PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833385

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833385

North America Insulin Delivery Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

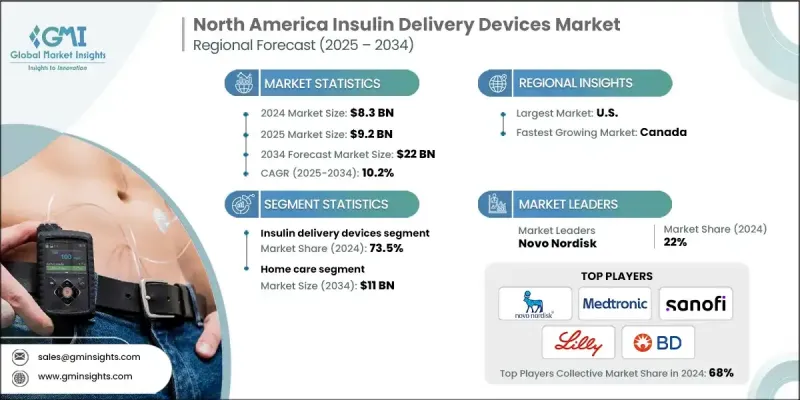

North America Insulin Delivery Devices Market was valued at USD 8.3 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 22 billion by 2034.

This robust growth is fueled by a surge in diabetes cases, increased focus on self-care, and steady innovation in device technology. As individuals become more proactive in managing their condition, the demand for insulin delivery tools that are portable, simple to operate, and clinically accurate continues to rise. Modern patients seek effective ways to manage blood glucose levels without compromising comfort or daily routine. The push for easy-to-handle solutions is driving widespread adoption of newer delivery technologies. Additionally, public awareness campaigns and proactive healthcare policies are playing a key role in encouraging early adoption of advanced insulin management tools. Support from national health agencies has further bolstered market momentum by promoting self-monitoring and independent care. In North America, manufacturers are integrating features that promote precision, safety, and comfort, addressing both clinical needs and patient preferences. These developments are making insulin administration more accessible, especially for individuals managing diabetes at home, reinforcing the market's forward trajectory over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $22 Billion |

| CAGR | 10.2% |

The insulin delivery devices segment held 73.5% share in 2024, due to strong patient preference for accurate and hassle-free insulin administration tools. This segment holds a dominant position thanks to its advanced design, long-term reliability, and consistent user satisfaction. Devices in this category are crafted to ensure seamless insulin administration with minimal effort, supporting both patient and clinical needs. Their intuitive design, digital compatibility, and portability have positioned them as the preferred choice among those looking for practical, high-performance options over traditional delivery methods.

The home care segment is projected to hit USD 11 billion by 2034, driven by rising demand for diabetes management in home settings. Patients are increasingly favoring at-home care due to the availability of devices that offer ease of use and reduce reliance on medical facilities. This shift is supported by broader access to training, digital resources, and healthcare initiatives aimed at empowering individuals to manage their conditions independently. Devices that require little setup or supervision are gaining traction for home-based use, allowing users to stay consistent with treatment without routine clinic visits.

United States Insulin Delivery Devices Market generated USD 7.4 billion in 2024. Market expansion in the US is underpinned by a combination of high diabetes prevalence, superior healthcare infrastructure, and regulatory policies that prioritize innovation and access. The transition from conventional injection tools to more advanced and user-friendly alternatives has gained significant momentum. These modern devices support precise insulin dosing, which aligns well with the broader goals of the US healthcare system to prioritize patient-centric care and clinical accuracy.

Major players in the North America Insulin Delivery Devices Market are Prominent players operating in the North America market include MicroPort, Becton, Dickinson and Company, Sanofi, Nipro, Haselmeier, Wockhardt, Medtronic, Owen Mumford, Gan & Lee Pharmaceuticals, Eli Lilly & Company, Novo Nordisk, Insulet, Terumo, F. Hoffmann-La Roche, and B. Braun Melsungen. Key strategies adopted by leading companies to strengthen their position in the North America insulin delivery devices market include a consistent focus on product innovation, ensuring that their offerings align with evolving patient preferences and clinical requirements. Manufacturers are heavily investing in ergonomic design and smart features that enhance usability and dosing accuracy. Collaborations with healthcare providers and digital health platforms help integrate insulin devices into broader diabetes care systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes

- 3.2.1.2 Technological advancements in insulin delivery devices

- 3.2.1.3 Increasing diabetes care expenditure

- 3.2.1.4 Favourable insurance and reimbursement policies

- 3.2.1.5 Growth in government initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of insulin delivery devices

- 3.2.2.2 Stringent regulatory requirements

- 3.2.3 Market opportunities

- 3.2.4 Integration with digital health platforms

- 3.2.5 Growing developments in smart and wearable devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Patent analysis

- 3.9 Reimbursement scenario

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Insulin delivery devices

- 5.2.1 Insulin pumps

- 5.2.1.1 Tubed pumps

- 5.2.1.2 Tubeless pumps

- 5.2.2 Pens

- 5.2.2.1 Reusable

- 5.2.2.2 Disposable

- 5.2.3 Other insulin delivery devices

- 5.2.1 Insulin pumps

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Pen needles

- 5.3.2.1 Standard

- 5.3.2.2 Safety

- 5.3.3 Syringes

- 5.3.4 Insulin pump consumables

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Home care

- 6.4 Other end users

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Canada

Chapter 8 Company Profiles

- 8.1 B. Braun Melsungen

- 8.2 Becton, Dickinson and Company

- 8.3 Eli Lilly & Company

- 8.4 F. Hoffmann-La Roche

- 8.5 Gan & Lee Pharmaceuticals

- 8.6 Haselmeier

- 8.7 Insulet

- 8.8 Medtronic

- 8.9 MicroPort

- 8.10 Nipro

- 8.11 Novo Nordisk

- 8.12 Owen Mumford

- 8.13 Sanofi

- 8.14 Terumo

- 8.15 Wockhardt