PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876550

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876550

U.S. Insulin Delivery Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

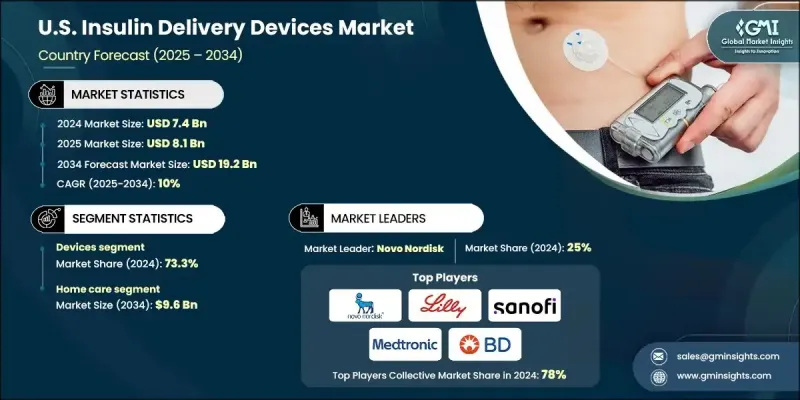

U.S. Insulin Delivery Devices Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 10% to reach USD 19.2 billion by 2034.

The consistent growth is driven by the increasing prevalence of diabetes across the nation, higher healthcare spending on diabetes management, and rapid technological advancements in insulin delivery solutions. These devices are designed to deliver insulin safely, precisely, and conveniently to individuals with diabetes, ensuring optimal blood glucose control. They play a vital role in helping patients manage their condition when their bodies fail to produce adequate insulin naturally. The integration of smart technologies such as Bluetooth and mobile app connectivity enables real-time monitoring, dosage tracking, and automated alerts, improving treatment adherence and overall outcomes. Additionally, digital health platforms and AI-based analytics are transforming diabetes care by enabling data-driven insulin management and predictive dosing. Modern designs now emphasize comfort, accuracy, and ease of use, aligning with the growing demand for personalized and patient-friendly diabetes care solutions. The introduction of wearable and portable insulin delivery devices has further enhanced accessibility, particularly for children, elderly patients, and individuals with active lifestyles, contributing to steady market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 billion |

| Forecast Value | $19.2 billion |

| CAGR | 10% |

The devices segment held 73.3% share in 2024, supported by the widespread use of technologically advanced insulin pumps, pens, and other delivery tools. These devices have become the preferred choice for patients seeking efficient, reliable, and user-friendly insulin administration options. They provide patients with greater independence, enabling them to manage diabetes more effectively while minimizing manual errors. Their continued innovation and integration of smart features have been instrumental in propelling market growth and shaping the next generation of diabetes management tools.

The home care segment is projected to reach USD 9.6 billion by 2034. The preference for home-based diabetes management has significantly increased, as patients seek greater convenience and control over their treatment. This trend is supported by the availability of compact, intuitive, and easy-to-use insulin delivery devices tailored for home settings. The shift toward self-care has also helped reduce hospital visits and healthcare costs, while empowering patients to monitor and manage their glucose levels more efficiently, improving overall quality of life.

Key participants in the U.S. Insulin Delivery Devices Market include Medtronic, Novo Nordisk, B. Braun Melsungen, F. Hoffmann-La Roche, Eli Lilly & Company, Terumo, Nipro, Insulet, Becton, Dickinson and Company, Owen Mumford, Haselmeier, Gan & Lee Pharmaceuticals, Wockhardt, MicroPort, and Sanofi. Leading players in the U.S. Insulin Delivery Devices Market are focusing on innovation, partnerships, and digital integration to strengthen their market presence. They are heavily investing in research and development to create smarter, more efficient insulin delivery technologies with enhanced connectivity and automation. Strategic collaborations with healthcare providers and technology firms enable them to introduce advanced solutions that improve patient engagement and treatment outcomes. Companies are also expanding their product portfolios through acquisitions and new product launches, addressing diverse patient needs across all demographics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of diabetes across U.S.

- 3.2.1.2 Increasing diabetes care expenditure in the country

- 3.2.1.3 Technological advancements in insulin delivery devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of insulin pumps

- 3.2.2.2 Stringent regulatory requirement

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and smart ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Patent analysis

- 3.7 Pricing analysis, 2024

- 3.8 Reimbursement scenario

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Insulin pumps

- 5.2.1.1 Tubed pumps

- 5.2.1.2 Tubeless pumps

- 5.2.2 Pens

- 5.2.2.1 Reusable

- 5.2.2.2 Disposable

- 5.2.3 Other insulin delivery devices

- 5.2.1 Insulin pumps

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Pen needles

- 5.3.2.1 Standard

- 5.3.2.2 Safety

- 5.3.3 Syringes

- 5.3.4 Insulin pump consumables

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Home care

- 6.4 Other end use

Chapter 7 Company Profiles

- 7.1 B. Braun Melsungen

- 7.2 Becton, Dickinson and Company

- 7.3 Eli Lilly & Company

- 7.4 F. Hoffmann-La Roche

- 7.5 Gan & Lee Pharmaceuticals

- 7.6 Haselmeier

- 7.7 Insulet

- 7.8 Medtronic

- 7.9 MicroPort

- 7.10 Nipro

- 7.11 Novo Nordisk

- 7.12 Owen Mumford

- 7.13 Sanofi

- 7.14 Terumo

- 7.15 Wockhardt