PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835660

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835660

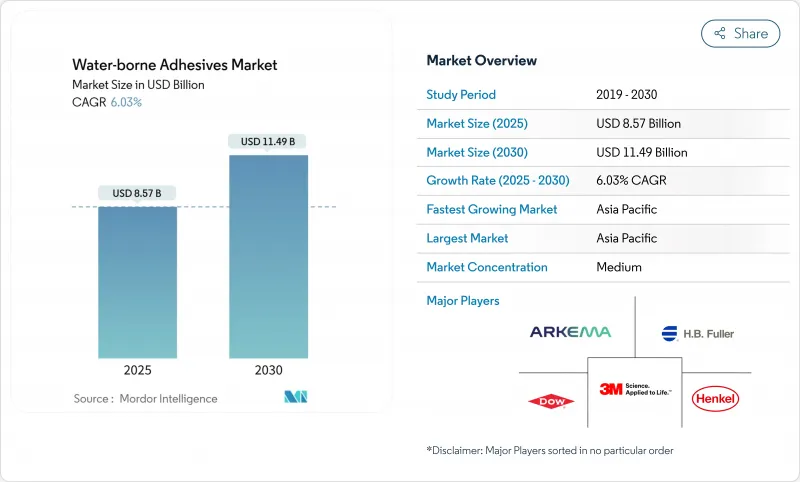

Water-borne Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Water-borne Adhesives Market size is estimated at USD 8.57 billion in 2025, and is expected to reach USD 11.49 billion by 2030, at a CAGR of 6.03% during the forecast period (2025-2030).

The water-borne adhesives market is growing as manufacturers accelerate the shift from solvent-based to water-based chemistries to comply with tightening global VOC rules and meet brand-owner sustainability targets. Growth momentum is reinforced by fast-expanding e-commerce packaging volumes, automotive lightweighting, and modular construction, each of which demands high-performance yet low-emission bonding systems. Regulatory convergence, especially Europe's VOC Solvents Emissions Directive and the Ecodesign for Sustainable Products Regulation, has made water-based chemistries a de facto license to operate, prompting multinationals to re-engineer portfolios while opening technology-transfer opportunities in emerging markets.

Global Water-borne Adhesives Market Trends and Insights

E-commerce-Led Boom in Corrugated Packaging in North America

Explosive online retail sales mean corrugated shippers now use seven times more adhesive per dollar transacted than traditional retail. Brand owners have tightened "ship-in-own-container" requirements, pushing converters to adopt fast-setting water-based grades such as H.B. Fuller's Advantra series that survive multi-node logistics while meeting curbside-recyclability guidelines. Automated case-sealing lines further amplify demand for clean-running, low-viscosity formulations compatible with high-speed applicators. These factors collectively lift the water-borne adhesives market as converters specify eco-compliant chemistries to secure contracts with omnichannel retailers.

VOC-Reduction Mandates Accelerating Solvent-to-Water Conversion in Europe

The EU VOC Solvents Emissions Directive caps industrial emissions so rigorously that water-borne systems have become standard in automotive trim, flooring and facade panels. Recent European Coatings Show demonstrations of bio-based PU dispersions highlighted equal or superior shear strength versus solvent counterparts, eroding legacy performance objections and consolidating the regulatory-driven shift. Early movers such as Arkema report a 5.1% volume lift in industrial grades after launching new acrylic water-borne binders tailored for low-carbon packaging.

Heat-Resistance Gap Limits Penetration into High-Temperature Applications

Continuous exposure beyond 150 °C challenges most water-borne networks. 3M's Fastbond 1000NF illustrates progress-delivering GREENGUARD-certified bonds that tolerate cyclical peaks-but heavy-duty engines, baking-oven panels and under-hood linings remain dominated by solvent systems. Bridging this thermal delta will require novel silicone-hybrid lattices now in early R&D pipelines; until then, market penetration into these niches stays capped.

Other drivers and restraints analyzed in the detailed report include:

- ASEAN Modular Construction Driving Fast-Setting PVA Demand

- Light-Weight Automotive Bonding Boosting PU Dispersions in Asia

- Higher Initial Cost and Investment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic emulsions held 38% of water-borne adhesives market share in 2024 thanks to versatility and low cost. Polyvinyl acetate remains the workhorse for wood bonding, yet rising indoor-air standards are steering contractors toward formaldehyde-free acrylics. Polyurethane dispersions, although contributing a modest slice of 2024 volume, are advancing at a 6.55% CAGR because they pair high peel strength with flexibility-attributes critical in lithium-ion battery packs and retort-pouch laminates.

The acrylic bloc faces margin pressure from propylene and acrylic-acid feedstock swings, nudging suppliers to integrate bio-acrylate routes or by-product streams. Chloroprene dispersions and niche hybrids serve metal furniture, footwear and mining belts where oil-resistance is non-negotiable, but remain volume-constrained. Overall, formulators that balance price-sensitive acrylic offerings with high-value PU portfolios will capture multi-tier growth.

