PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892649

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892649

U.S. Molecular Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

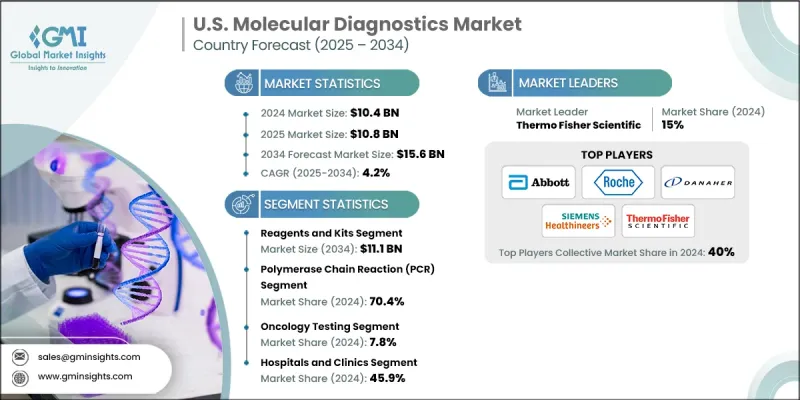

U.S. Molecular Diagnostics Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 15.6 billion by 2034.

This consistent expansion is supported by the growing burden of chronic and infectious conditions, steady improvements in molecular testing technologies, increasing federal initiatives, higher healthcare spending, and a rapidly aging population. The rising number of older adults in the country continues to elevate demand, as individuals 65 and above face a greater risk of multiple long-term illnesses requiring frequent diagnostic evaluation. Molecular diagnostics involves analyzing biological markers across DNA, RNA, and proteins to detect, track, and understand numerous diseases. This method plays a crucial role in identifying genetic abnormalities, infectious pathogens, and oncology-related indicators with strong accuracy. It has become a cornerstone of modern clinical practice, enabling specialists to investigate diseases at a deeper molecular level. Advances in testing systems have contributed to faster result turnaround, more precise diagnoses, and improved personalization of medical care. As early detection and targeted treatment approaches grow increasingly important, the adoption of molecular diagnostic technologies continues to accelerate across oncology, infectious disease management, and genetic testing applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $15.6 Billion |

| CAGR | 4.2% |

The instruments category reached USD 2.9 billion in 2024 and is projected to reach USD 4.5 billion by 2034 at a 4.4% CAGR. Molecular diagnostics relies on highly specialized equipment capable of amplifying, detecting, and evaluating nucleic acids and other biomolecules. These devices form the backbone of laboratory operations, supporting reliable identification of disease markers, genetic evaluation, and personalized medical assessments. They remain essential to sample processing, genetic profiling, and accurate test interpretation across clinical laboratories, medical centers, and research-focused environments.

The polymerase chain reaction (PCR) segment held a 70.4% share in 2024. PCR technology enables the amplification of targeted DNA or RNA sequences, allowing precise analysis of extremely small genetic samples. Digital PCR enhances this capability by dividing each sample into numerous individual reactions, improving accuracy when detecting genetic material found in minimal concentrations.

The hospitals and clinics segment held a 45.9% share in 2024. These healthcare settings maintain extensive lab capacity and skilled personnel, allowing them to perform a wide range of molecular tests for diverse medical needs. Their ability to integrate molecular diagnostics into routine and urgent-care workflows ensures continuous demand and widespread adoption throughout patient care settings.

Prominent companies operating in the U.S. Molecular Diagnostics Market include Sysmex Corporation, Thermo Fisher Scientific, Agilent Technologies, Qiagen, Abbott Laboratories, Siemens Healthineers, Biocartis, Illumina, Hologic, Becton, Dickinson and Company, Bio-Rad Laboratories, F. Hoffmann-La Roche, Danaher Corporation, bioMerieux, and QuidelOrtho Corporation. Companies in the U.S. Molecular Diagnostics Market are enhancing their competitive presence by expanding assay portfolios, improving automation, and investing in next-generation sequencing and high-throughput testing platforms. Many firms emphasize R&D to introduce faster, more sensitive tests aligned with the growing demand for precision medicine. Strategic collaborations with healthcare systems, biotech firms, and research institutions help broaden clinical adoption and accelerate product innovation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic and infectious diseases

- 3.2.1.2 Increasing technological advancements in molecular diagnostics

- 3.2.1.3 Rising government initiatives and healthcare spending

- 3.2.1.4 Growing geriatric population base

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of molecular diagnostic tests and equipment

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing AI and automation integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Reagents and kits

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polymerase chain reaction (PCR)

- 6.3 Hybridization

- 6.4 Sequencing

- 6.5 Isothermal nucleic acid amplification technology (INAAT)

- 6.6 Microarrays

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Infectious disease diagnostics

- 7.2.1 COVID-19

- 7.2.2 Flu

- 7.2.3 Respiratory syncytial virus (RSV)

- 7.2.4 Tuberculosis

- 7.2.5 CT/NG

- 7.2.6 HIV

- 7.2.7 Hepatitis C

- 7.2.8 Hepatitis B

- 7.2.9 Other infectious disease diagnostics

- 7.3 Genetic disease testing

- 7.4 Oncology testing

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Diagnostic Laboratories

- 8.4 Other end use

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Agilent Technologies

- 9.3 Becton, Dickinson and Company

- 9.4 Biocartis

- 9.5 bioMerieux

- 9.6 Bio-Rad Laboratories

- 9.7 Danaher Corporation

- 9.8 F. Hoffmann-La Roche

- 9.9 Hologic

- 9.10 Illumina

- 9.11 Qiagen

- 9.12 QuidelOrtho Corporation

- 9.13 Siemens Healthineers

- 9.14 Sysmex Corporation

- 9.15 Thermo Fisher Scientific