PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822565

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822565

China Cerebral Palsy Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

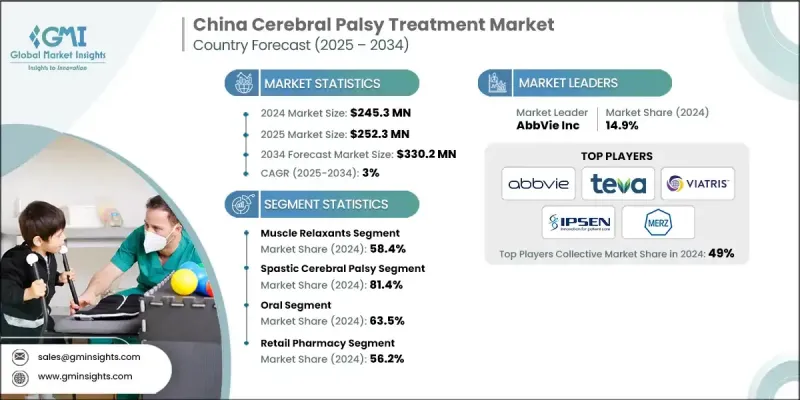

The China Cerebral Palsy Treatment Market was valued at USD 245.3 million in 2024 and is estimated to grow at a CAGR of 3% to reach USD 330.2 million by 2034.

Improved public health education and broader access to pediatric neurology services are leading to earlier detection of cerebral palsy in infants and toddlers. This is increasing demand for early-stage interventions and long-term treatment plans across the country.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $245.3 Million |

| Forecast Value | $330.2 Million |

| CAGR | 3% |

Rising Demand for Muscle Relaxants

The muscle relaxants segment held a significant share in 2024, as these medications are commonly prescribed to manage muscle stiffness and spasticity, two of the most debilitating symptoms in cerebral palsy patients. Drugs like baclofen, diazepam, and tizanidine are widely used to reduce excessive muscle tone and improve mobility, allowing for better participation in physical therapy. The segment continues to gain momentum as demand for non-invasive and drug-based interventions grows.

Spastic Cerebral Palsy Segment

The spastic cerebral palsy generated a notable share in 2024, accounting for many diagnosed cases in China. This subtype is characterized by tight or stiff muscles, which impair movement and posture. As a result, it represents the primary clinical focus of most treatment plans and intervention strategies. The market demand in this segment is robust, driven by a growing emphasis on early diagnosis, multidisciplinary care models, and the introduction of both drug-based and physical therapies.

Rising Adoption of Oral Drugs

The oral segment generated a notable share in 2024, driven by its ease of administration, patient compliance, and broad therapeutic applicability. Medications such as muscle relaxants and antispastic agents are often formulated for oral use, especially in children who may find injections or infusions distressing. This delivery route continues to be favored by physicians and caregivers alike for long-term treatment plans. In China, the growing availability of oral formulations through retail pharmacies and hospitals is contributing to this segment's steady expansion.

Retail Pharmacy to Gain Traction

The Retail pharmacies segment held a notable share in 2024, driven by second-tier cities and rural areas where hospital access may be limited. These pharmacies serve as key distribution points for oral medications, supplements, and supportive care products. As awareness grows and more families seek outpatient treatment options, retail pharmacies are becoming a preferred channel for recurring prescriptions.

Major players in the China cerebral palsy treatment are Pediatrix Therapeutics (Tris Pharma), IPSEN, Roche, VIATRIS, GSK, Merz Pharmaceuticals, Dr. Reddy's, teva, AbbVie, Novartis, amneal, CHEPLAPHARM.

To strengthen their foothold in the China cerebral palsy treatment market, companies are adopting a multi-layered approach. Key strategies include local partnerships with hospitals and rehabilitation centers to improve distribution and brand visibility, as well as investment in pediatric formulations tailored to the Chinese market. Many firms are also expanding their product pipelines through R&D, focusing on safer, more effective, medications for spasticity and motor dysfunction. Additionally, digital health platforms are being used to support caregiver education, treatment adherence, and remote consultation services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cerebral palsy

- 3.2.1.2 Advancements in drug formulations

- 3.2.1.3 Increased awareness and early diagnosis

- 3.2.1.4 Surging investments in research and development activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects associated with drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Development of targeted therapies

- 3.2.3.2 Strategic partnerships between pharma companies and pediatric hospitals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Role of home healthcare in cerebral palsy management

- 3.6.1 Importance of home-based care for CP patients

- 3.6.2 Home-based therapy services (physical, occupational, speech)

- 3.6.3 Use of assistive devices and mobility aids at home

- 3.6.4 Home nursing and caregiver support dynamics

- 3.6.5 Cost-benefit aspects of home care vs hospital care

- 3.7 Reimbursement scenario

- 3.8 Brand analysis

- 3.9 Pipeline analysis

- 3.10 Emerging treatment therapies

- 3.11 Pricing analysis

- 3.12 Consumer behaviour analysis

- 3.13 Investment landscape

- 3.14 Epidemiological scenario

- 3.15 Porter's analysis

- 3.16 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Muscle relaxants

- 5.3 Anticonvulsants

- 5.4 Anticholinergics

- 5.5 Antidepressants

- 5.6 Other drug types

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Spastic cerebral palsy

- 6.2.1 Hemiplegia

- 6.2.2 Diplegia

- 6.2.3 Quadriplegia

- 6.3 Dyskinetic cerebral palsy

- 6.4 Ataxic cerebral palsy

- 6.5 Mixed cerebral palsy

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacy

- 8.3 Hospital pharmacy

- 8.4 Online pharmacy

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 amneal

- 9.3 CHEPLAPHARM

- 9.4 Dr. Reddy's

- 9.5 GSK

- 9.6 IPSEN

- 9.7 Merz Pharmaceuticals

- 9.8 Novartis

- 9.9 Pediatrix Therapeutics (Tris Pharma)

- 9.10 Roche

- 9.11 teva

- 9.12 VIATRIS