PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773332

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773332

Water-based Adhesive Applicators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

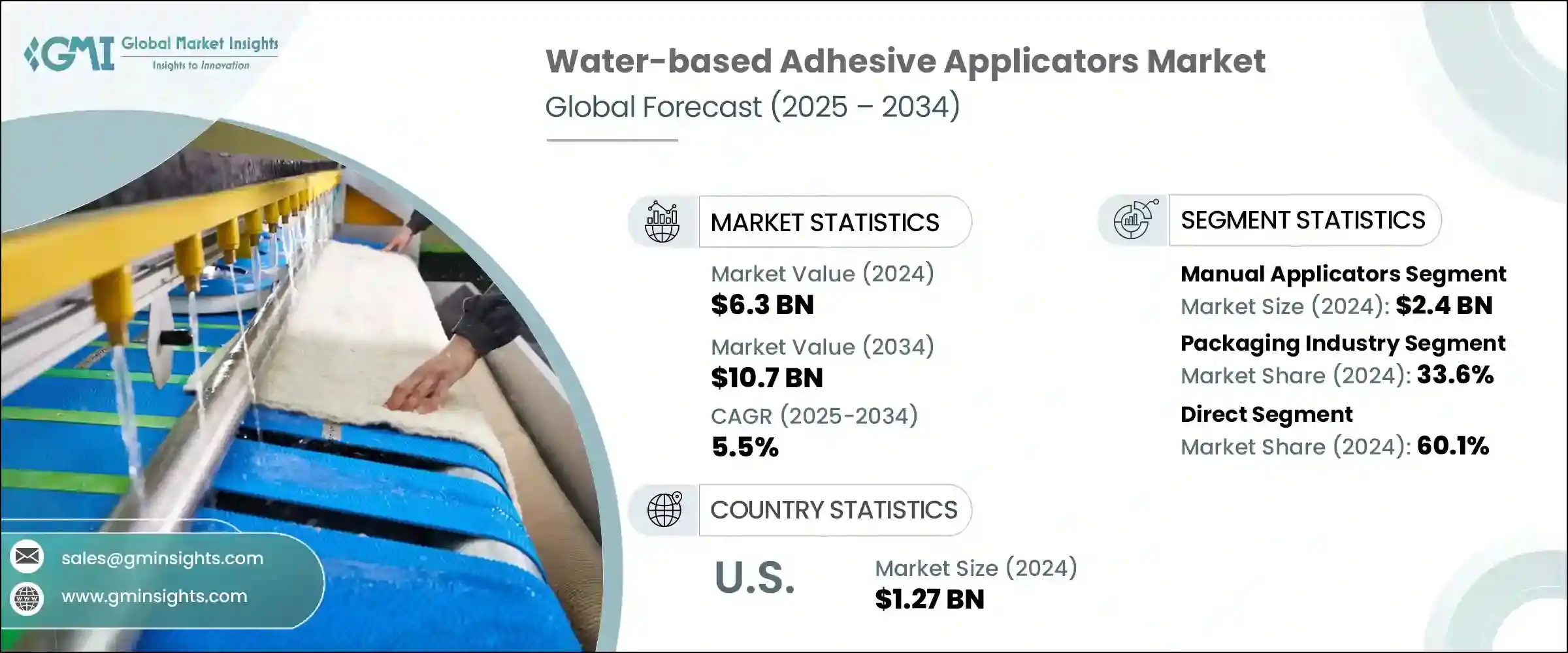

The Global Water-based Adhesive Applicators Market was valued at USD 6.3 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 10.7 billion by 2034. The industry is witnessing steady growth driven by expansion in the packaging sector, fueled by the boom in e-commerce, fast-moving consumer goods, and food and beverage industries. With a growing preference for eco-conscious packaging, these applicators are widely used for labeling, sealing, and flexible packaging due to their compatibility with recyclable materials. In addition to offering clean and efficient bonding, they support sustainability efforts and function well in high-speed production.

