PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844304

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844304

Asia Pacific Veterinary Assistive Reproduction Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

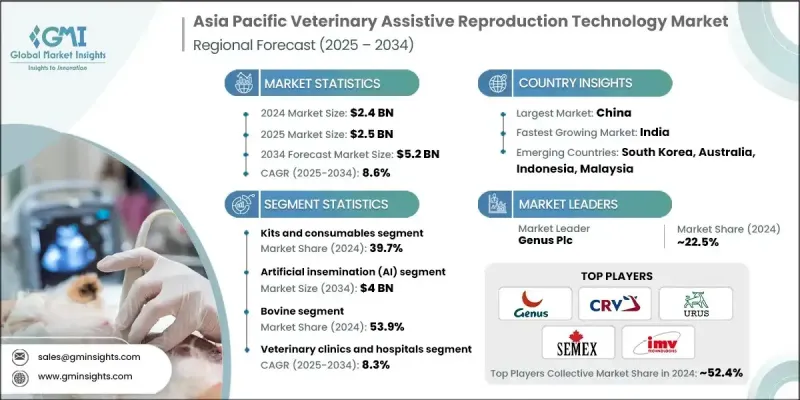

Asia Pacific Veterinary Assistive Reproduction Technology Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 5.2 billion by 2034.

The rising demand for animal protein across the region continues to fuel this growth, as countries look for efficient and scientifically advanced methods to improve livestock productivity. Veterinary assistive reproduction technologies (ART) include advanced breeding tools such as artificial insemination (AI), embryo transfer (ET), in vitro fertilization (IVF), and other methods that optimize reproduction in animals. Innovations in reproductive biotech, including cryopreservation, intracytoplasmic sperm injection (ICSI), and AI-assisted diagnostics, have significantly enhanced fertility outcomes. These advancements enable precise cycle tracking and better-timed interventions, leading to more effective and reliable breeding programs. In parallel, supportive government initiatives and funding for livestock development are encouraging widespread ART adoption. Increased investment in research facilities, veterinary care infrastructure, and national breeding schemes continue to support market expansion, while also promoting sustainable agriculture and improved genetics across diverse animal species.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 8.6% |

In 2024, the kits and consumables segment held a 39.7% share and is expected to grow at a CAGR of 8.7% through 2034. This segment benefits from the ongoing and repeated need for essential items such as catheters, culture media, semen extenders, pipettes, and cryopreservation straws in procedures like AI and ET. Unlike one-time equipment purchases, these consumables are used repeatedly, creating steady and recurring demand. This consistent usage drives the segment's growth and makes it a critical component of ART operations.

The artificial insemination (AI) segment is projected to reach USD 4 billion by 2034. Its popularity stems from its affordability, simplicity, and effectiveness, making it accessible across a wide range of farming environments. AI also reduces the risk of disease transmission and physical injury compared to natural breeding. Additionally, the success of AI-based breeding programs, supported by public sector initiatives, reinforces the widespread adoption of this technology across the region. These efforts are increasing reproductive efficiency and livestock productivity while reducing costs for farmers.

The bovine segment held a 53.9% share in 2024. High demand for dairy and beef in leading economies like Australia, India, and China is driving significant investment in advanced reproductive technologies for cattle. Continued governmental backing for livestock development, especially in large cattle-producing nations, further supports the growth of this segment. Enhanced productivity, improved genetic quality, and efficient herd management are central to the rising demand for ART in bovine applications.

China Veterinary Assistive Reproduction Technology Market generated USD 740 million in 2024, driven by its vast livestock population and rising demand for meat and dairy products. State-supported breeding initiatives and the expansion of veterinary infrastructure further support ART adoption. China's focus on enhancing livestock genetics and increasing food production capabilities positions it as a major player in the Asia Pacific ART industry.

Key companies in the Asia Pacific Veterinary Assistive Reproduction Technology Market include STgenetics, Genus Plc, Bovine Elite, AI Vet Services, LIC, SEMEX, URUS Group LP, Swine Genetics International, Minitube Group, VikingGenetics, Select Sires, Geno SA, and CRV Holdings B.V. To strengthen their presence, companies in the Asia Pacific veterinary ART sector are focusing on product innovation, geographic expansion, and strategic partnerships. Many are investing in R&D to develop next-generation consumables and devices that improve success rates and streamline procedures. Companies are also expanding their reach into rural and emerging markets through training programs and mobile vet services. Collaborations with governments, academic institutions, and agricultural cooperatives allow businesses to access larger breeding programs and strengthen trust among stakeholders.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Animal type

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising protein consumption in the region

- 3.2.1.2 Advancements in reproductive technology

- 3.2.1.3 Government-supported breeding initiatives

- 3.2.1.4 Improved veterinary infrastructure and spending

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of ART procedures

- 3.2.2.2 Lack of skilled personnel

- 3.2.3 Market opportunities

- 3.2.3.1 Development of cryobanks and genetic trade

- 3.2.3.2 Expanding reach to small and mid-scale farms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Livestock population, by country

- 3.7 Future market trends

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Semen

- 5.3.1 Normal semen

- 5.3.2 Sexed semen

- 5.4 Instruments

- 5.5 Kits and consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Artificial insemination (AI)

- 6.3 In vitro fertilization (IVF)

- 6.4 Embryo transfer (MOET)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bovine

- 7.3 Swine

- 7.4 Ovine

- 7.5 Caprine

- 7.6 Equine

- 7.7 Other animal types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary clinics and hospitals

- 8.3 Animal breeding centers

- 8.4 Research institutes and universities

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 China

- 9.3 Japan

- 9.4 India

- 9.5 Australia

- 9.6 South Korea

- 9.7 Indonesia

- 9.8 Malaysia

- 9.9 Thailand

- 9.10 Singapore

- 9.11 Vietnam

Chapter 10 Company Profiles

- 10.1 AI Vet Services

- 10.2 Bovine Elite

- 10.3 CRV Holdings B.V.

- 10.4 Geno SA

- 10.5 Genus Plc

- 10.6 LIC

- 10.7 Minitube Group

- 10.8 SEMEX

- 10.9 Select Sires

- 10.10 Swine Genetics International

- 10.11 STgenetics

- 10.12 URUS Group LP

- 10.13 VikingGenetics