Flexible packaging generated 40% of water-borne adhesives market size in 2024, driven by pouch, sachet and mailer conversions for omnichannel retail. Yet multi-layer lamination is the fastest-advancing cell at 7.23% CAGR as brand owners seek high-barrier designs combining PET, aluminum oxide and bio-PLA films. Water-based two-component systems now enable more than 65 N/15 mm bond strength, matching solvent-polyurethane predecessors while ensuring food-contact compliance.

Tapes, labels and graphic arts supply chains adopt dispersion-based PSAs that meet automated application speeds without stringing. Book-binding and paper-converting segments respond to lower-energy hot-cure cycles offered by new vinyl-acetate-ethylene copolymers. As e-commerce accelerates, corrugated-case adhesives with immediate tack yet fiber-tear substrate failure gain prominence, expanding total addressable demand.

The Water-Borne Adhesives Market Report Segments the Industry by Resin Type (Acrylics, Polyvinyl Acetate Emulsion, and More), Application (Flexible Packaging, Tapes and Labels, and More), End-User Industry (Building and Construction, Paper, Board, and More), Substrate (Paper and Paperboard, Metals, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 40% revenue leadership in 2024 reflects its unrivaled manufacturing depth, robust construction pipeline and accelerating electric-vehicle production. China's Tier-2 cities drive panel adhesive uptake, while India's infrastructure push anchors volume gains. The region's 6.89% CAGR also stems from regulatory tightening in Japan and South Korea, which incentivizes solvent-free chemistries through tax breaks and green-procurement lists.

North America ranks second, buoyed by e-commerce packaging and automotive lightweighting. The United States continues to mandate lower VOC limits in consumer products, expanding the water-borne adhesives market, whereas Canada's energy-efficiency codes spur adoption in residential retrofit insulation. Mexico's maquiladora corridors increasingly specify water-based formulations to service OEM export requirements.

Europe exerts outsized technology influence through stringent directives. Germany's auto interiors, France's flexible food packaging and the UK's timber-frame housing sectors collectively lift continental demand. Eastern European converters, supported by EU cohesion funds, upgrade to dispersion lines, eroding solvent share faster than originally forecast.

South America offers a mixed outlook: Brazil's construction recovery and agribusiness packaging needs push modest demand growth, aided by Henkel's new innovation hub in Jundiai. Argentina maintains smaller but specialized appetites in flexible food wraps. Middle East and Africa remain nascent yet promising; Saudi giga-projects and South African retail logistics are starting to specify water-based grades to meet imported-goods standards.

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- Benson Polymers Pvt Ltd.

- DIC CORPORATION

- Dow

- Dymax

- Evonik Industries AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Jowat SE

- MAPEI S.p.A.

- Parker Hannifin Corp

- Pidilite Industries Ltd.

- PPG Industries, Inc.

- Sika AG

- Soudal Group

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce-Led Boom in Corrugated Packaging in North America

- 4.2.2 VOC-Reduction Mandates Accelerating Solvent-to-Water Conversion in Europe

- 4.2.3 ASEAN Modular Construction Driving Fast-Setting PVA Demand

- 4.2.4 Light-weight Automotive Bonding Boosting PU Dispersions in Asia

- 4.2.5 Regulatory Push in Emerging Markets

- 4.3 Market Restraints

- 4.3.1 Heat-Resistance Gap Limits Penetration into High-Temperature Applications

- 4.3.2 Limited Usage in High-end Applications

- 4.3.3 Higher Initial Cost and Investment

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Resin Type

- 5.1.1 Acrylics

- 5.1.2 Polyvinyl Acetate (PVA) Emulsion

- 5.1.3 Ethylene Vinyl Acetate (EVA) Emulsion

- 5.1.4 Polyurethane Dispersions and CR (Chloroprene Rubber) Latex

- 5.1.5 Other Resin Types

- 5.2 By Application

- 5.2.1 Flexible Packaging

- 5.2.2 Tapes and Labels

- 5.2.3 Paper Converting and Graphic Arts

- 5.2.4 Laminating and Filmic Structures

- 5.2.5 Flooring and Carpeting

- 5.2.6 Bookbinding and Publishing

- 5.2.7 Non-woven and Hygiene Products

- 5.2.8 Others

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Paper, Board, and Packaging

- 5.3.3 Woodworking and Joinery

- 5.3.4 Transportation

- 5.3.5 Healthcare

- 5.3.6 Electrical and Electronics

- 5.3.7 Other End-user Industries

- 5.4 By Substrate

- 5.4.1 Paper and Paperboard

- 5.4.2 Plastics and Films

- 5.4.3 Wood and Composites

- 5.4.4 Metals

- 5.4.5 Glass and Ceramics

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JVs, Expansions)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Benson Polymers Pvt Ltd.

- 6.4.6 DIC CORPORATION

- 6.4.7 Dow

- 6.4.8 Dymax

- 6.4.9 Evonik Industries AG

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel AG & Co. KGaA

- 6.4.12 Jowat SE

- 6.4.13 MAPEI S.p.A.

- 6.4.14 Parker Hannifin Corp

- 6.4.15 Pidilite Industries Ltd.

- 6.4.16 PPG Industries, Inc.

- 6.4.17 Sika AG

- 6.4.18 Soudal Group

- 6.4.19 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Rising Demand for Sustainable and Eco-Friendly Products