PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833433

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833433

U.S. Continuous Glucose Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

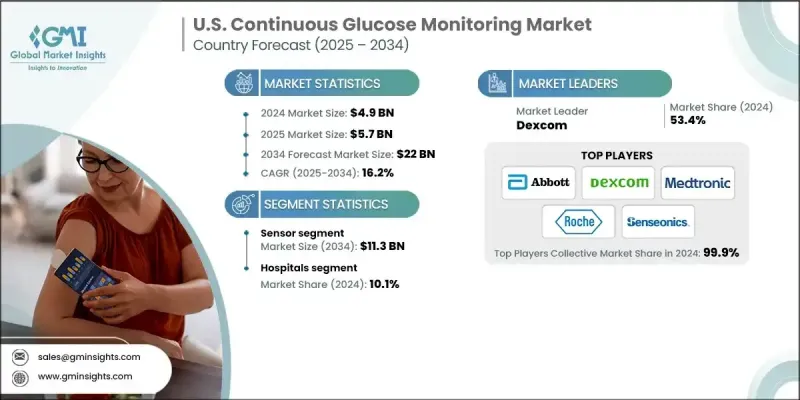

U.S. Continuous Glucose Monitoring Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 16.2% to reach USD 22 billion by 2034.

This strong growth is largely influenced by the rising diabetes burden across the country, the introduction of over-the-counter CGM systems, the rapid adoption of telehealth and remote patient monitoring, and the increasing acceptance of home-based health technologies. Continuous glucose monitoring emerges as a preferred solution due to its ability to deliver real-time data and actionable insights. These devices consist of wearable sensors, transmitters, and receivers that provide continuous glucose measurements while sending alerts to users. The integration of digital platforms further boosts their adoption, as patients and clinicians can share data seamlessly for improved disease management. Unlike traditional methods that depend on fingerstick samples, CGM solutions utilize sensors placed beneath the skin to track glucose levels around the clock. Their transformation from clinical tools into consumer-oriented devices is also driving adoption among both diabetic and non-diabetic users, strengthening market expansion and creating new opportunities in preventive healthcare and metabolic wellness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 billion |

| Forecast Value | $22 billion |

| CAGR | 16.2% |

The transmitter segment generated USD 2.2 billion in 2024 and is estimated to reach USD 9.8 billion by 2034. Transmitters act as a crucial link in CGM systems by wirelessly sending glucose data from the sensor to smartphones, receivers, or insulin pumps. Attached to the sensor, these devices make real-time glucose sharing possible, ensuring continuous monitoring and timely alerts. Their growing role in enabling seamless connectivity and cloud integration continues to push this segment forward.

The hospitals segment held a 10.1% share in 2024. With healthcare systems adopting digital and patient-focused models, CGM devices are being increasingly integrated across care settings. Real-time glucose tracking is particularly beneficial for patients with unstable or complex glucose fluctuations, as it provides a consistent stream of data that aids quick medical interventions and reduces risks associated with delayed monitoring.

Key participants in the U.S. Continuous Glucose Monitoring Market include Abbott Laboratories, Dexcom, A. Menarini Diagnostics, F. Hoffmann-La Roche, Insulet Corporation, i-SENS, Glucovation, Medtronic, Nemaura Medical, Senseonics, and Sinocare. Companies in the U.S. continuous glucose monitoring industry are adopting multiple strategies to reinforce their market positioning. Continuous innovation remains a top priority, with firms investing heavily in R&D to develop smaller, longer-lasting, and more affordable CGM devices. Expansion of distribution networks and partnerships with pharmacies and digital health platforms are also being pursued to improve accessibility. Many players are enhancing their ecosystem by integrating CGMs with insulin delivery systems, wearable apps, and telehealth platforms to create comprehensive solutions for patients and providers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes in U.S.

- 3.2.1.2 Growing preference for home-based monitoring

- 3.2.1.3 Expansion of over-the-counter CGM devices

- 3.2.1.4 Growth of telehealth and remote patient monitoring

- 3.2.2 Industry Pitfalls and challenges:

- 3.2.2.1 High cost related to devices

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities:

- 3.2.3.1 The use of AI and predictive analytics in CGM technology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Transmitters

- 5.3 Sensors

- 5.4 Receivers

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Home care setting

- 6.4 Diagnostic centres and clinics

- 6.5 Other end use

Chapter 7 Company Profiles

- 7.1 Abbott Laboratories

- 7.2 A. Menarini Diagnostics

- 7.3 Dexcom

- 7.4 F. Hoffmann-La Roche

- 7.5 Glucovation

- 7.6 Insulet Corporation

- 7.7 i-SENS

- 7.8 Medtronic

- 7.9 Nemaura Medical

- 7.10 Senseonics

- 7.11 Sinocare