PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797872

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797872

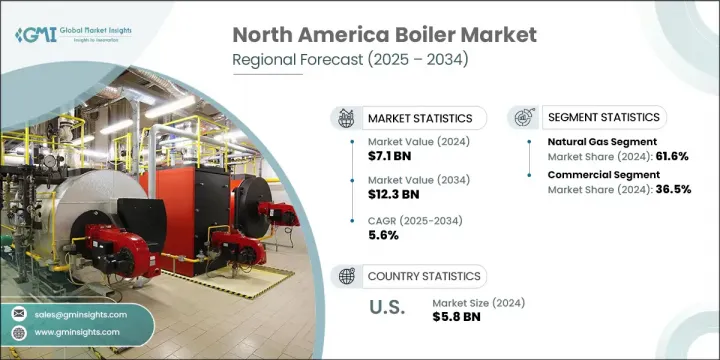

North America Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

North America Boiler Market was valued at USD 7.1 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 12.3 billion by 2034. The market is undergoing a notable shift as end-users increasingly replace older heating systems with modern, high-efficiency condensing boilers. The focus on improving energy conservation, reducing emissions, and meeting sustainability targets is a primary driver behind this transition. Advanced boiler technologies are gaining ground for their ability to capture and reuse latent heat, resulting in higher thermal performance and lower fuel usage. The expanding need for hydronic heating, particularly in northern and colder regions, is accelerating demand, with homeowners and businesses favoring these systems for their quiet operation and superior indoor comfort. North America's aging building infrastructure, growing investments in green buildings, and an expanding industrial base are reinforcing long-term demand for reliable and efficient boiler systems across commercial, institutional, and industrial spaces.

Boilers, engineered as sealed-loop systems, produce either steam or hot water through heat generated from fuels like oil, electricity, or natural gas. These systems find widespread use in domestic and industrial heating, as well as in process-specific thermal applications. The commercial sector is rapidly adopting intelligent boiler technologies, with digital controls, IoT integration, and remote maintenance capabilities becoming standard offerings. Commercial developers are increasingly opting for modular boiler setups to handle fluctuating thermal loads and provide system redundancy. The push toward digitized energy management, reinforced by regulatory pressure for low-emission systems, is reshaping how heating is delivered in office spaces, hospitality facilities, and public institutions. Meanwhile, the demand for ultra-low NOx and advanced emissions control is encouraging boiler manufacturers to roll out cleaner systems in line with regulatory frameworks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $12.3 Billion |

| CAGR | 5.6% |

The oil-fired boilers segment will reach USD 1.5 billion by 2034. Their continued use, particularly in rural and semi-urban areas without natural gas access, maintains demand. These systems are also used in commercial backup heating to ensure fuel flexibility and energy security in regions with harsh winters or unreliable gas infrastructure. Many commercial spaces retain oil boilers for redundancy purposes or to hedge against fuel price volatility, especially in locations where hybrid energy strategies are preferred.

The commercial segment accounted for a 36.5% share in 2024 and is projected to reach USD 4.5 billion by 2034. Increasing emphasis on low-carbon building operations and smart energy infrastructure is leading to greater uptake of condensing boiler units capable of adapting to dynamic load requirements. As real estate portfolios face stricter emissions targets under ESG frameworks, boiler systems that deliver consistent heating performance while minimizing fuel consumption are in higher demand. Shared heating infrastructure for institutional campuses and mixed-use developments, including district energy networks, is also adding to the sector's momentum.

Mexico Boiler Market is expected to grow at a CAGR of 6% through 2034. The country's fast-growing industrial and commercial base is driving installations across sectors such as hospitality, manufacturing, and food production. New industrial zones are increasingly turning to efficient boiler systems to align with international sustainability benchmarks and green certification requirements. Rising demand for process heating and upgrades to outdated heating infrastructure are also key contributors to this upward trend.

Prominent companies leading the North America Boiler Market include Bosch Thermotechnology, Burnham Holdings, Miura America, A. O. Smith, and Babcock & Wilcox Enterprises. Leading players in the North America boiler market are focusing on innovation, system efficiency, and sustainability to strengthen their market presence. Product portfolios are being expanded with energy-efficient condensing boilers, modular solutions, and low-emission units to meet growing regulatory and customer demands. Companies are heavily investing in R&D to incorporate IoT, AI-based diagnostics, and automation for predictive maintenance and performance optimization. Strategic alliances with HVAC contractors and energy service companies are also helping expand market reach. To cater to commercial and industrial segments, major manufacturers are offering scalable heating solutions capable of supporting both peak loads and energy savings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of boilers

- 3.8 Price trend analysis

- 3.8.1 By fuel

- 3.8.2 By capacity

- 3.9 Investment analysis & future outlook

- 3.10 Technology evolution and innovation landscape

- 3.10.1 Condensing vs non-condensing technology trends

- 3.10.2 Smart boiler and iot integration

- 3.10.3 Heat exchanger material innovations

- 3.10.4 Combustion control advancements

- 3.10.5 Modulating burner technology

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.2.3 Mexico

- 4.3 Strategic dashboard

- 4.3.1 Major M&A activities

- 4.3.2 Key partnerships and collaborations

- 4.3.3 Product innovations and launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Coal

- 5.5 Electric

- 5.6 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 ≤ 10 MMBTU/hr

- 6.3 > 10 - 50 MMBTU/hr

- 6.4 > 50 - 100 MMBTU/hr

- 6.5 > 100 - 250 MMBTU/hr

- 6.6 > 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 Offices

- 7.3.2 Healthcare facilities

- 7.3.3 Educational institutions

- 7.3.4 Lodgings

- 7.3.5 Retail stores

- 7.3.6 Others

- 7.4 Industrial

- 7.4.1 Food processing

- 7.4.2 Pulp & paper

- 7.4.3 Chemical

- 7.4.4 Refinery

- 7.4.5 Primary metal

- 7.4.6 Others

- 7.5 Others

Chapter 8 Market Size and Forecast, By Country, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

- 8.4 Mexico

Chapter 9 Company Profiles

- 9.1 A. O. Smith

- 9.2 Ariston Holding

- 9.3 Babcock & Wilcox Enterprises

- 9.4 Babcock Wanson

- 9.5 Bosch Thermotechnology

- 9.6 Bradford White Corporation

- 9.7 Burnham Holdings

- 9.8 Clayton Industries

- 9.9 Cleaver-Brooks

- 9.10 Daikin Industries

- 9.11 Fulton

- 9.12 Hurst Boiler & Welding

- 9.13 LAARS Heating Systems

- 9.14 Lennox International

- 9.15 Lochinvar

- 9.16 Miura America

- 9.17 Navien

- 9.18 NTI Boilers

- 9.19 PB Heat

- 9.20 Rentech Boiler Systems

- 9.21 Rinnai America

- 9.22 U.S. Boiler Company

- 9.23 Viessmann

- 9.24 WM Technologies