PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906174

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906174

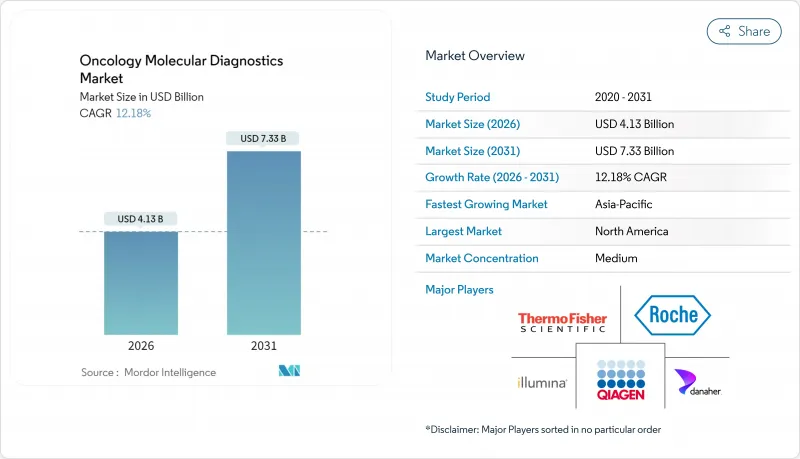

Oncology Molecular Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Oncology Molecular Diagnostics Market size in 2026 is estimated at USD 4.13 billion, growing from 2025 value of USD 3.68 billion with 2031 projections showing USD 7.33 billion, growing at 12.18% CAGR over 2026-2031.

Companion diagnostics linked to targeted therapies, expanding liquid biopsy approvals, and AI-enabled bioinformatics are accelerating clinical uptake. Demand is also fueled by national genomics programs that improve reimbursement frameworks and by the rising prevalence of cancer, which drives multiple molecular tests per patient along the treatment continuum. Meanwhile, point-of-care platforms are moving sophisticated assays out of centralized laboratories, shrinking turnaround times and broadening access. Competitive dynamics favor vertically integrated leaders that pair proprietary reagents with analytics software, while niche innovators leverage AI and liquid biopsy technologies to capture white-space opportunities within the oncology molecular diagnostics market.

Global Oncology Molecular Diagnostics Market Trends and Insights

Liquid-biopsy companion diagnostics transforming treatment pathways

FDA approvals for liquid biopsy companion diagnostics have multiplied since 2023, enabling real-time genomic monitoring without invasive tissue sampling. FoundationOne Liquid CDx now guides MET exon 14 skipping therapy in non-small cell lung cancer, expanding precision care to patients with limited tissue. Clinical adoption is rising because the assays detect resistance mutations before imaging changes appear, letting oncologists switch therapies earlier and improving outcomes.

National genomics initiatives accelerating reimbursement frameworks

Programs such as Australia's PrOSPeCT offer 23,000 patients free genomic testing funded by USD 185 million, demonstrating how coordinated policy, clinical trial access, and coverage decisions converge to democratize precision oncology. As similar schemes roll out in China and Japan, standardized protocols lower payer uncertainty, expanding compensated testing indications across the oncology molecular diagnostics market.

Genomic pathologist shortage creating diagnostic bottlenecks

Only 3% of pathology departments report adequate staffing of genomic specialists, with Latin America most affected. Limited expertise constrains report interpretation and delays clinical decision making. Teleconsultation networks and AI decision support mitigate but do not fully resolve the capacity gap, tempering growth in regions with the greatest need.

Other drivers and restraints analyzed in the detailed report include:

- AI-driven bioinformatics slashing NGS turnaround times

- Increasing demand for point-of-care testing

- Cost barriers limiting adoption in emerging markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reagents and consumables generated 61.55% revenue in 2025, reflecting recurrent demand and proprietary chemistries that capture low-abundance mutations. This strong position anchors steady cash flows for manufacturers within the oncology molecular diagnostics market. Software and services, although smaller today, rise at a 15.21% CAGR as cloud-hosted analytics automate interpretation and reduce the need for scarce genomic pathologists.

Growth in AI-powered platforms positions bioinformatics as a strategic moat. Vendors bundling reagents with subscription-based interpretation tools secure end-to-end integration, fostering customer stickiness. The oncology molecular diagnostics software solutions market size is projected to expand markedly as laboratories seek efficiency gains and standardized reporting.

PCR delivered 34.62% revenue in 2025 as laboratories value its cost efficiency and reliability. Digital PCR further extends sensitivity for detecting rare variants in liquid biopsy. In parallel, next-generation sequencing enjoys a 13.5% CAGR, propelled by declining run costs and broader clinical utility. Hybrid capture panels detect hundreds of genes in one assay, transforming treatment selection.

NGS adoption also benefits from combined tissue and plasma workflows that reveal tumor heterogeneity. As laboratories validate liquid biopsy NGS panels, the oncology molecular diagnostics market size for comprehensive profiling grows faster than single-gene PCR assays, yet PCR remains indispensable for rapid single-mutation confirmation.

