PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885872

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885872

Southeast Asia igaming Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

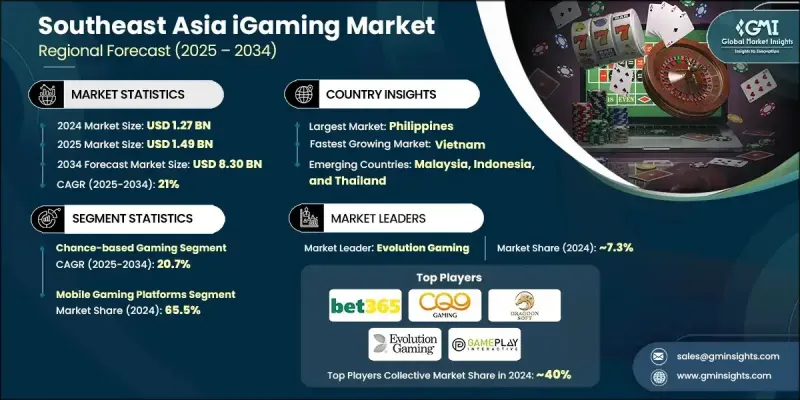

Southeast Asia igaming Market was valued at USD 1.27 billion in 2024 and is estimated to grow at a CAGR of 21% to reach USD 8.30 billion by 2034.

Market expansion remains closely tied to the region's diverse and highly fragmented regulatory landscape, where each country applies its own framework ranging from permissive licensing structures to comprehensive restrictions. This varying governance environment creates operational complexity for legitimate providers, while regulators work to reduce the influence of large unregulated networks. Technology-enabled connectivity and cross-border digital activity continue to shape regional dynamics, driving the need for stronger oversight and coordinated approaches. Legal operators are steadily adopting mobile-first platforms, responsible gaming tools, and automated monitoring technologies to help navigate jurisdiction-specific requirements. Long-term growth will depend heavily on progress in regional cooperation, the ability of governments to move toward more aligned regulatory practices, and the effectiveness of licensed operators in proving their commitment to consumer safeguards and public policy priorities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.27 Billion |

| Forecast Value | $8.30 Billion |

| CAGR | 21% |

The chance-based gaming category generated USD 0.66 billion in 2024 and is forecast to grow at an estimated CAGR of 20.7% from 2025 to 2034. These formats tend to attract widespread participation due to ease of play, straightforward mechanics, and immediate engagement, which support high-frequency user interaction and ongoing interest.

The mobile gaming platforms reached USD 0.83 billion in 2024, holding a 65.5% share. Widespread smartphone penetration, enhanced processing power, advanced graphics technology, and rapid network connectivity, including 5G, have greatly improved the mobile gaming environment. As a result, mobile gaming offers accessibility, affordability, and convenience, making it one of the most engaging and monetizable channels within the regional iGaming sector.

The Philippines igaming Market was valued at USD 300.2 million in 2024 and is projected to grow at a CAGR of 20.2% between 2025 and 2034. The country provides a structured regulatory environment that enables licensed businesses to operate both locally and internationally. The Philippines has evolved into a central hub for offshore digital gaming operations, supported by infrastructure development, an English-proficient workforce, and strong technological capability, which together make it an attractive base for global digital gaming providers.

Key companies operating in the Southeast Asia igaming Market include 888Casino, Bet365, Habanero Systems, Evolution Gaming, Allbet Gaming, CQ9 Gaming, Dragoon Soft, Gameplay Interactive, Maxbet, Oriental Game, Pinnacle Sports, Playtech, Pragmatic Play, Sbobet, and Spade Gaming. Companies in the Southeast Asia iGaming market are expanding their foothold by prioritizing mobile-first product development, investing in compliance automation, and enhancing secure payment infrastructures. Many operators are adopting advanced data analytics to personalize user experiences and increase retention. Strengthening responsible gambling frameworks, including behavior-tracking tools and self-regulation features, is also becoming central to competitive positioning. Firms are focusing on multilingual platforms, localized content, and region-specific UX designs to better appeal to diverse user bases. Strategic alliances with technology providers, blockchain integration for transparency, and improved cybersecurity practices further reinforce trust and operational efficiency while helping companies scale across varying regulatory environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Game category trends

