PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833405

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833405

China Continuous Glucose Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

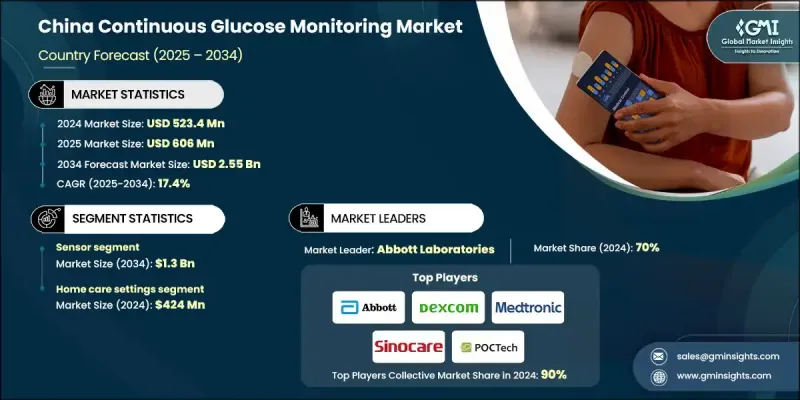

The China Continuous Glucose Monitoring Market was valued at USD 523.4 million in 2024 and is estimated to grow at a CAGR of 17.4% to reach USD 2.55 billion by 2034.

This upward trend is largely supported by a combination of factors, including the rising number of diabetes cases nationwide, a rapidly aging population, advancements in CGM technologies, and growing awareness through government-led health campaigns. CGM devices, which track glucose levels in real time throughout the day and night using subcutaneous sensors, are becoming increasingly vital in the diabetes care ecosystem. Their growing importance in proactive disease management, especially in elderly and chronic care patients, has led to widespread adoption across both clinical and home care settings. Major manufacturers such as Medtronic, Abbott Laboratories, Dexcom, and Sinocare are playing pivotal roles in transforming this space with user-friendly solutions. As the Chinese healthcare sector accelerates its focus on chronic disease management, CGMs are gaining prominence for their ability to provide continuous, real-time insights, allowing for better glycemic control and reduced complications associated with diabetes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $523.4 Million |

| Forecast Value | $2.55 Billion |

| CAGR | 17.4% |

The sensor component segment was valued at USD 265.5 million in 2024 and is anticipated to reach USD 1.3 billion by 2034 at a CAGR of 17.5%. This growth stems from a sharp shift toward at-home care and personalized health monitoring. Within CGM systems, sensors continuously assess glucose levels in the interstitial fluid, while transmitters collect these readings and relay the data to connected devices such as smartphones or dedicated receivers. These transmitters form the bridge between the sensor and the user's monitoring interface, allowing for real-time updates without the need for traditional fingerstick testing. Such connectivity supports remote monitoring by healthcare professionals and enhances compliance among users.

In 2024, the home care settings generated USD 424 million and held an 81% share. This segment continues to witness strong momentum, primarily driven by the high incidence of diabetes across the country. With an increasing focus on remote health monitoring, CGMs are emerging as a preferred solution for at-home diabetes care. These devices alert users in real time about significant glucose fluctuations, enabling timely intervention and reducing the need for frequent hospital visits. Enhanced usability, improved sensor life, and easy smartphone integration have broadened their appeal across all age groups.

Leading players operating in the China Continuous Glucose Monitoring Industry include Dexcom, Jiangsu Yuyue Medical Equipment & Supply, Abbott Laboratories, Senseonics, Medtrum Technologies, Med Trust, Medtronic, Zhejiang POCTech, and Sinocare. These companies continue to invest in R&D, device miniaturization, and AI-based glucose trend analysis to offer differentiated products for the growing Chinese market. Companies operating in China continuous glucose monitoring market are adopting a multi-tiered strategy to build market dominance. First, they are investing significantly in R&D to enhance sensor accuracy, extend sensor wear duration, and develop wireless capabilities for seamless data sharing. Many firms are also forming collaborations with local healthcare providers to strengthen distribution channels and increase patient accessibility. Additionally, several players are pursuing regulatory approvals to fast-track product launches.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising diabetes prevalence across China

- 3.2.1.2 Technological advancements in continuous glucose monitoring devices

- 3.2.1.3 Increasing government initiatives to promote awareness regarding diabetes

- 3.2.1.4 Increasing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High cost of CGM devices

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and predictive analytics to provide personalized alerts

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain and distribution analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Transmitters

- 5.3 Sensors

- 5.4 Receivers

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Home care setting

- 6.4 Diagnostic centres and clinics

- 6.5 Other end use

Chapter 7 Company Profiles

- 7.1 Abbott Laboratories

- 7.2 Dexcom

- 7.3 Jiangsu Yuyue Medical Equipment & Supply

- 7.4 Med Trust

- 7.5 Medtronic

- 7.6 Medtrum Technologies

- 7.7 Senseonics

- 7.8 Sinocare

- 7.9 Zhejiang POCTech