Simultaneously, demand is rising in the furniture and woodworking segments, where these applicators play a vital role in bonding porous materials like wood, laminates, and veneers. Trends such as DIY home improvement and modular furniture have further fueled this uptake. The growing adoption of semi-automatic and automatic applicator systems is also reshaping the market landscape, particularly in sectors like construction and consumer goods. These technologies improve operational efficiency, lower material waste, and offer consistent adhesive application, aligning with automation trends across global manufacturing environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 5.5% |

In 2024, the manual applicators segment generated USD 2.4 billion and is projected to grow at a CAGR of 4.4% through 2034. Their appeal lies in cost-efficiency and flexibility, making them ideal for low-volume or precision-focused operations. Small and mid-sized manufacturers, especially in packaging, furniture, and textiles, continue to use manual applicators where automation is not essential or cost-justified. These devices also deliver better adhesive control on non-uniform or complex surfaces, which makes them popular for detailed bonding tasks in varied industrial settings.

The direct distribution channels segment held a 60.1% share in 2024 and is expected to grow at a CAGR of 5.8% from 2025 to 2034. Direct sales are gaining traction as they allow manufacturers to tailor their solutions and respond rapidly to customer needs. Industries such as construction, automotive, and packaging often require custom adhesive systems and value close manufacturer involvement for integration, training, and after-sales services. Businesses using semi-automatic and smart applicators rely heavily on this channel for consistent performance, technical assistance, and streamlined procurement.

North America Water-based Adhesive Applicators Market generated USD 1.27 billion in 2024, projected to grow at a CAGR of 5% through 2034. Growth in the U.S. market is largely fueled by the country's industrial strength in sectors like packaging, automotive, woodworking, and construction. With rising concerns around emissions, water-based adhesives are preferred for their low VOCs and regulatory compliance. Additionally, advanced manufacturing and automation trends across U.S. industries continue to drive the demand for high-performance applicator systems that improve speed, safety, and precision.

Key players in the Water-based Adhesive Applicators Market include Buhnen GmbH & Co. KG, Nordson Corporation, Robatech AG, ITW Dynatec, H.B. Fuller Company, 3M Company, Franklin International, Graco Inc., Sika AG, Henkel AG & Co. KGaA, Valco Melton, Glue Machinery Corporation, Surebonder (FPC Corporation), Dymax Corporation, and Ad Tech (FPC Corporation). Companies competing in the water-based adhesive applicators market are prioritizing innovation, automation, and customization to enhance their market position. Many are heavily investing in R&D to develop eco-friendly, energy-efficient systems that meet evolving industrial and environmental standards. To stay competitive, leading firms are expanding their product lines with smart, IoT-enabled applicators that provide real-time monitoring and performance data. Strategic partnerships with end-use industries and OEMs also help boost integration across diverse manufacturing platforms. Firms are optimizing direct sales networks to ensure faster delivery, improved technical support, and better customer retention.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Automation

- 2.2.3 End use

- 2.2.4 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in automated applicator adoption

- 3.2.1.2 Surge in demand from the packaging sector

- 3.2.1.3 Integration of smart control systems

- 3.2.1.4 Advancements in adhesive formulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Performance limitations of water-based adhesives

- 3.2.2.2 High initial investment for automated applicators

- 3.2.3 Opportunities

- 3.2.3.1 Adoption in medical and hygiene applications

- 3.2.3.2 Increasing demand for lightweight vehicles

- 3.2.3.3 Integration with smart manufacturing (Industry 4.0)

- 3.2.3.4 Demand for VOC-free adhesive solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Automation, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Manual applicator

- 5.3 Semi-automatic applicators

- 5.4 Automatic applicators

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Packaging industry

- 6.3 Furniture & woodworking

- 6.4 Construction & building materials

- 6.5 Automotive & aerospace

- 6.6 Textile & apparel

- 6.7 Metals

- 6.8 Glass

- 6.9 Others (Foam, textiles/fabrics, leather)

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 Ad Tech (FPC Corporation)

- 9.3 Buhnen GmbH & Co. KG

- 9.4 Dymax Corporation

- 9.5 Franklin International

- 9.6 Glue Machinery Corporation

- 9.7 Graco Inc.

- 9.8 H.B. Fuller Company

- 9.9 Henkel AG & Co. KGaA

- 9.10 ITW Dynatec

- 9.11 Nordson Corporation

- 9.12 Robatech AG

- 9.13 Sika AG

- 9.14 Surebonder (FPC Corporation)

- 9.15 Valco Melton