PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833397

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833397

North America Continuous Glucose Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

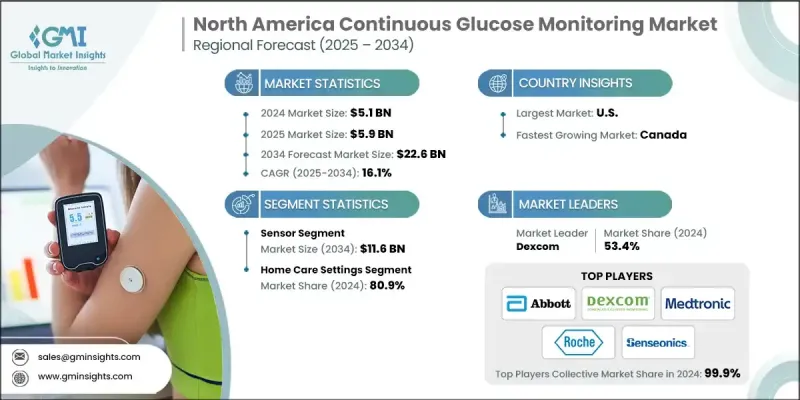

The North America Continuous Glucose Monitoring Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 16.1% to reach USD 22.6 billion by 2034.

Growing Adoption of CGM Sensors

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $22.6 Billion |

| CAGR | 16.1% |

The sensors segment accounted for a significant share in 2024. These sensors are essential for capturing real-time glucose levels from interstitial fluid and transmitting accurate data to devices or smartphone applications. As users seek enhanced comfort, longer wear duration, and minimal calibration requirements, manufacturers are focusing on advancing sensor technology. Innovations such as extended wear sensors, flexible materials, and pre-calibrated solutions are fueling this segment's expansion. The upward trend underscores a broader movement toward user convenience, particularly for individuals managing diabetes outside of traditional healthcare facilities.

Increasing shift toward homecare settings

The homecare segment is expected to experience steady growth between 2025 and 2034, driven by a rising preference for remote monitoring and self-managed care. Patients are increasingly turning to CGM systems to track glucose levels in real time from the comfort of their homes. These systems not only support daily disease management but also enable seamless data sharing with healthcare providers and family members through connected digital platforms. This trend is minimizing the need for frequent clinical visits and empowering individuals to take a more proactive and independent role in their diabetes care.

U.S. to Emerge as a Lucrative Region

U.S. continuous glucose monitoring (CGM) market held a significant share in 2024, driven by rising diabetes prevalence, growing patient awareness, and strong technology adoption across healthcare systems. With the Centers for Disease Control and Prevention (CDC) estimating over 37 million Americans living with diabetes, the demand for real-time glucose monitoring solutions is escalating. Market leaders are responding to this need with next-generation CGM devices that offer extended sensor life, smartphone compatibility, and seamless integration with insulin delivery systems. Market growth is further supported by favorable reimbursement policies, consumer demand for personalized healthcare, and a significant shift toward home-based and remote monitoring technologies.

Major players involved in the North America continuous glucose monitoring (CGM) market are i-SENS, Glucovation, Medtronic, Nemaura Medical, F. Hoffmann-La Roche, Dexcom, A. Menarini Diagnostics, Senseonics, Abbott Laboratories, Insulet Corporation, and Sinocare.

Companies competing in the North America continuous glucose monitoring (CGM) market are focusing on innovation, partnerships, and patient-centric solutions to strengthen their market position. Strategic collaborations with digital health platforms, pharmacy chains, and insurance providers are helping major players expand reach and accessibility. Many firms are investing heavily in R&D to develop non-invasive or minimally invasive CGM solutions that improve comfort and accuracy while reducing maintenance. Mergers and acquisitions remain a favored strategy for expanding product portfolios and gaining a competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Component trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes in North America

- 3.2.1.2 Technological advancements in continuous glucose monitoring devices

- 3.2.1.3 Increased awareness by government initiatives and public health campaigns

- 3.2.1.4 Increasing obesity rates and lifestyle-related health issues

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost related to devices

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and predictive analytics to provide personalized alerts

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Transmitters

- 5.3 Sensors

- 5.4 Receivers

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Home care setting

- 6.4 Diagnostic centres and clinics

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Canada

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 A. Menarini Diagnostics

- 8.3 Dexcom

- 8.4 F. Hoffmann-La Roche

- 8.5 Glucovation

- 8.6 Insulet Corporation

- 8.7 i-SENS

- 8.8 Medtronic

- 8.9 Nemaura Medical

- 8.10 Senseonics

- 8.11 Sinocare