PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844305

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844305

Automotive Audio Semiconductor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

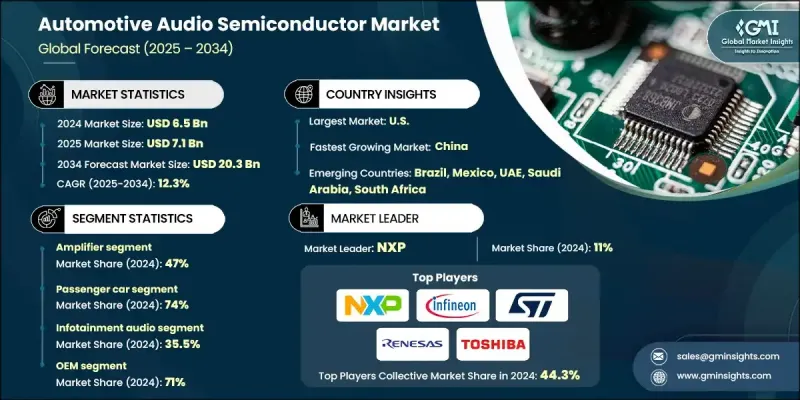

The Global Automotive Audio Semiconductor Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 12.3% to reach USD 20.3 billion by 2034.

This growth reflects the surge in demand for advanced in-vehicle infotainment systems, as automakers prioritize immersive user experiences. With modern consumers expecting touchscreens, voice interaction, and seamless audio connectivity, semiconductors play a key role in powering high-fidelity sound processing and efficient multi-channel setups. As electric and hybrid vehicles emphasize cabin comfort and advanced electronic features, specialized semiconductors are increasingly required to meet performance, energy efficiency, and low-noise standards. Voice-command systems and AI-driven infotainment platforms also rely on sophisticated audio chips to interpret commands and enhance real-time sound quality. The shift toward connected, interactive cabin environments is directly influencing the rise in semiconductor integration across all vehicle segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $20.3 Billion |

| CAGR | 12.3% |

In 2024, the amplifiers segment held a 47% share and is forecast to grow at a CAGR of 13% through 2034. Advanced Class-D amplifiers are being widely integrated into vehicle audio architectures, supporting multi-channel audio with minimal distortion while optimizing power efficiency. This trend is primarily driven by consumer demand for elevated sound experiences, particularly in mid-range and high-end vehicle segments.

The passenger cars segment held a 74% share in 2024 and is anticipated to grow at a CAGR of 12.9% between 2025 and 2034. The rising use of infotainment technologies in this segment, including voice recognition, audio streaming, and interactive displays, has significantly increased the need for integrated semiconductor solutions like power amplifiers, DSPs, and connectivity chips. Enhanced sound features are now essential even in entry-level models, reinforcing the demand for audio-focused semiconductors throughout the passenger vehicle category.

US Automotive Audio Semiconductor Market held a 90% share and generated USD 1.6 billion in 2024. The country remains a global leader in the sale of premium and luxury vehicles, where high-end branded sound systems are essential features. These vehicles require advanced semiconductors for surround sound processing, signal conditioning, and amplifier performance. As carmakers strive to differentiate with immersive audio experiences, the US continues to lead in the adoption and development of automotive audio chip technologies.

Key players in the Automotive Audio Semiconductor Market include Infineon Technologies, ROHM Semiconductor, NXP, Analog Devices, STMicroelectronics, ON Semiconductor, Qualcomm, Toshiba Electronic Devices, Texas Instruments, and Renesas Electronics. To maintain a strong position in the competitive automotive audio semiconductor market, leading companies are investing heavily in next-gen audio technologies, including smart amplifiers and AI-integrated DSPs. Firms are focusing on energy-efficient chip designs that meet the demands of electric vehicles while enhancing acoustic performance. Strategic alliances with automotive OEMs help accelerate product adoption, while R&D efforts are geared toward developing compact, multifunctional chips that support advanced connectivity and voice interfaces.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Propulsion