The Oncology Molecular Diagnostics Market Report is Segmented by Product Type (Instrument, and More), Technology (Polymerase Chain Reaction, and More), Cancer Type (Breast Cancer, and More), Sample Type (Tissue Biopsy, and More), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 39.72% revenue in 2025, leveraging early regulatory approvals and broad insurance coverage for comprehensive genomic profiling. Testing rates for actionable biomarkers approach 90% in leading cancer centers. Expanded Medicare coverage for minimal residual disease tracking further enlarges the oncology molecular diagnostics market.

Europe adopts a cost-effectiveness lens, leading to selective uptake but consistent reimbursement once clinical utility is proven. Harmonized companion diagnostic and drug approvals by the European Medicines Agency ensure synchronized market entry, supporting stable growth moderated by budget impact assessments.

Asia-Pacific posts the fastest 15.89% CAGR supported by China's precision medicine plan and Japan's genomic cancer program. Investments in national sequencing networks and public-private partnerships lower per-test costs and accelerate technology transfer. As local innovators refine assays for region-specific mutations, the oncology molecular diagnostics market size in Asia-Pacific expands rapidly with rising cancer incidence and improving healthcare infrastructure.

- Abbott Laboratories

- Roche

- Danaher

- Thermo Fisher Scientific

- Illumina

- QIAGEN

- Sysmex

- bioMerieux

- Agilent Technologies Inc. (Dako)

- HTG Molecular Diagnostics

- Veracyte

- TBG Diagnostics Ltd.

- Guardant Health

- Foundation Medicine Inc.

- Exact Sciences Corp.

- NeoGenomics Laboratories

- BGI Genomics Co. Ltd.

- Bio-Rad Laboratories

- Natera

- Myriad Genetics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Uptake of Liquid-Biopsy Companion Diagnostics Post FDA & EMA Approvals

- 4.2.2 National Genomics Initiatives Accelerating Reimbursement

- 4.2.3 AI-driven Bioinformatics Reducing NGS Turn-around Time

- 4.2.4 Rising Prevalence of Cancer

- 4.2.5 Increasing Demand for Point-of-care Testing

- 4.2.6 Growing Integration of Multi-Omics Approaches for Comprehensive Cancer Profiling

- 4.3 Market Restraints

- 4.3.1 Shortage of Genomic Pathologists in Latin America

- 4.3.2 High Cost of Molecular Diagnostic Tests

- 4.3.3 Sensitivity & QC Challenges in Liquid Biopsy ctDNA Testing

- 4.3.4 Lack of Skilled Workforce and Stringent Regulatory Framework

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Instruments

- 5.1.2 Reagents & Consumables

- 5.1.3 Software & Services

- 5.2 By Technology

- 5.2.1 Polymerase Chain Reaction (PCR)

- 5.2.2 Isothermal NAAT

- 5.2.3 Next-Generation Sequencing (NGS)

- 5.2.4 In-situ Hybridization (FISH/CISH)

- 5.2.5 Mass Spectrometry

- 5.2.6 Chips & Microarrays

- 5.2.7 Transcription-Mediated Amplification

- 5.3 By Cancer Type

- 5.3.1 Breast Cancer

- 5.3.2 Lung Cancer

- 5.3.3 Colorectal Cancer

- 5.3.4 Prostate Cancer

- 5.3.5 Hematological Malignancies

- 5.3.6 Liver Cancer

- 5.3.7 Cervical & Gynecologic Cancers

- 5.3.8 Other Solid Tumors

- 5.4 By Sample Type

- 5.4.1 Tissue Biopsy

- 5.4.2 Liquid Biopsy (Blood/Plasma/Serum)

- 5.4.3 Fine-Needle Aspirates & Cytology Samples

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Diagnostic Centers

- 5.5.3 Point-of-Care Settings

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche Ltd

- 6.3.3 Danaher Corporation

- 6.3.4 Thermo Fisher Scientific Inc.

- 6.3.5 Illumina Inc.

- 6.3.6 Qiagen N.V.

- 6.3.7 Sysmex Corporation

- 6.3.8 bioMerieux SA

- 6.3.9 Agilent Technologies Inc. (Dako)

- 6.3.10 HTG Molecular Diagnostics Inc.

- 6.3.11 Veracyte Inc.

- 6.3.12 TBG Diagnostics Ltd.

- 6.3.13 Guardant Health Inc.

- 6.3.14 Foundation Medicine Inc.

- 6.3.15 Exact Sciences Corp.

- 6.3.16 NeoGenomics Laboratories

- 6.3.17 BGI Genomics Co. Ltd.

- 6.3.18 Bio-Rad Laboratories Inc.

- 6.3.19 Natera Inc.

- 6.3.20 Myriad Genetics Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment