PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871106

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871106

Automotive Lighting Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

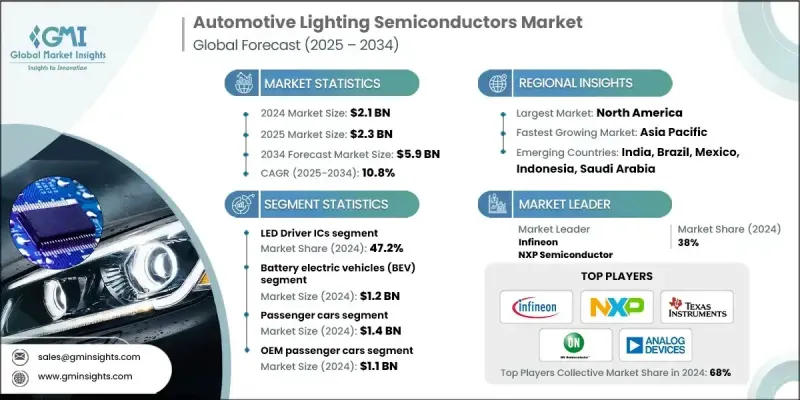

The Global Automotive Lighting Semiconductors Market was valued at USD 2.1 Billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 5.9 Billion by 2034.

The market growth is driven by the shift from traditional halogen and xenon lamps to LED and OLED lighting technologies, which provide better brightness, longer life, and lower energy consumption. Automotive manufacturers are increasingly integrating these advanced lighting systems to enhance efficiency, sustainability, and vehicle design. The adoption of adaptive and smart lighting, which adjusts beam intensity and direction based on driving conditions, is accelerating demand for semiconductors capable of precise real-time control. These innovations are critical for energy efficiency, safety, and overall vehicle performance, positioning automotive lighting semiconductors as a key enabler of modern automotive technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 10.8% |

In 2024, the battery electric vehicles (BEV) sector generated USD 1.2 Billion owing to the rising use of energy-efficient lighting systems. The increasing production of BEVs, coupled with growing demand for advanced LED and adaptive lighting, is driving semiconductor adoption for improved vehicle performance and safety. Manufacturers are focusing on enhancing the performance, reliability, and integration capabilities of lighting semiconductors. Developing multifunctional chips that combine LED driving, sensing, and communication features is a key strategy to add value for automakers.

The passenger car segment generated USD 1.4 Billion in 2024. This leadership is fueled by widespread adoption of LED and OLED lighting, offering energy efficiency, improved brightness, and design flexibility. The increasing integration of advanced driver-assistance systems (ADAS) with adaptive headlights and automated signaling further boosts demand. Consumer preference for stylish, safe, and modern lighting solutions is driving manufacturers to invest in high-performance lighting semiconductors. Rising production of passenger vehicles across Europe, North America, and Asia supports sustained market expansion and technological advancement.

North America Automotive Lighting Semiconductors Market reached USD 732.5 million in 2024. This increase is attributed to greater adoption of LED and OLED lighting in both passenger and commercial vehicles for energy efficiency, visibility, and design. Integration of ADAS systems, including adaptive headlights, automated signaling, and intelligent lighting controls, further strengthens semiconductor demand. Additionally, rising vehicle production, consumer demand for safe and stylish lighting, and stricter safety regulations contribute to the growing deployment of automotive lighting semiconductors in North America.

Prominent Automotive Lighting Semiconductors Market participants include Infineon, NXP Semiconductors, Texas Instruments, ON Semiconductor, Analog Devices, STMicroelectronics, Monolithic Power Systems, Renesas Electronics, ams-OSRAM, Nichia, Lumileds, Seoul Semiconductor, and Samsung LED. Key strategies adopted by companies in the automotive lighting semiconductors market include investing heavily in research and development to create energy-efficient, high-performance, and multifunctional chips, forming strategic partnerships with automakers to co-develop tailored solutions, and expanding manufacturing capabilities to meet growing demand. Firms are also focusing on improving reliability and integration capabilities, developing adaptive and smart lighting solutions, and localizing production to strengthen supply chain resilience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product Type

- 2.2.2 Vehicle Powertrain

- 2.2.3 Vehicle Class

- 2.2.4 End Use Analysis

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of LED and OLED technologies in vehicle lighting systems

- 3.2.1.2 Increasing demand for energy-efficient and long-lasting lighting solutions

- 3.2.1.3 Growth in electric and autonomous vehicles requiring advanced lighting systems

- 3.2.1.4 Rising consumer preference for premium and aesthetic vehicle designs

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Implementation and Integration Costs

- 3.2.2.2 Market Fragmentation & Interoperability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 LED Driver ICs

- 5.3 Power Management ICs (PMICs)

- 5.4 Microcontrollers (MCUs)

- 5.5 Optoelectronic Components

- 5.6 Discrete Components

Chapter 6 Market Estimates & Forecast, By Vehicle Powertrain, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Internal Combustion Engine (ICE) Vehicles

- 6.3 Hybrid Electric / Plug-in Hybrid Electric Vehicles (HEV/PHEV)

- 6.4 Battery Electric Vehicles (BEV)

Chapter 7 Market Estimates & Forecast, By Vehicle Class, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.3 Light Commercial Vehicles (LCVs)

- 7.4 Heavy Commercial Vehicles (HCVs)

Chapter 8 Market Estimates & Forecast, By End Use Customer, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 OEM Passenger Cars

- 8.3 OEM Commercial Vehicles

- 8.4 Tier-1 Suppliers

- 8.5 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Infineon

- 10.2 NXP Semiconductors

- 10.3 Texas Instruments

- 10.4 ON Semiconductor

- 10.5 Analog Devices

- 10.6 STMicroelectronics

- 10.7 Monolithic Power Systems

- 10.8 Renesas Electronics

- 10.9 ams-OSRAM

- 10.10 Nichia

- 10.11 Lumileds

- 10.12 Seoul Semiconductor

- 10.13 Samsung LED