PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844386

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844386

Veterinary Autoimmune Disease Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

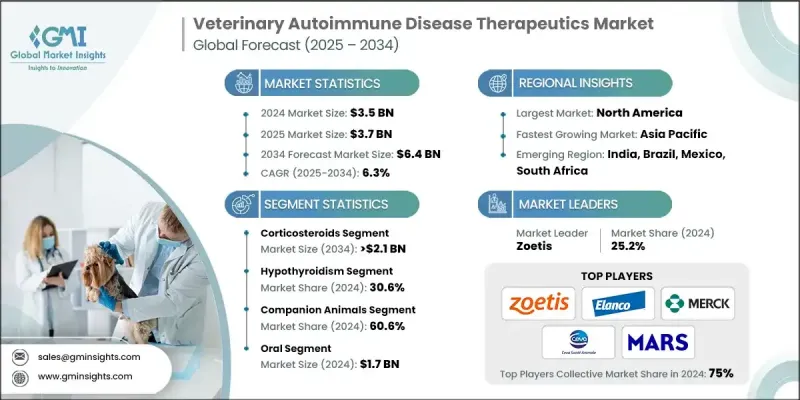

The Global Veterinary Autoimmune Disease Therapeutics Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 6.4 billion by 2034.

The rising occurrence of autoimmune disorders in animals, along with the growing trend of pet ownership, continues to fuel the demand for effective veterinary treatments. With increased awareness around animal health, diagnostic advancements, and demand for long-term wellness in pets, the market is gaining significant traction. Treatments are evolving to address complex conditions where an animal's immune system targets its own tissues. This has driven innovation in areas such as biologics, immunosuppressive drugs, and personalized therapeutics, helping boost both accuracy and outcomes in disease management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 6.3% |

Veterinary therapies designed for autoimmune diseases now range from corticosteroids to advanced biologic solutions, helping to manage conditions like lupus, pemphigus, and immune-mediated anemia more effectively. The market is witnessing major technological progress in drug delivery systems, resulting in improved adherence and treatment efficacy. Companies are prioritizing eco-conscious therapies, including organic and sustainable drug formulations. Strong collaboration between veterinary pharmaceutical manufacturers and academic research bodies is accelerating access to newer, more targeted therapeutics. A growing focus on long-acting injectables and tailored medications is helping improve both treatment outcomes and quality of life for affected animals across multiple species.

The corticosteroids segment reached USD 1.2 billion in 2024. This dominance stems from their quick therapeutic impact, cost-effectiveness, and proven efficacy across a wide range of autoimmune disorders in animals. These drugs are frequently used to manage symptoms linked with immune-related conditions such as immune-mediated arthritis, hypothyroidism, and anemia by modulating inflammation and the immune response. Their accessibility and established effectiveness make corticosteroids a cornerstone treatment option for veterinarians worldwide in managing chronic and acute cases.

The hypothyroidism segment held a 30.6% share in 2024, making it the leading disease indication. This condition is one of the most common autoimmune disorders diagnosed in dogs, leading to reduced production of thyroid hormones due to immune system malfunction. The high occurrence of hypothyroidism has led to the development of disease-specific drugs that restore hormonal balance and improve overall health in companion animals. Key symptoms such as fatigue, hair loss, and obesity in pets are increasingly being managed through consistent and precise hormone replacement therapies.

U.S Veterinary Autoimmune Disease Therapeutics Market reached USD 1.35 billion in 2024. The rising prevalence of immune disorders in both pets and livestock is driving demand for treatments such as immunosuppressants and newer modalities like stem cell-based interventions. The U.S. market benefits from a robust pipeline of research efforts, supported by collaborations between veterinary pharmaceutical companies and national institutions, which continue to enhance product safety and efficacy. Increasing investments in advanced diagnostics and access to cutting-edge veterinary care are also contributing to regional growth.

Major companies actively shaping the Global Veterinary Autoimmune Disease Therapeutics Market include Zoetis, Ceva Sante Animale, Vet-Stem, Aratana Therapeutics, Mars Veterinary Health, Dechra Pharmaceuticals, Norbrook, Vetoquinol, Heska, Elanco, Merck, and Virbac. To strengthen their foothold, companies in the Veterinary Autoimmune Disease Therapeutics Market are pursuing a variety of strategic initiatives. These include expanding their geographical reach to enter underpenetrated regions with rising pet ownership and livestock care needs. Many firms are investing heavily in R&D to develop targeted biologics, monoclonal antibodies, and personalized medicine options for companion animals. Collaborations with research organizations and veterinary clinics enable faster development and approval of novel therapies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Therapy type

- 2.2.3 Disease

- 2.2.4 Animal type

- 2.2.5 Route of administration

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing threat of transfer of zoonotic diseases among humans

- 3.2.1.2 Rising incidence of auto-immune diseases in livestock animals

- 3.2.1.3 Increasing awareness and diagnosis of autoimmune diseases

- 3.2.1.4 Growing companion animal ownership

- 3.2.1.5 Increasing expenditure on animal healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of veterinary autoimmune therapies

- 3.2.2.2 Increased risk of infection due to autoimmune drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for breed-specific and personalized treatments

- 3.2.3.2 Growth in telemedicine and remote veterinary diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.6.1 Current technology

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Therapy Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Corticosteroids

- 5.3 Azathioprine

- 5.4 Cyclosporine

- 5.5 Mycophenolate

- 5.6 Leflunomide

- 5.7 Cyclophosphamide

- 5.8 Levothyroxine

- 5.9 Other therapy types

Chapter 6 Market Estimates and Forecast, By Disease, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hypothyroidism

- 6.3 Pemphigus disease

- 6.4 Canine lupus

- 6.5 Auto-immune haemolytic anaemia

- 6.6 Bullous pemphigoid

- 6.7 Discoid lupus erythematosus (DLE)

- 6.8 Immune-related arthritis

- 6.9 Other diseases

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Companion animals

- 7.2.1 Dogs

- 7.2.2 Cats

- 7.2.3 Horses

- 7.2.4 Other companion animals

- 7.3 Livestock animals

- 7.3.1 Cattle

- 7.3.2 Swine

- 7.3.3 Poultry

- 7.3.4 Sheep

- 7.3.5 Other livestock animals

- 7.4 Other animals

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Injectable

- 8.4 Topical

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals

- 9.3 Veterinary clinics

- 9.4 Other distribution channels

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aratana Therapeutics

- 11.2 Ceva Sante Animale

- 11.3 Dechra Pharmaceuticals

- 11.4 Elanco

- 11.5 Heska

- 11.6 Mars Veterinary Health

- 11.7 Merck

- 11.8 Norbrook

- 11.9 Vetoquinol

- 11.10 Vet-Stem

- 11.11 Virbac

- 11.12 Zoetis