PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876636

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876636

Automotive Holographic Display Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

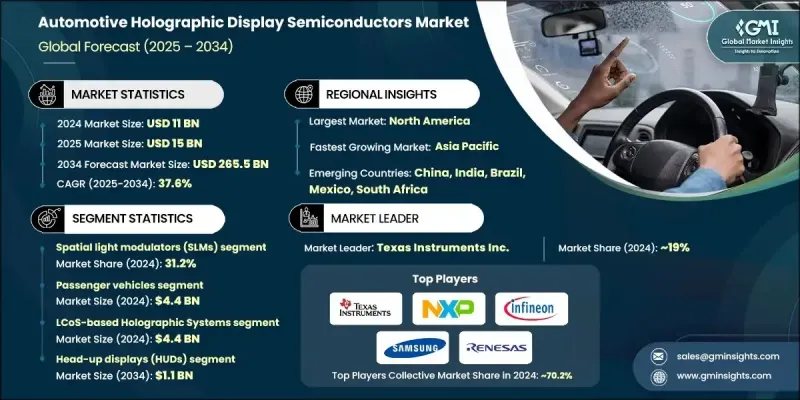

The Global Automotive Holographic Display Semiconductors Market was valued at USD 11 billion in 2024 and is estimated to grow at a CAGR of 37.6% to reach USD 265.5 billion by 2034.

The rapid adoption of augmented reality and digital visualization technologies in vehicles is accelerating demand for advanced semiconductors that power next-generation holographic display systems. Automakers are increasingly focusing on integrating high-performance chips capable of delivering ultra-clear, real-time images for enhanced driver safety and immersive infotainment experiences. As the automotive industry transitions toward connected and autonomous vehicles, holographic displays are being used to project critical data directly within the driver's line of sight, improving situational awareness and overall safety. These innovative display systems rely on powerful semiconductors that process complex visual information instantly and maintain performance under dynamic conditions. Governments promoting smart mobility, sustainability, and electric vehicle technologies are also driving semiconductor innovation and adoption. The expansion of premium and electric vehicle production, combined with growing consumer demand for futuristic in-car environments, continues to strengthen market growth. Ongoing collaboration between technology providers, semiconductor companies, and automotive manufacturers is accelerating the commercialization of advanced holographic display systems that redefine the digital cockpit experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11 Billion |

| Forecast Value | $265.5 Billion |

| CAGR | 37.6% |

The digital micromirror devices (DMDs) segment accounted for USD 2.8 billion in 2024 and is anticipated to grow at a CAGR of 39.5% through 2034. DMD-based semiconductors deliver exceptional image precision, brightness, and contrast, making them integral to high-performance holographic and head-up displays. These systems employ thousands of microscopic mirrors to manipulate light with extreme accuracy, resulting in vivid and high-resolution projections. Their ability to maintain clarity and responsiveness in diverse lighting environments enhances driver visibility and real-time awareness. The integration of DMDs into electric and autonomous vehicles is expanding rapidly as they support advanced driver assistance, navigation visualization, and safety alerts, helping manufacturers meet growing expectations for next-level automotive display systems.

The passenger vehicle segment generated USD 4.4 billion in 2024. This dominance is attributed to rising consumer interest in advanced infotainment, augmented reality interfaces, and driver assistance technologies. The increasing production of electric and luxury cars is further elevating the need for holographic display semiconductors that provide efficient power management and premium visual output. Manufacturers are emphasizing the development of cost-effective, energy-optimized semiconductor solutions specifically designed for passenger vehicles to balance performance and affordability. The demand for immersive, interactive digital displays inside vehicles continues to rise, reshaping user experience standards across the automotive industry.

North America Automotive Holographic Display Semiconductors Market held a share of 28.2% in 2024. The regional market benefits from rapid technological innovation, strong electric vehicle adoption, and early integration of augmented reality head-up displays. High investment in R&D, government initiatives promoting connected mobility, and the presence of prominent semiconductor producers are supporting steady market expansion. The region's automotive sector is leveraging holographic display systems as a competitive differentiator, focusing on enhancing safety, driver awareness, and entertainment capabilities within connected vehicles.

