PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871091

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871091

Latin America Veterinary Orthopedic Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

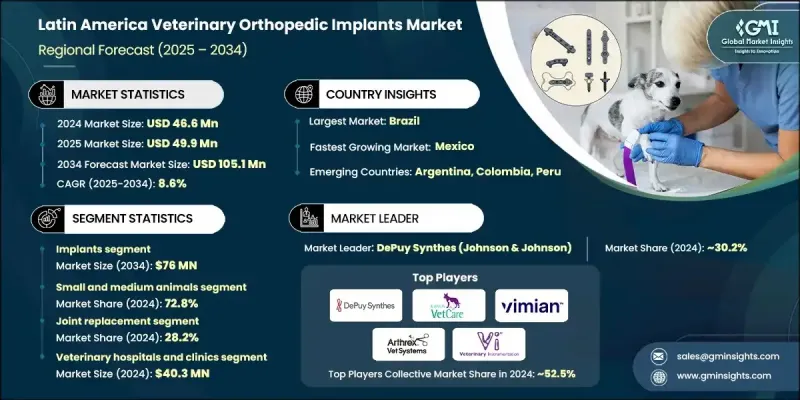

Latin America Veterinary Orthopedic Implants Market was valued at USD 46.6 million in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 105.1 million by 2034.

The market is advancing steadily as veterinarians across the region adopt innovative solutions for treating musculoskeletal injuries and conditions in animals. These implants, typically crafted from stainless steel or titanium, play a crucial role in managing fractures, joint dysfunctions, and degenerative diseases. As veterinary medicine becomes more specialized, the demand for advanced fixation systems like locking plates and intramedullary nails has increased significantly. These devices deliver better stabilization and promote faster recovery compared to traditional alternatives. Additionally, a notable rise in complex orthopedic conditions such as ligament tears and joint disorders is driving the preference for cutting-edge implant technologies. Growing use of minimally invasive techniques, including smaller incisions and arthroscopy-compatible implants, is transforming surgical approaches and improving outcomes. This not only reduces animal discomfort and recovery time but also appeals to pet owners seeking high-quality care for their animals. The market benefits from strong consumer awareness, increased pet ownership, and ongoing improvements in veterinary infrastructure throughout the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.6 Million |

| Forecast Value | $105.1 Million |

| CAGR | 8.6% |

In 2024, the implants segment generated USD 33.2 million, projected to hit USD 76 million by 2034. This strong performance is driven by a growing pet population and increased awareness surrounding the availability and benefits of advanced orthopedic implants. A rise in pet adoption, particularly of dogs, is fueling demand for effective surgical solutions. Cases of fractures, cranial cruciate ligament injuries, osteoarthritis, and hip dysplasia are growing across Latin America, accelerating the adoption of implant-based treatments and supporting the expansion of this segment.

The small and medium animal segment held a 72.8% share in 2024, owing to the high number of companion animals like cats and dogs. The large pet base across Latin American countries generates constant demand for veterinary care, including surgical interventions. Veterinary professionals increasingly focus on orthopedic solutions for these animals, particularly fracture repairs and ligament reconstructions. Manufacturers are tailoring implant product lines specifically for small animal applications, further solidifying this segment's market dominance.

Brazil Veterinary Orthopedic Implants Market generated USD 20.2 million in 2024, securing its position as the leading country in the region for veterinary orthopedic implants. The country stands out with its extensive network of veterinary specialists, advanced clinics, and growing awareness among pet owners. Brazil's leadership in this space is also supported by innovation in surgical techniques and rapid adoption of high-performance implant technologies.

Key players active in the Latin America Veterinary Orthopedic Implants Market include Movora (Vimian Group), Arthrex Vet Systems, Fusion Implants, Ortho Max, BlueSAO, Integra LifeSciences, Veterinary Instrumentation, GerVetUSA, GPC Medical, Narang Medical Limited, Orthomed, B. Braun, AmerisourceBergen Corporation (Cencora), Rita Leibinger, and DePuy Synthes (Johnson & Johnson). Companies in the Latin America Veterinary Orthopedic Implants Market are adopting strategies that combine localized manufacturing, tailored product portfolios, and specialized veterinary education. They are introducing region-specific product designs aimed at common small animal conditions to ensure compatibility with local veterinary practices. Strategic partnerships with distributors and clinics allow faster market penetration and better on-ground service delivery.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Country trends

- 2.2.3 Product trends

- 2.2.4 Animal type trends

- 2.2.5 Application trends

- 2.2.6 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising penetration of pet insurance

- 3.2.1.2 Growing incidence of musculoskeletal disorders in animals

- 3.2.1.3 Rising pet ownership and humanization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of orthopedic procedures and implants

- 3.2.2.2 Post-surgical complications and recovery time

- 3.2.3 Market opportunities

- 3.2.3.1 Emergence of biodegradable and resorbable implants

- 3.2.3.2 Expansion of veterinary specialty hospitals and referral centers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Pet population, by country

- 3.7 Livestock population, by country

- 3.8 Consumer behavior analysis

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implants

- 5.2.1 Plates

- 5.2.1.1 TPLO plates

- 5.2.1.2 TTA plates

- 5.2.1.3 Trauma plates

- 5.2.1.4 Specialty plates

- 5.2.1.5 Other plates

- 5.2.2 Joint implants

- 5.2.3 Bone screws and anchors

- 5.2.4 Pins and wires

- 5.2.5 Other implants

- 5.2.1 Plates

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Small and medium animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Other small and medium animals

- 6.3 Large animals

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Tibial plateau leveling osteotomy (TPLO)

- 7.3 Tibial tuberosity advancement (TTA)

- 7.4 Joint replacement

- 7.4.1 Hip replacement

- 7.4.2 Knee replacement

- 7.4.3 Elbow replacement

- 7.4.4 Ankle replacement

- 7.5 Trauma

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Other End use

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Brazil

- 9.3 Mexico

- 9.4 Argentina

- 9.5 Colombia

- 9.6 Chile

- 9.7 Peru

Chapter 10 Company Profiles

- 10.1 AmerisourceBergen Corporation (Cencora)

- 10.2 Arthrex Vet Systems

- 10.3 B. Braun

- 10.4 BlueSAO

- 10.5 DePuy Synthes (Johnson & Johnson)

- 10.6 Fusion Implants

- 10.7 GerVetUSA

- 10.8 GPC Medical

- 10.9 Integra LifeSciences

- 10.10 Movora (Vimian Group)

- 10.11 Narang Medical Limited

- 10.12 Ortho Max

- 10.13 Orthomed

- 10.14 Rita Leibinger

- 10.15 Veterinary Instrumentation