PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876587

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876587

Europe Insulin Delivery Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

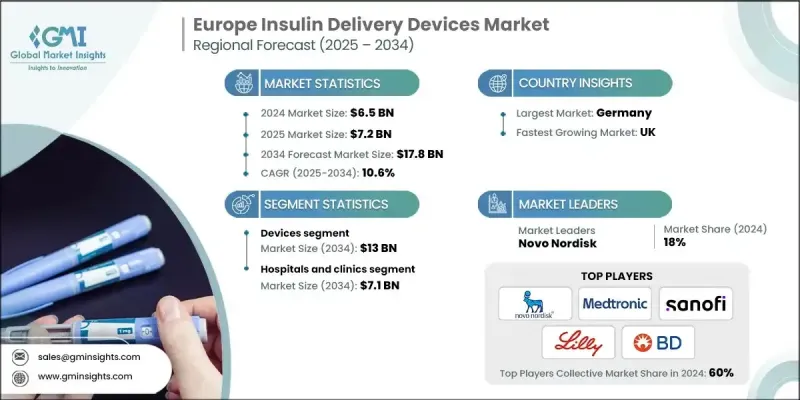

Europe Insulin Delivery Devices Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 10.6% to reach USD 17.8 billion by 2034.

Market growth is driven by the rising prevalence of diabetes, a rapidly aging population, continuous advancements in insulin delivery technology, and favorable government initiatives and reimbursement structures. As the population ages, the likelihood of developing chronic metabolic disorders such as Type 2 diabetes rises sharply due to changes in metabolism, decreased activity levels, and growing insulin resistance. Insulin delivery devices serve as essential tools for ensuring safe, accurate, and convenient insulin administration in individuals with diabetes, enabling effective blood glucose regulation for those whose bodies cannot produce sufficient insulin. The European market is also being reshaped by innovations that emphasize discretion, automation, and connectivity. Modern insulin pumps and smart wearable devices are increasingly designed to be compact, tubeless, and smartphone-compatible, empowering users with real-time control over their treatment. These technological shifts, combined with strong policy frameworks and public awareness campaigns, are propelling widespread adoption of advanced insulin delivery systems across Europe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $17.8 Billion |

| CAGR | 10.6% |

The consumables segment is expected to grow at a CAGR of 10.7% during 2034. Consumables include essential disposable components such as pen needles, syringes, infusion sets, reservoirs, and testing strips used regularly in diabetes management. These items are indispensable for maintaining precision, hygiene, and patient comfort, making them an integral part of everyday insulin administration. Their frequent replacement and consistent usage contribute to steady revenue generation across the European insulin delivery ecosystem.

The hospitals and clinics segment is anticipated to reach USD 7.1 billion by 2034, underscoring the importance of institutional healthcare settings in diabetes treatment. Hospitals and clinics act as key touchpoints for diagnosis, education, and initiation of insulin therapy. With the shift toward integrated, patient-centered care models, these facilities continue to play a crucial role in facilitating access to advanced insulin delivery devices and supporting improved long-term diabetes management outcomes across the region.

Germany Insulin Delivery Devices Market generated USD 901 million in 2024, supported by its high diabetes incidence and strong public awareness. The country's data-driven healthcare strategies and nationwide surveillance programs are enabling the adoption of cutting-edge diabetes technologies and encouraging public health investment in modern insulin delivery devices. Germany's advanced healthcare infrastructure and proactive policy framework continue to foster innovation and increase patient access to next-generation treatment solutions.

Key players operating in the Europe Insulin Delivery Devices Market include Sanofi, Medtronic, Haselmeier, Novo Nordisk, Terumo, MicroPort, ViCentra B.V., Tandem Diabetes Care, Wockhardt Ltd., Nipro, B. Braun Melsungen, Insulet, F. Hoffmann-La Roche, Becton, Dickinson and Company, Owen Mumford, Gan & Lee Pharmaceuticals, and Eli Lilly and Company. To strengthen their position in the Europe Insulin Delivery Devices Market, leading companies are adopting strategies centered on technological innovation, strategic partnerships, and expansion of manufacturing capabilities. Many are investing heavily in research and development to introduce compact, connected, and automated insulin delivery systems that enhance accuracy and convenience for users. Collaborations with hospitals, digital health firms, and distribution networks are helping expand patient access across different countries. Companies are also focusing on regional production to reduce costs and improve supply chain efficiency. Mergers, acquisitions, and product diversification are being leveraged to broaden portfolios and increase competitiveness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes across the region

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Technological advancement in insulin delivery devices

- 3.2.1.4 Government initiatives and reimbursement policies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with digital health platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Patent analysis

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Insulin pumps

- 5.2.1.1 Tubed pumps

- 5.2.1.2 Tubeless pumps

- 5.2.2 Pens

- 5.2.2.1 Reusable

- 5.2.2.2 Disposable

- 5.2.3 Other insulin delivery devices

- 5.2.1 Insulin pumps

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Pen needles

- 5.3.2.1 Standard

- 5.3.2.2 Safety

- 5.3.3 Syringes

- 5.3.4 Insulin pumps consumables

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Home care

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Germany

- 7.3 France

- 7.4 UK

- 7.5 Italy

- 7.6 Spain

- 7.7 Netherlands

- 7.8 Sweden

- 7.9 Belgium

- 7.10 Denmark

- 7.11 Finland

- 7.12 Norway

- 7.13 Lithuania

- 7.14 Latvia

- 7.15 Estonia

- 7.16 Russia

- 7.17 Poland

- 7.18 Switzerland

Chapter 8 Company Profiles

- 8.1 B. Braun Melsungen

- 8.2 Becton, Dickinson and Company

- 8.3 Eli Lilly and Company

- 8.4 F. Hoffmann-La Roche

- 8.5 Gan & Lee Pharmaceuticals

- 8.6 Haselmeier

- 8.7 Insulet

- 8.8 Medtronic

- 8.9 MicroPort

- 8.10 Nipro

- 8.11 Novo Nordisk

- 8.12 Owen Mumford

- 8.13 Sanofi

- 8.14 Tandem Diabetes Care

- 8.15 Terumo

- 8.16 ViCentra

- 8.17 Wockhardt