- 2.2.2 Platform Type trends

- 2.2.3 Participant Tier trends

- 2.2.4 Country trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 Risk-adjusted ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Operator Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.4.1 By country and game category

- 3.5 Future market trends

- 3.6 Risk assessment and mitigation

- 3.6.1 Regulatory compliance risks

- 3.6.2 Capacity constraint impact analysis

- 3.6.3 Technology transition risks

- 3.6.4 Pricing volatility and cost escalation risks

- 3.7 User buying behavior analysis

- 3.7.1 Adoption patterns

- 3.7.2 Preference analysis

- 3.7.3 Regional variations in user behavior

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Competitive product performance and monetization models

- 4.6.1 Direct Competitor Analysis by Country

- 4.6.2 Monetization Model Analysis

- 4.6.2.1 Freemium vs. Premium Model Performance

- 4.6.2.2 In-App Purchase Optimization Strategies

- 4.6.2.3 Subscription Model Performance

- 4.6.2.4 Advertising Revenue Integration

- 4.6.3 User Acquisition Cost (UAC) and Lifetime Value (LTV) Benchmarks

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New technology integration

- 4.7.4 Platform diversification

Chapter 5 Market Estimates & Forecast, By Game Category, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Chance-based gaming

- 5.2.1 Traditional dice games

- 5.2.1.1 Bầu Cua Ca Cop

- 5.2.1.2 Tai Xỉu

- 5.2.1.3 Other Dice Games

- 5.2.2 Traditional card games

- 5.2.3 Localized live dealer games

- 5.2.4 Modern digital casino games

- 5.2.1 Traditional dice games

- 5.3 Skill & strategy gaming

- 5.3.1 Regional skill-based games

- 5.3.1.1 Tongits

- 5.3.1.2 Pusoy

- 5.3.1.3 Tiến Len

- 5.3.1.4 Thai Card Variants

- 5.3.1.5 Others

- 5.3.2 Poker and international card games

- 5.3.3 Other (Skill-based tournaments, etc.)

- 5.3.1 Regional skill-based games

- 5.4 Sports & event betting gaming

- 5.4.1 Traditional sports

- 5.4.1.1 Football

- 5.4.1.2 Basketball

- 5.4.1.3 Badminton

- 5.4.1.4 Others

- 5.4.2 Esports and virtual sports

- 5.4.3 Cultural event betting

- 5.4.3.1 Xoc Ðĩa

- 5.4.3.2 Sabong

- 5.4.3.3 Muay Thai

- 5.4.3.4 Others

- 5.4.1 Traditional sports

- 5.5 Social & casual gaming

Chapter 6 Market Estimates & Forecast, By Platform Type, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Mobile gaming platforms

- 6.3 PC gaming platforms

- 6.4 Console gaming platforms

- 6.5 Casino gaming platform

Chapter 7 Market Estimates & Forecast, By Participant Tier, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 VIP/High rollers

- 7.3 Regular players

- 7.4 Casual players

- 7.5 Micro players

Chapter 8 Market Estimates & Forecast, By Country, 2021 - 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Philippines

- 8.3 Vietnam

- 8.4 Thailand

- 8.5 Malaysia

- 8.6 Indonesia

- 8.7 Singapore

Chapter 9 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 9.1 888Casino

- 9.2 Allbet Gaming

- 9.3 Bet365

- 9.4 CQ9 Gaming

- 9.5 Dragoon Soft

- 9.6 Evolution Gaming

- 9.7 Gameplay Interactive

- 9.8 Habanero Systems

- 9.9 Maxbet

- 9.10 Oriental Game

- 9.11 Pinnacle Sports

- 9.12 Playtech

- 9.13 Pragmatic Play

- 9.14 Sbobet

- 9.15 Spade Gaming