PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876808

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876808

Total Knee Replacement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

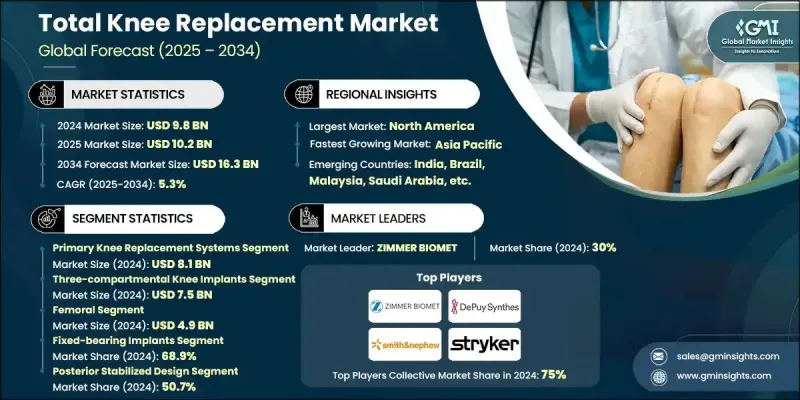

The Global Total Knee Replacement Market was valued at USD 9.8 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 16.3 billion by 2034.

The market's growth is largely fueled by the rising prevalence of osteoarthritis and osteoporosis, increasing rates of joint infections necessitating revisions, and continuous advancements in surgical techniques. The expansion of outpatient and ambulatory surgical centers has further contributed to higher procedure accessibility. Degenerative joint diseases reduce mobility and cause chronic pain, particularly in aging populations, driving the demand for total knee replacement procedures to restore function and improve quality of life. Surgeons and medical device manufacturers are responding with innovative implant designs and patient-specific solutions using advanced imaging and digital planning tools. These technologies enhance implant fit, comfort, and long-term performance while reducing postoperative complications. Additionally, demand for precision-engineered and customizable implants is growing, encouraging manufacturers to develop solutions that meet patient-specific anatomical requirements and optimize recovery outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 Billion |

| Forecast Value | $16.3 Billion |

| CAGR | 5.3% |

The primary knee replacement systems segment generated USD 8.1 billion in 2024. Rising obesity rates, the adoption of smart implant technologies, and 3D printing innovations are driving the segment. Primary knee replacements remain the preferred first-line procedure due to their established clinical reliability and long-term durability.

The three-compartmental knee implants segment generated USD 7.5 billion in 2024. These implants are designed to resurface all three compartments of the knee and are widely recommended for patients with extensive joint degeneration, offering comprehensive joint restoration.

North America Total Knee Replacement Market accounted for a 54.1% share in 2024. Growth in the region is driven by advanced healthcare infrastructure, an aging population, and the adoption of robotic-assisted surgery and smart implants that enhance precision and rehabilitation outcomes. Minimally invasive procedures and outpatient surgical care are supported by established reimbursement mechanisms, further encouraging market expansion.

Key companies operating in the Total Knee Replacement Market include Allegra, B BRAUN, Corin, Depuy Synthes (Johnson & Johnson), enovis, Exactech, Medacta International, MicroPort Orthopedics, ORTHO Development, Restor3D, Smith+Nephew, Stryker, Waldemar LINK, ZIMMER BIOMET, and Amplitude. Leading companies in the Total Knee Replacement Market are enhancing their presence by investing in research and development to produce patient-specific implants and next-generation surgical systems. Many are incorporating digital planning and robotic-assisted technologies to improve surgical precision and outcomes. Strategic partnerships with hospitals, surgical centers, and healthcare providers are strengthening market reach and facilitating product adoption. Firms are also expanding geographically by establishing manufacturing facilities and distribution networks in high-demand regions. Innovation in smart implants and 3D-printed components is a priority, supporting improved durability and functionality.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Device type trends

- 2.2.4 Component trends

- 2.2.5 Implant type trends

- 2.2.6 Design trends

- 2.2.7 Surgery type trends

- 2.2.8 Fixation material trends

- 2.2.9 Material trends

- 2.2.10 Polyethylene inserts trends

- 2.2.11 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of arthritis and osteoporosis

