PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833618

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833618

Insulin Delivery Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

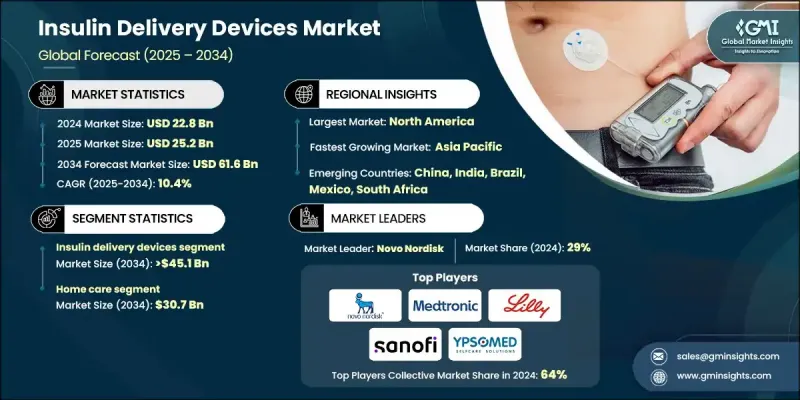

The Global Insulin Delivery Devices Market was valued at USD 22.8 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 61.6 billion by 2034.

This robust growth is driven by the increasing prevalence of diabetes worldwide, continuous advancements in technology, and greater awareness around self-management of the disease. Patients are increasingly demanding user-friendly, portable, and accurate insulin delivery options, including insulin pens, pumps, and patch devices, to better manage their glucose levels. Furthermore, global health organizations and national governments are playing a vital role in accelerating market expansion through initiatives focused on improving diabetes care. The World Health Organization's Global Diabetes Compact, for example, aims to reduce diabetes risk and ensure that all patients have access to affordable, quality treatment. Insulin delivery devices are essential tools designed to administer insulin safely and effectively, helping individuals maintain proper blood sugar levels when their bodies cannot produce enough insulin naturally. Technological innovation remains a significant factor propelling market growth, with companies enhancing device comfort, safety, and ease of use by incorporating features such as ergonomic grips, prefilled cartridges, and automated dosing. The integration of digital technologies like Bluetooth and mobile app connectivity is providing patients and healthcare providers with real-time insulin therapy data, enabling more personalized and efficient management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.8 billion |

| Forecast Value | $61.6 billion |

| CAGR | 10.4% |

The insulin delivery device segment held 73.5% share in 2024, owing to its advanced technology, durability, and increasing preference among both patients and healthcare professionals. This segment includes devices such as insulin pens, pumps, and others, all designed to provide precise, convenient, and user-friendly insulin administration. Their popularity stems from ease of use, portability, and the ability to connect with digital health platforms, making them indispensable tools for independent diabetes management. These devices help minimize dosing errors and enhance overall treatment outcomes.

The home care segment is anticipated to reach USD 30.7 billion by 2034, fueled by a growing number of patients choosing to manage diabetes within the comfort of their own homes. The availability of easy-to-use devices, increased awareness of self-care, and supportive policies from public health bodies all contribute to this trend. Patients prefer portable insulin delivery devices that simplify daily treatment routines and reduce hospital visits. Disposable insulin pens and wearable pumps, known for their convenience and reliability, are especially popular in home settings due to minimal training requirements.

North America Insulin Delivery Devices Market held 41.6% share in 2024, driven by a high diabetes prevalence, advanced healthcare infrastructure, and strong regulatory backing. The region's healthcare systems emphasize precision, safety, and user-friendliness, which makes insulin pens the favored choice in both inpatient and outpatient settings. The widespread availability of these devices through hospital pharmacies, retail outlets, and online platforms, combined with insurance coverage and government support, further accelerates adoption.

Key players in the Insulin Delivery Devices Market include Biocon, Novo Nordisk, Becton Dickinson and Company, Medtronic plc, Eli Lilly & Company, Insulet Corporation, Terumo Corporation, B. Braun Melsungen AG, Sanofi, Haselmeier, Ypsomed Holdings, Dongbao Pharmaceutical, Julphar, Tandem Diabetes Care, Owen Mumford, ViCentra B.V., Scientific Corporation, Debiotech S.A., Nipro Corporation, Gan & Lee Pharmaceuticals, Suzhou Peng Ye Medical Devices, Pacetronix, and MicroPort. Companies in the insulin delivery devices market focus on several core strategies to strengthen their market position and expand their global footprint. Continuous investment in research and development is crucial, enabling the launch of innovative products with enhanced usability, safety, and connectivity features such as AI-powered dosing and remote monitoring. Expanding distribution channels, including partnerships with healthcare providers, pharmacies, and digital health platforms, helps improve product accessibility worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes

- 3.2.1.2 Technological advancements in insulin delivery devices

- 3.2.1.3 Increasing diabetes care expenditure

- 3.2.1.4 Favourable device insurance and reimbursement policies

- 3.2.1.5 Adoption of facilitative initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of insulin delivery devices

- 3.2.2.2 High out-of-pocket expenditure in developing countries

- 3.2.2.3 Stringent government regulations

- 3.2.3 Market opportunities

- 3.2.4 Integration with digital health platforms

- 3.2.5 Development of smart and wearable devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Patent analysis

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Insulin delivery devices

- 5.2.1 Insulin pumps

- 5.2.1.1 Tubed pumps

- 5.2.1.2 Tubeless pumps

- 5.2.2 Pens

- 5.2.2.1 Reusable

- 5.2.2.2 Disposable

- 5.2.3 Other insulin delivery devices

- 5.2.1 Insulin pumps

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Pen needles

- 5.3.2.1 Standard

- 5.3.2.2 Safety

- 5.3.3 Syringes

- 5.3.4 Insulin pumps consumables

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and Clinics

- 6.3 Home care

- 6.4 Other end users

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 B. Braun Melsungen AG

- 8.2 Becton, Dickinson and Company

- 8.3 Biocon

- 8.4 Debiotech S.A.

- 8.5 Dongbao Pharmaceutical

- 8.6 Eli Lilly & Company

- 8.7 F. Hoffmann-La Roche Ltd.

- 8.8 Gan & Lee Pharmaceuticals

- 8.9 Haselmeier

- 8.10 Insulet Corporation

- 8.11 Julphar

- 8.12 Lenomed Medical

- 8.13 Medtronic plc

- 8.14 MicroPort

- 8.15 Nipro Corporation

- 8.16 Novo Nordisk

- 8.17 Owen Mumford

- 8.18 Sanofi

- 8.19 Scientific Corporation

- 8.20 Suzhou Peng Ye Medical Devices

- 8.21 Tandem Diabetes Care

- 8.22 Terumo Corporation

- 8.23 ViCentra B.V.

- 8.24 Wockhardt Ltd.

- 8.25 Ypsomed Holdings