PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858857

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858857

Asia Pacific Bunker Fuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

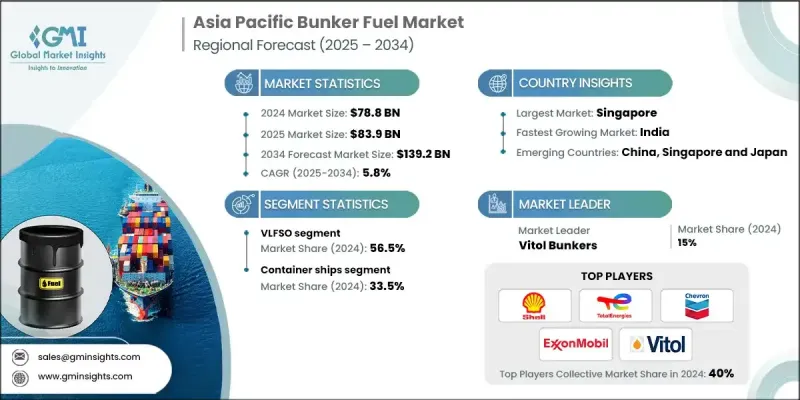

Asia Pacific Bunker Fuel Market was valued at USD 78.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 139.2 billion by 2034.

The growth is influenced by intensifying environmental regulations and the global maritime sector's increasing focus on cleaner and more sustainable fuel alternatives. With the implementation of the IMO's 2020 sulfur cap, there has been a widespread transition toward fuels with reduced sulfur content, pushing suppliers and refiners to realign their product portfolios accordingly. As operators across the region seek compliance, there is growing reliance on cleaner marine fuels, driving the demand for compliant options. The increasing shift toward LNG is notable, given its capacity to cut emissions significantly. Ongoing developments in bunkering facilities and propulsion systems are supporting this transition. Interest in alternative fuels such as methanol, biofuels, and ammonia is also rising, driven by tightening emission standards. Alongside these fuel trends, advancements in technology and digitization are reshaping fuel procurement processes. Industry players are embracing digital tools to streamline operations, monitor fuel quality, and manage real-time emission tracking, which continues to refine the way fuel is supplied and consumed across the region's maritime landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $78.8 Billion |

| Forecast Value | $139.2 Billion |

| CAGR | 5.8% |

The VLSFO is expected to reach USD 95 billion by 2034, driven by strict emission control measures and the immediate compliance capabilities it offers to shipping companies without the need for major engine upgrades. Its widespread availability at regional ports, along with efforts by refineries to enhance production efficiency, is shaping its market trajectory. Increasing strategic alliances and supply chain optimizations are further boosting VLSFO uptake across fleets.

In terms of vessel categories, the container ship segment held a 33.5% share in 2024 and is projected to grow at a CAGR of 5.5% through 2034. These vessels are among the most energy-intensive in the industry, making them key consumers of advanced bunker fuels. As maritime logistics expand and demand for high-capacity freight services continues to rise, operators are adopting compliant marine fuels like VLSFO and marine gas oil (MGO) to meet evolving regulations. Integration of fuel-efficient technologies and modern propulsion systems is further accelerating demand in this segment.

China Bunker Fuel Market held16.6% share and generated USD 13 billion in 2024. The country's dominant position is backed by its critical role in regional and global shipping routes, as well as its significant investment in expanding port capabilities. China is gradually shifting from high-sulfur fuel oil (HSFO) toward low-emission fuel alternatives, including VLSFO, LNG, and bio-marine fuels. Government-supported initiatives are encouraging pilot projects and infrastructure development to facilitate the adoption of next-generation marine fuels.

Leading companies operating within the Asia Pacific Bunker Fuel Market include Exxon Mobil Corporation, Cheniere Energy, Chemoil Energy Limited, Total Energies, BP, Hindustan Petroleum Corporation Limited, Brightoil Petroleum, China Marine Bunker (PetroChina) Co., Ltd., Shell, Innospec, Indian Oil Corporation, Chevron Corporation, PetroChina Company Limited, Sempra Energy, Minerva Bunkering, Repsol, TFG Marine Pte. Ltd., PETRONAS, Korea LNG Bunkering, and Vitol Bunkers. To strengthen their presence in the Asia Pacific Bunker Fuel Market, key companies are investing in infrastructure upgrades and expanding their supply networks at strategic port locations. Many are forming partnerships with shipping firms and port authorities to secure long-term supply contracts. Firms are also diversifying their fuel portfolios to include LNG, methanol, and bio-based alternatives, aligning with decarbonization trends. In response to tightening regulations, companies are focusing on digital transformation to improve procurement transparency, fuel traceability, and emissions monitoring.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Vessel type trends

- 2.5 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digital transformation with IoT technologies

- 3.7.2 Emerging market penetration

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 China

- 4.2.2 India

- 4.2.3 Japan

- 4.2.4 South Korea

- 4.2.5 Australia

- 4.2.6 Singapore

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Key innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 HSFO

- 5.3 VLSFO

- 5.4 MGO

- 5.5 LNG

- 5.6 Others

Chapter 6 Market Size and Forecast, By Vessel Type, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 Container ships

- 6.3 Tanker

- 6.4 Cargo vessels

- 6.5 Cruise ships

- 6.6 Others

Chapter 7 Market Size and Forecast, By Country, 2021 - 2034, (USD Million)

- 7.1 Key trends

- 7.2 China

- 7.3 India

- 7.4 Japan

- 7.5 South Korea

- 7.6 Australia

- 7.7 Singapore

Chapter 8 Company Profiles

- 8.1 BP

- 8.2 Brightoil Petroleum

- 8.3 Chemoil Energy Limited

- 8.4 Cheniere Energy

- 8.5 Chevron Corporation

- 8.6 China Marine Bunker (PetroChina) Co., Ltd

- 8.7 Exxon Mobil Corporation

- 8.8 Hindustan Petroleum Corporation Limited

- 8.9 Innospec

- 8.10 Indian Oil Corporation

- 8.11 KOREA LNG BUNKERING

- 8.12 Minerva Bunkering

- 8.13 PetroChina Company Limited

- 8.14 Petroliam Nasional Berhad (PETRONAS)

- 8.15 Repsol

- 8.16 Sempra Energy

- 8.17 Shell

- 8.18 TFG Marine Pte. Ltd.

- 8.19 TotalEnergies

- 8.20 Vitol Bunkers