PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871184

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871184

Asia Pacific Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

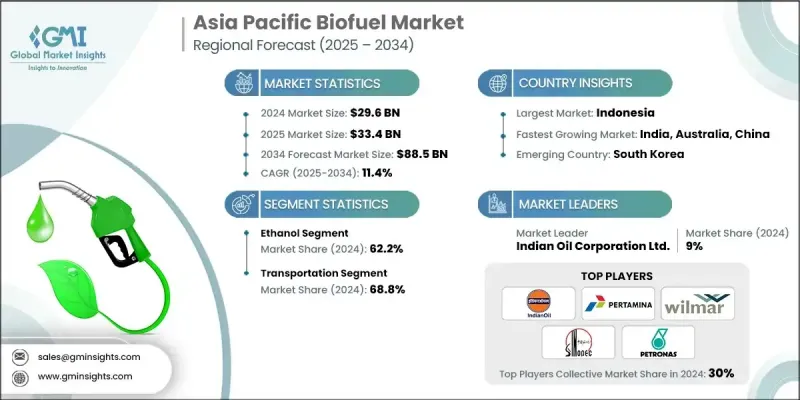

Asia Pacific Biofuel Market was valued at USD 29.6 Billion in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 88.5 Billion by 2034.

The market is witnessing accelerated adoption of advanced biofuels, driven by supportive government policies and incentives that encourage the use of alternative feedstocks and promote second- and third-generation biofuels. These reforms aim to enhance energy security, reduce dependence on fossil fuels, and help countries achieve their climate targets. By including brownfield and bolt-on projects under incentive schemes, existing facilities can upgrade to cleaner fuel production with lower capital expenditure and faster implementation. Investment in research, infrastructure, and private sector participation is fueling innovation, while regulatory frameworks and subsidies are supporting domestic biofuel production. Aviation decarbonization goals, particularly the demand for Sustainable Aviation Fuel (SAF), are also driving market growth. SAF allows emission reductions without major aircraft modifications, aligning with regional carbon reduction mandates and government-backed funding programs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.6 Billion |

| Forecast Value | $88.5 Billion |

| CAGR | 11.4% |

The ethanol segment held a 62.2% share in 2024 and is expected to grow at a CAGR of 10.3% through 2034. Expansion of ethanol blending mandates and development of second-generation ethanol technologies are boosting consumption. Ethanol is increasingly being explored for integration into sustainable aviation fuels and marine biofuels. Blended ethanol fuels are compatible with existing engines and infrastructure, particularly in short-haul aviation and inland shipping, supporting the global push to decarbonize challenging sectors.

The transportation segment held a 68.8% share in 2024 and is projected to grow at a CAGR of 11.4% through 2034. Governments across the Asia Pacific are implementing aggressive biofuel blending policies, integrating biofuels into national energy transition strategies, and offering fiscal incentives, infrastructure support, and public-private partnerships to enhance production and distribution.

Indonesia Biofuel Market held a 50% share in 2024, generating USD 15 Billion. Growth is fueled by community-based biofuel production models and optimized use of existing palm oil plantations, with decentralized approaches utilizing diverse feedstocks such as non-palm crops and recycled oils.

Key players in the Asia Pacific Biofuel Market include Bangchak Corporation, Praj Industries, SK Innovation, COFCO Biochemical, Wilmar International, S-Oil Corporation, China National Petroleum Corporation, Musim Mas Group, PT Pertamina, Felda Global Ventures, HD HYUNDAI, Indian Oil Corporation Ltd., Carotino Sdn Bhd, Petronas, Shree Renuka Sugars Ltd., EcoCeres, Inc., Sinopec, PTT Public Company Limited, Manildra Group, and Viva Energy Group. Companies in the Asia Pacific Biofuel Market are strengthening their foothold by investing in advanced biofuel technologies, such as second and third-generation processes, to diversify feedstock use. They are forming strategic alliances with governments, feedstock suppliers, and logistics partners to enhance production and distribution networks. Expansion of production capacity through brownfield and greenfield projects, coupled with the adoption of sustainable sourcing practices, is improving operational efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Fuel trends

- 2.1.3 Application trends

- 2.1.4 Feedstock trends

- 2.1.5 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 Environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, Mtoe)

- 5.1 Key trends

- 5.2 Biodiesel

- 5.3 Ethanol

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, Mtoe)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Aviation

- 6.4 Others

Chapter 7 Market Size and Forecast, By Feedstock, 2021 - 2034 (USD Million, Mtoe)

- 7.1 Key trends

- 7.2 Coarse grain

- 7.3 Sugar crop

- 7.4 Vegetable oil

- 7.5 Others

Chapter 8 Market Size and Forecast, By Country, 2021 - 2034 (USD Million, Mtoe)

- 8.1 Key trends

- 8.2 China

- 8.3 India

- 8.4 Indonesia

- 8.5 South Korea

- 8.6 Australia

Chapter 9 Company Profiles

- 9.1 Bangchak Corporation

- 9.2 Carotino Sdn Bhd

- 9.3 China National Petroleum Corporation

- 9.4 COFCO Biochemical

- 9.5 EcoCeres, Inc.

- 9.6 Felda Global Ventures

- 9.7 HD HYUNDAI

- 9.8 Indian Oil Corporation Ltd.

- 9.9 Manildra Group

- 9.10 Musim Mas Group

- 9.11 Petronas

- 9.12 Praj Industries

- 9.13 PT Pertamina

- 9.14 PTT Public Company Limited

- 9.15 Shree Renuka Sugars Ltd.

- 9.16 Sinopec

- 9.17 SK Innovation

- 9.18 S-Oil Corporation

- 9.19 Viva Energy Group

- 9.20 Wilmar International