5.4.2 Seat covers

- 5.4.3 Dashboard covers

- 5.4.4 Infotainment systems

- 5.4.5 Storage organizers

- 5.5 Performance accessories

- 5.5.1 Suspension & lift kits

- 5.5.2 Air intakes

- 5.5.3 Exhaust systems

- 5.5.4 Tuners & programmers

- 5.5.5 Braking systems

- 5.6 Towing & hauling accessories

- 5.6.1 Trailer hitches

- 5.6.2 Tow hooks

- 5.6.3 Weight distribution systems

- 5.6.4 Brake controllers

- 5.7 Wheels & tires

- 5.8 Off-road tires

- 5.9 Custom wheels/rims

Chapter 6 Market Estimates & Forecast, By Size, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Full-size

- 6.3 Mid-size

- 6.4 Compact

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 OEM (Original Equipment Manufacturer)

- 7.3 Aftermarket

- 7.3.1 Online retailers

- 7.3.2 Direct stores

- 7.3.3 Dealerships

- 7.3.4 Specialty installers

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Individual consumers

- 8.3 Commercial users

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Western Europe

- 9.2.1 Germany

- 9.2.2 Austria

- 9.2.3 France

- 9.2.4 Switzerland

- 9.2.5 Belgium

- 9.2.6 Luxembourg

- 9.2.7 Netherlands

- 9.2.8 Portugal

- 9.3 Eastern Europe

- 9.3.1 Poland

- 9.3.2 Romania

- 9.3.3 Czechia

- 9.3.4 Slovenia

- 9.3.5 Hungary

- 9.3.6 Bulgaria

- 9.3.7 Slovakia

- 9.3.8 Croatia

- 9.4 Northern Europe

- 9.4.1 UK

- 9.4.2 Denmark

- 9.4.3 Sweden

- 9.4.4 Finland

- 9.4.5 Norway

- 9.5 Southern Europe

- 9.5.1 Italy

- 9.5.2 Spain

- 9.5.3 Greece

- 9.5.4 Bosnia and Herzegovina

- 9.5.5 Albania

Chapter 10 Company Profiles

- 10.1 Aeroklas

- 10.2 Alu-Cab

- 10.3 ARIES Automotive

- 10.4 BEDSLIDE

- 10.5 Bushwacker

- 10.6 Carryboy

- 10.7 DECKED

- 10.8 EGR Automotive

- 10.9 Ford

- 10.10 Front Runner Outfitters

- 10.11 GM

- 10.12 HardtopsUK

- 10.13 Misutonida S.r.l.

- 10.14 Mountain Top Industries

- 10.15 Pro//Top Europe

- 10.16 Ranger Design Europe

- 10.17 RealTruck

- 10.18 Rhino Products

- 10.19 SJS Canopies

- 10.20 Stellantis