- 3.2.1.2 Need for personalized and patient specific implants

- 3.2.1.3 Growing infection rates contributing to rise in knee revisions

- 3.2.1.4 Surging preference for bicruciate-retaining total knee arthroplasty

- 3.2.1.5 Increasing usage of unicondylar knee procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Increased number of knee implant recalls

- 3.2.2.2 High cost associated with the surgery

- 3.2.3 Opportunities

- 3.2.3.1 Smart implants and IoT integration

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Procedure failure/success rate landscape

- 3.8 Pricing analysis, 2021-2034

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 MEA

- 3.9 Knee surgery landscape

- 3.9.1 Measured resection technique

- 3.9.2 Gap balancing technique

- 3.9.3 Balanced sizer

- 3.9.4 Measured sizer

- 3.10 Patient demographics and epidemiological trends

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

- 3.14 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Primary knee replacement systems

- 5.3 Partial knee replacement systems

- 5.4 Revision knee replacement systems

Chapter 6 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn and Units)

- 6.1 Key trends

- 6.2 Three-compartmental knee implants

- 6.3 Bicompartmental knee implants

- 6.4 Unicompartmental knee implants

Chapter 7 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 Femoral

- 7.3 Tibial

- 7.4 Patellar

Chapter 8 Market Estimates and Forecast, By Implant Type, 2021 - 2034 ($ Mn and Units)

- 8.1 Key trends

- 8.2 Fixed-bearing implants

- 8.3 Mobile-bearing implants

- 8.4 Medial pivot implants

- 8.5 Other implant types

Chapter 9 Market Estimates and Forecast, By Design, 2021 - 2034 ($ Mn and Units)

- 9.1 Key trends

- 9.2 Posterior stabilized design

- 9.3 Cruciate retaining design

- 9.4 Other designs

Chapter 10 Market Estimates and Forecast, By Surgery Type, 2021 - 2034 ($ Mn and Units)

- 10.1 Key trends

- 10.2 Traditional surgery type

- 10.3 Technology assisted surgery type

Chapter 11 Market Estimates and Forecast, By Fixation Material, 2021 - 2034 ($ Mn and Units)

- 11.1 Key trends

- 11.2 Cemented

- 11.3 Cementless

- 11.4 Hybrid

Chapter 12 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn and Units)

- 12.1 Key trends

- 12.2 Metal-on-plastic

- 12.3 Ceramic-on-plastic

- 12.4 Metal-on-metal

- 12.5 Ceramic-on-ceramic

Chapter 13 Market Estimates and Forecast, By Polyethylene Inserts, 2021 - 2034 ($ Mn and Units)

- 13.1 Key trends

- 13.2 Antioxidant polyethylene inserts

- 13.3 Highly cross-linked polyethylene inserts

- 13.4 Conventional polyethylene inserts

Chapter 14 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn and Units)

- 14.1 Key trends

- 14.2 Hospitals

- 14.3 Ambulatory surgery centers

- 14.4 Other End Use

Chapter 15 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 15.1 Key trends

- 15.2 North America

- 15.2.1 U.S.

- 15.2.2 Canada

- 15.3 Europe

- 15.3.1 Germany

- 15.3.2 UK

- 15.3.3 France

- 15.3.4 Spain

- 15.3.5 Italy

- 15.3.6 Netherlands

- 15.4 Asia Pacific

- 15.4.1 China

- 15.4.2 Japan

- 15.4.3 India

- 15.4.4 Australia

- 15.4.5 South Korea

- 15.4.6 Thailand

- 15.4.7 Malaysia

- 15.5 Latin America

- 15.5.1 Brazil

- 15.5.2 Mexico

- 15.5.3 Argentina

- 15.6 MEA

- 15.6.1 South Africa

- 15.6.2 Saudi Arabia

- 15.6.3 UAE

Chapter 16 Company Profiles

- 16.1 Allegra

- 16.2 amplitude

- 16.3 B BRAUN

- 16.4 Corin

- 16.5 Depuy Synthes (Johnson & Johnson)

- 16.6 enovis

- 16.7 exactech

- 16.8 Medacta International

- 16.9 MicroPort Orthopedics

- 16.10 ORTHO Development

16.11. restor3 d

- 16.12 Smith+Nephew

- 16.13 stryker

- 16.14 Waldemar LINK

- 16.15 ZIMMER BIOMET