Key players shaping the Global Automotive Holographic Display Semiconductors Market include Synaptics Incorporated, Samsung Electronics Co., Ltd., Texas Instruments Inc., Himax Technologies, Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, ROHM Semiconductor, Infineon Technologies AG, Magnachip Semiconductor Corporation, Novatek Microelectronics Corp., ON Semiconductor Corporation, Raydium Semiconductor Corporation, LX Semicon Co., Ltd., FocalTech Systems Co., Ltd., ams OSRAM AG, Valens Semiconductor Ltd., Appotronics Co., Ltd., Ceres Holographics Ltd., and Envisics Ltd. Leading companies in the Automotive Holographic Display Semiconductors Market are pursuing innovation-driven strategies focused on enhancing image precision, energy efficiency, and integration capabilities. Many are investing heavily in R&D to develop semiconductor architectures optimized for augmented reality and real-time 3D visualization. Collaborations with automakers and technology developers are accelerating product testing and deployment in next-generation vehicles. Companies are also expanding manufacturing capacity to meet growing demand for high-speed, low-power chips used in head-up and holographic display systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional Trends

- 2.2.2 Semiconductor Device Type Trends

- 2.2.3 Vehicle Type Trends

- 2.2.4 Holographic Technology Type Trends

- 2.2.5 Application Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing Adoption of Reality (AR) Head-Up Displays (HUDs) for Improved Driver Safety and Navigation Visualization.

- 3.2.1.2 Rising Demand for Premium and Electric Vehicles Equipped with Advanced Digital Systems.

- 3.2.1.3 Continuous Technological Advancements in Semiconductor Design Enhancing Display Performance and Energy Efficiency.

- 3.2.1.4 Increasing Consumer Preference for Immersive and Futuristic In-Car Experiences.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Production and Integration Costs Associated with Holographic Display Semiconductors.

- 3.2.2.2 Thermal Management and Miniaturization Issues in Compact Vehicle Dashboards.

- 3.2.3 Market opportunities

- 3.2.3.1 Development of Energy-efficient Semiconductor Materials for Next-Generation AR and 3D Display Systems.

- 3.2.3.2 Integration of AI-driven Holographic Visualization for Predictive Navigation and Safety Alerts.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Semiconductor Device Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Spatial Light Modulators (SLMs)

- 5.3 Digital Micromirror Devices (DMDs)

- 5.4 Processing Semiconductors

- 5.5 Driver Integrated Circuits

- 5.6 Power Management ICs

Chapter 6 Market Estimates and Forecast, By Vehicle Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Passenger Vehicles

- 6.3 Commercial Vehicles

- 6.4 Autonomous Vehicles

Chapter 7 Market Estimates and Forecast, By Holographic Technology Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 LCoS-based Holographic Systems

- 7.3 DLP-based Holographic Systems

- 7.4 Metasurface-based Systems

- 7.5 Waveguide-integrated Systems

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Head-Up Displays (HUDs)

- 8.3 Instrument Cluster Displays

- 8.4 Infotainment Systems

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Texas Instruments Inc.

- 10.2 NXP Semiconductors N.V.

- 10.3 Renesas Electronics Corporation

- 10.4 Samsung Electronics Co., Ltd.

- 10.5 Himax Technologies, Inc.

- 10.6 ROHM Semiconductor

- 10.7 Infineon Technologies AG

- 10.8 Synaptics Incorporated

- 10.9 Magnachip Semiconductor Corporation

- 10.10 Novatek Microelectronics Corp.

- 10.11 ON Semiconductor Corporation

- 10.12 Raydium Semiconductor Corporation

- 10.13 LX Semicon Co., Ltd.

- 10.14 FocalTech Systems Co., Ltd.

- 10.15 ams OSRAM AG

- 10.16 Valens Semiconductor Ltd.

- 10.17 Ceres Holographics Ltd.

- 10.18 Appotronics Co., Ltd.

- 10.19 Envisics Ltd.