PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858869

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858869

Branded Food Staple Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

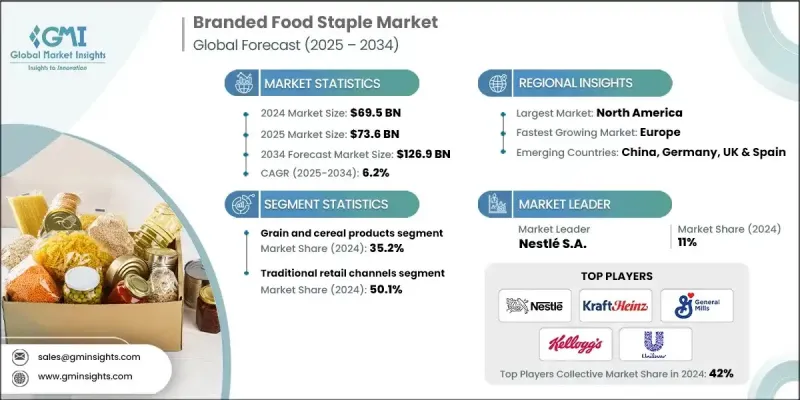

The Global Branded Food Staple Market was valued at USD 69.5 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 126.9 billion by 2034.

This market comprises widely consumed, packaged essential food items such as rice, flour, sugar, cooking oils, and pulses, each offering consistent quality and the reliability of trusted brands. As global urbanization accelerates and consumer habits evolve, there's a clear shift toward packaged staples that guarantee food safety, traceability, and defined nutritional value. The rising demand for clean-label, fortified, and additive-free options aligns with the broader health-conscious movement, further amplifying branded staple consumption. Currently, consumers are favoring transparency, quality assurance, and convenience over bulk or unpackaged alternatives. Branded staples are gaining significant traction in both mature and emerging markets, especially as people adopt busier lifestyles and seek trusted names in their everyday diets. Improved income levels, awareness around food safety, and lifestyle changes are shaping consumption trends globally. Markets are also adapting to the demand for sustainable practices and eco-friendly packaging, which reflects growing environmental consciousness among consumers and influences product choices across regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.5 Billion |

| Forecast Value | $126.9 Billion |

| CAGR | 6.2% |

The grain and cereal products segment held a 35.2% share and is projected to grow at a CAGR of 6.5% through 2034. This segment's stronghold is driven by greater urban penetration, rising awareness of nutritional content in packaged grains, and increasing focus on health-based food selections. Demand for cooking oils and fats remains high, supported by growing interest in plant-based, heart-healthy options. Branded offerings now include oils enriched with omega-3 and varieties such as coconut, flaxseed, and avocado, contributing to the overall expansion of this product category.

The traditional retail segment held a 50.1% share in 2024 and is forecast to grow at a CAGR of 6.3% by 2034. Supermarkets, local grocery stores, and small-scale shops continue to be the primary buying points for staple food items worldwide. With the modernization of retail formats, in-store upgrades like branded display zones, nutrition counters, and sampling stations are elevating consumer engagement and driving brand preference at point-of-sale locations.

North America Branded Food Staple Market held 30.3% share in 2024, driven by the rising preference for organic, clean-label, and health-focused food products. Regional trends show growing interest in sustainable sourcing and eco-friendly packaging, which is influencing both product design and purchasing behavior. As consumers become increasingly health-aware and environmentally conscious, brands in this region are adjusting their strategies to cater to these evolving expectations and ensure long-term growth.

Key players actively shaping the Global Branded Food Staple Market include The Coca-Cola Company, Nestle S.A., Mondelez International Inc., PepsiCo Inc., The Hershey Company, McCormick & Company, Inc., Danone S.A., Mars Incorporated, General Mills Inc., The Kellogg's Company, Kraft Heinz Company, Associated British Foods plc (ABF), and Unilever. To strengthen their foothold in the Global Branded Food Staple Market, leading companies are implementing strategic actions focused on product innovation, sustainability, and supply chain efficiency. A major priority is expanding portfolios with health-forward options such as organic, fortified, or plant-based staples that meet evolving consumer demands. Brands are also investing in eco-friendly packaging solutions and responsible sourcing to align with environmental goals. Leveraging digital channels and omnichannel retail strategies, these companies are enhancing direct-to-consumer reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product category

- 2.2.3 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Changing Consumer Lifestyles and Dietary Preferences

- 3.2.1.2 Brand Recognition and Trust

- 3.2.1.3 Increasing Health and Wellness Awareness

- 3.2.1.4 Technological Advancements in Packaging and Production

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Price Volatility of Raw Materials

- 3.2.2.2 Intense Competition from Private Labels

- 3.2.3 Market opportunities

- 3.2.3.1 Health-oriented Product Innovation

- 3.2.3.2 Private Label Partnerships

- 3.2.3.3 Sustainable Packaging Solutions

- 3.2.3.4 Emerging Market Penetration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Category, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Grain and cereal products

- 5.2.1 Rice and rice products

- 5.2.2 Wheat and wheat-based products

- 5.2.3 Oats and oat-based products

- 5.2.4 Specialty and ancient grains

- 5.3 Cooking oils and fats

- 5.3.1 Vegetable oils

- 5.3.2 Olive oil and premium oils

- 5.3.3 Specialty and functional oils

- 5.3.4 Butter and margarine products

- 5.4 Sugar and sweeteners

- 5.4.1 Refined sugar products

- 5.4.2 Natural and alternative sweeteners

- 5.4.3 Honey and maple products

- 5.4.4 Artificial sweetener systems

- 5.5 Salt and seasonings

- 5.5.1 Table salt and specialty salts

- 5.5.2 Spice and seasoning blends

- 5.5.3 Herbs and natural seasonings

- 5.5.4 Ethnic and international seasonings

- 5.6 Canned and preserved foods

- 5.6.1 Canned vegetables and fruits

- 5.6.2 Preserved meat and seafood

- 5.6.3 Pickled and fermented products

- 5.7 Pasta and noodle products

- 5.7.1 Traditional pasta products

- 5.7.2 Specialty and artisanal pasta

- 5.7.3 Alternative and gluten-free pasta

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Traditional retail channels

- 6.2.1 Supermarkets and hypermarkets

- 6.2.2 Convenience stores

- 6.2.3 Specialty food stores

- 6.3 Modern retail formats

- 6.3.1 Discount retailers

- 6.3.2 Organic and natural food stores

- 6.3.3 Gourmet and premium retailers

- 6.4 E-commerce and digital channels

- 6.4.1 Online grocery platforms

- 6.4.2 Direct-to-consumer sales

- 6.4.3 Subscription services

Chapter 7 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Associated British Foods plc (ABF)

- 8.2 Danone S.A.

- 8.3 General Mills Inc.

- 8.4 Kraft Heinz Company

- 8.5 Mars Incorporated

- 8.6 McCormick & Company, Inc.

- 8.7 Mondelez International Inc.

- 8.8 Nestle S.A.

- 8.9 PepsiCo Inc.

- 8.10 The Coca-Cola Company

- 8.11 The Hershey Company

- 8.12 The Kellogg's Company

- 8.13 Unilever