PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822592

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822592

North America Cerebral Palsy Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

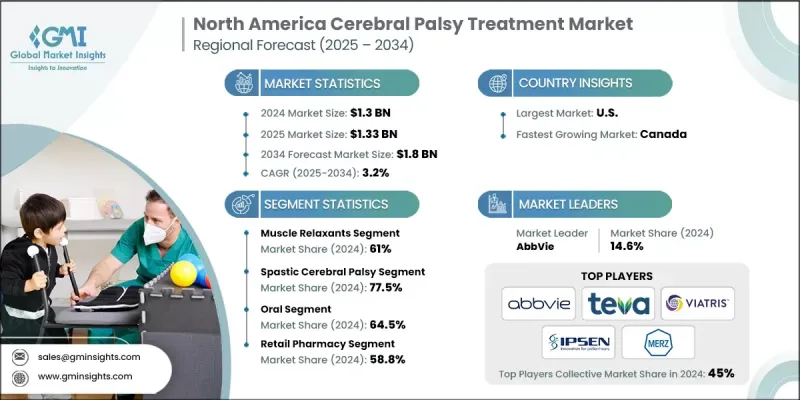

North America cerebral palsy treatment market was valued at USD 1.3 billion in 2024 and is projected to grow from USD 1.33 billion in 2025 to USD 1.8 billion by 2034, at a CAGR of 3.2%, according to the latest report published by Global Market Insights, Inc.

Market growth is led by the widespread incidence of spastic cerebral palsy, expanded access to sophisticated treatments, and robust pharmaceutical R&D within the United States. The presence of several FDA-approved drugs, along with established retail pharmacy infrastructures, facilitates continued adoption of oral drugs and supportive care throughout the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $1.8 Billion |

| CAGR | 3.2% |

Key Drivers:

- Growing demand for spastic cerebral palsy treatment: The most prevalent cerebral palsy variant is treated with muscle relaxants and neurotoxins, which drive pharma sales.

- Multidisciplinary care models prevalence: Multidisciplinary treatment programs, including neurologists, orthopedic surgeons, and therapists, ensure long-term patient treatment plans.

- Greater oral therapy use: Oral products are becoming the preferred treatment standard due to convenience and better adherence rates, especially in children.

- Increasing retail pharmacy access: With large pharmacy networks in North America, patient access to CP drugs and follow-up prescriptions is unobstructed.

Key Players:

- The big players like AbbVie Inc., Teva, VIATRIS, IPSEN, and Merz Pharmaceuticals together hold about 49% market share in the North America cerebral palsy treatment market.

- AbbVie dominates the North America cerebral palsy treatment market with a 14.6% market share in 2024.

Key Challenges:

- Long-term safety of muscle relaxants: Chronic administration may result in side effects such as sedation or dependency, particularly in children.

- Absence of curative therapies: Cerebral palsy is still incurable; treatments now aim at symptom control and enhancing mobility.

- Care coordination challenges: Management through various specialists and payers increases patient and caregiver burden.

1. By Drug Type - Muscle Relaxants Dominate

Muscle relaxants dominated the market with the highest share in 2024. Prescribed extensively for controlling spasticity, drugs such as baclofen, diazepam, and dantrolene are widely prescribed throughout the region.

2. By Disease Type - Spastic Cerebral Palsy Most Prominent

Spastic cerebral palsy was the most prevalent segment with the highest prevalence rate and targeting this condition with a specific treatment strategy using antispasmodic and supportive therapies.

3. Route of Administration - Requirements for Oral Drugs

Oral segment had the largest share of the market in 2024, as there was increased demand for non-surgical treatment options for home use, and this was particularly noted with children, where long-term therapy was required.

4. By Distribution Channel - Retail Pharmacies Dominating Distribution

Retail pharmacies dominated the distribution channel in 2024, and they provided widespread availability of prescriptions, generics, and maintenance therapy, though large chain pharmacies and mail order.

5. By Region - United States Holds Dominant Position in the Market

The U.S. had the largest percentage of the North America market in 2024. It remains a leader in research activity, clinical studies, and early use of approved drug therapies.

Key players in the North America cerebral palsy treatment market are AbbVie, Amneal, CHEPLAPHARM, Dr. Reddy's, GSK, IPSEN, Merz Pharmaceuticals, Novartis, Roche, Teva, UCB, and Viatris.

Major pharmaceutical companies are undertaking product innovation, FDA submissions, acquisitions, and regional alliances as means to strengthen their foothold in the North American market. AbbVie and IPSEN continue to be undeterred regarding neurotoxin treatments and long-acting muscle relaxants, while Amneal and Teva are expanding their oral generics portfolio. Merz Pharmaceuticals is partnering with area providers to increase access to botulinum toxin treatment options. Other players will focus on bolstering their patient support and digital adherence programs to reach caregivers and pediatric care teams.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Drug type trends

- 2.2.3 Disease type trends

- 2.2.4 Route of administration trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cerebral palsy

- 3.2.1.2 Advancements in drug formulations

- 3.2.1.3 Increased awareness and early diagnosis

- 3.2.1.4 Surging investments in research and development activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects associated with drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Development of targeted therapies

- 3.2.3.2 Strategic partnerships between pharma companies and pediatric hospitals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Role of home healthcare in cerebral palsy management

- 3.6.1 Importance of home-based care for CP patients

- 3.6.2 Home-based therapy services (physical, occupational, speech)

- 3.6.3 Use of assistive devices and mobility aids at home

- 3.6.4 Home nursing and caregiver support dynamics

- 3.6.5 Cost-benefit aspects of home care vs hospital care

- 3.7 Reimbursement scenario

- 3.8 Brand analysis

- 3.9 Pipeline analysis

- 3.10 Clinical trial landscape

- 3.11 Emerging treatment therapies

- 3.12 Pricing analysis

- 3.13 Consumer behaviour analysis

- 3.14 Investment landscape

- 3.15 Epidemiological scenario

- 3.16 Patient demographics and care settings

- 3.16.1 Pediatric Vs. adult patients

- 3.16.2 Urban Vs. rural access

- 3.17 Market entry barriers

- 3.18 Porter's analysis

- 3.19 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Muscle relaxants

- 5.3 Anticonvulsants

- 5.4 Anticholinergics

- 5.5 Antidepressants

- 5.6 Other drug types

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Spastic cerebral palsy

- 6.2.1 Hemiplegia

- 6.2.2 Diplegia

- 6.2.3 Quadriplegia

- 6.3 Dyskinetic cerebral palsy

- 6.4 Ataxic cerebral palsy

- 6.5 Mixed cerebral palsy

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacy

- 8.3 Hospital pharmacy

- 8.4 Online pharmacy

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 U.S.

- 9.3 Canada

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 amneal

- 10.3 CHEPLAPHARM

- 10.4 Dr. Reddy's

- 10.5 GSK

- 10.6 IPSEN

- 10.7 Merz Pharmaceuticals

- 10.8 Novartis

- 10.9 Roche

- 10.10 teva

- 10.11 ucb

- 10.12 VIATRIS