PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822538

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822538

Germany Cerebral Palsy Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

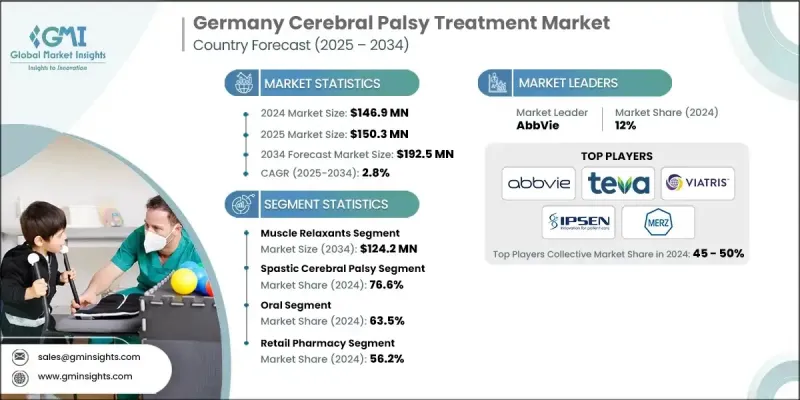

Germany cerebral palsy treatment market was valued at USD 146.9 million in 2024 and is projected to grow from USD 150.3 million in 2025 to USD 192.5 million by 2034, at a CAGR of 2.8%, according to the latest report published by Global Market Insights, Inc.

The market is dominated by the widespread prevalence of spastic cerebral palsy, increasing awareness for early therapeutic intervention, and the availability of a robust healthcare infrastructure in Germany. Emerging oral muscle relaxants, neurotoxins, and integration of physical therapy are propelling treatment adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $146.9 Million |

| Forecast Value | $192.5 Million |

| CAGR | 2.8% |

Key Drivers:

1. Developments in the clinical treatment and diagnostics of spastic cerebral palsy are creating a large and stable base for demand. Of all the types of CP, spastic CP is the most prevalent, and it typically involves physiotherapy and muscle relaxants as treatments.

2. Oral therapy innovations are expanding the market of oral muscle relaxants and antispasmodics for children, providing better compliance and safety for patients.

3. Coverage and support insurance policies: Most of the rehabilitation treatment therapy for cerebral palsy is covered by statutory health insurance in the German system, reducing the out-of-pocket costs to patients and their caregivers.

4. Wider availability of retail and specialty pharmacies: Expanded drug accessibility and home delivery are making extended treatment more prevalent.

Key Players:

- Industry leaders such as AbbVie Inc., VIATRIS, Teva, IPSEN, Merz Pharmaceuticals, and UCB have captured a significant share of the moderately consolidated Germany market between 50% and 60%.

- AbbVie stood as a market leader in 2024, with a market share of about 12%.

Key Challenges:

- Side effects and off-label pediatric labeling: Muscle relaxants may induce tolerance, fatigue, or off-label pediatric issues after prolonged use in children.

- Absence of a curative treatment: Cerebral palsy is a lifelong condition, and treatments are not primarily designed to cure but to manage symptoms.

- Dependent on specialists: Treatment tends to have better outcomes if the neurologist, physiotherapist, and/or pediatrician communicate and collaborate, which complicates treatment for patients.

Browse key industry insights spread across 70 pages with 20 market data tables and figures from the report, "Germany Cerebral Palsy Treatment Market - By Drug Type, By Disease Type, By Route of Administration, By Distribution Channel - Forecast, 2025 - 2034" in detail, along with the table of contents:

1. By Drug Type - Muscle Relaxants Dominate

Muscle relaxants created the largest share of the market in 2024. Prescribed medications such as baclofen, diazepam, and tizanidine are for the treatment of muscle spasticity, allowing for improved mobility for paediatric and adult patients with cerebral palsy.

2. By Disease Type - Spastic Cerebral Palsy Leads

Spastic cerebral palsy accounted for the largest disease segment in 2024. Described as stiffness with movement difficulties, this type of CP is most common in Germany and serves as the central target for pharmaceutical and therapeutic interventions.

3. By Route of Administration - Oral Delivery Gaining Popularity

The oral segment holds the major market share in 2024. Pediatric syrup presentations and extended-release tablets are improving adherence and convenience for caregivers in home care facilities.

4. By Distribution Channel - Retail Pharmacies Take Center Stage

Retail pharmacies were the leading distribution channel in 2024. With a well-organized infrastructure in Germany, they are responsible for filling prescription drugs and follow-up refills with urban and rural patients.

Key drugmakers present in the Germany cerebral palsy treatment market are AbbVie, Amneal, CHEPLAPHARM, Dr. Reddy's, GSK, IPSEN, Merz Pharmaceuticals, Novartis, Roche, Teva, UCB, and Viatris.

To solidify their position in the German market, key players are shifting attention to product localization, regulatory approvals, and strategic distribution partnerships. IPSEN and Merz Pharmaceuticals are expanding their portfolio of neurotoxins with local studies and partnerships with German clinics. AbbVie and GSK are implementing their branded muscle relaxants with therapy processes. Conversely, CHEPLAPHARM and Viatris are consolidating supply chains using hospital and retail pharmacy network agreements and focusing on digital patient-support tools and reducing pediatric oral formulations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cerebral palsy

- 3.2.1.2 Advancements in drug formulations

- 3.2.1.3 Increased awareness and early diagnosis

- 3.2.1.4 Surging investments in research and development activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects associated with drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Development of targeted therapies

- 3.2.3.2 Strategic partnerships between pharma companies and pediatric hospitals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Role of home healthcare in cerebral palsy management

- 3.5.1 Importance of home-based care for CP patients

- 3.5.2 Home-based therapy services (physical, occupational, speech)

- 3.5.3 Use of assistive devices and mobility aids at home

- 3.5.4 Home nursing and caregiver support dynamics

- 3.5.5 Cost benefit aspects of home care vs hospital care

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Reimbursement scenario

- 3.8 Brand analysis

- 3.9 Pipeline analysis

- 3.10 Emerging treatment therapies

- 3.11 Pricing analysis

- 3.12 Consumer behaviour analysis

- 3.13 Investment landscape

- 3.14 Epidemiological scenario

- 3.15 German clinical practice guidelines for CP drug treatment

- 3.16 Porter's analysis

- 3.17 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Muscle relaxants

- 5.3 Anticonvulsants

- 5.4 Anticholinergics

- 5.5 Antidepressants

- 5.6 Other drug types

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Spastic cerebral palsy

- 6.2.1 Hemiplegia

- 6.2.2 Diplegia

- 6.2.3 Quadriplegia

- 6.3 Dyskinetic cerebral palsy

- 6.4 Ataxic cerebral palsy

- 6.5 Mixed cerebral palsy

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacy

- 8.3 Hospital pharmacy

- 8.4 Online pharmacy

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 amneal

- 9.3 CHEPLAPHARM

- 9.4 Dr. Reddy’s

- 9.5 GSK

- 9.6 IPSEN

- 9.7 Merz Pharmaceuticals

- 9.8 Novartis

- 9.9 Roche

- 9.10 teva

- 9.11 ucb

- 9.12 VIATRIS