- 2.2.5 Application

- 2.2.6 Installation

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for immersive in-car audio

- 3.2.1.2 Increasing EV adoption

- 3.2.1.3 Integration of AI and voice assistants

- 3.2.1.4 Shift toward connected and software-defined vehicles

- 3.2.1.5 Premium OEM collaborations with audio brands

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High R&D and production costs

- 3.2.2.2 Semiconductor supply chain volatility

- 3.2.2.3 Stringent automotive reliability standards

- 3.2.2.4 Rapid pace of tech change

- 3.2.3 Market opportunities

- 3.2.3.1 Growing EV and hybrid production in APAC

- 3.2.3.2 Adoption of active noise cancellation (ANC)

- 3.2.3.3 Cloud-connected infotainment systems

- 3.2.3.4 Expansion of premium car ownership in emerging markets

- 3.2.3.5 Collaboration between chipmakers and Tier-1 OEMs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent analysis

- 3.11 Price trends

- 3.11.1 By region

- 3.11.2 By product

- 3.12 Cost breakdown analysis

- 3.13 Production statistics

- 3.13.1 Production hubs

- 3.13.2 Import and export

- 3.13.3 Major import countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

- 3.15 Investment Landscape Analysis

- 3.15.1 Semiconductor R&D Investment

- 3.15.2 Automotive Audio Technology Funding

- 3.15.3 Venture Capital in Audio Innovation

- 3.15.4 Corporate Investment Patterns

- 3.15.5 Government Research Funding

- 3.15.6 M&A Activity in Audio Semiconductors

- 3.16 Automotive Audio Architecture Evolution

- 3.17 ADAS Audio Integration

- 3.18 Multi-Zone and Personalized Audio Systems

- 3.19 Software-Defined Vehicle (SDV) Impact

- 3.20 Audio Quality and Performance Benchmarking

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn) (Units)

- 5.1 Key trends

- 5.2 Amplifier

- 5.3 DSP

- 5.4 Microphone

- 5.5 Tuner

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn) (Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 All-electric

- 6.5 HEV

- 6.6 PHEV

- 6.7 FCEV

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Units)

- 7.1 Key trends

- 7.2 Infotainment audio

- 7.3 In-car Voice

- 7.4 Active noise cancellation

- 7.5 ADAS audio cues

- 7.6 Telematics & call audio

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Installation, 2021 - 2034 ($Bn) (Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn) (Units)

- 9.1 Key trends

- 9.2 Passenger car

- 9.2.1 Hatchback

- 9.2.2 Sedan

- 9.2.3 SUV

- 9.3 Commercial Vehicle

- 9.3.1 Light duty

- 9.3.2 Medium duty

- 9.3.3 Heavy-duty

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn) (Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Analog Devices

- 11.1.2 Cirrus Logic

- 11.1.3 Infineon Technologies

- 11.1.4 NXP

- 11.1.5 ON Semiconductor

- 11.1.6 Qualcomm

- 11.1.7 Renesas Electronics

- 11.1.8 ROHM Semiconductor

- 11.1.9 STMicroelectronics

- 11.1.10 Texas Instruments

- 11.1.11 Toshiba Electronic Devices

- 11.2 Regional Champions

- 11.2.1 MediaTek

- 11.2.2 Realtek

- 11.2.3 ESS Technology

- 11.2.4 Synaptics

- 11.2.5 Dialog Semiconductor

- 11.2.6 Wolfson Microelectronics

- 11.2.7 AKM Semiconductor

- 11.2.8 Yamaha

- 11.2.9 Nuvoton Technology

- 11.2.10 Silicon Labs

- 11.3 Emerging Players & Service Providers

- 11.3.1 Cadence Design Systems

- 11.3.2 CEVA

- 11.3.3 Dolby Laboratories

- 11.3.4 DSP Group

- 11.3.5 DTS

- 11.3.6 Fortemedia

- 11.3.7 Imagination Technologies

- 11.3.8 Knowles

- 11.3.9 Tempo Semiconductor

- 11.3.10 Waves Audio