PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892694

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892694

Autonomous Vehicle Fleet Operations Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

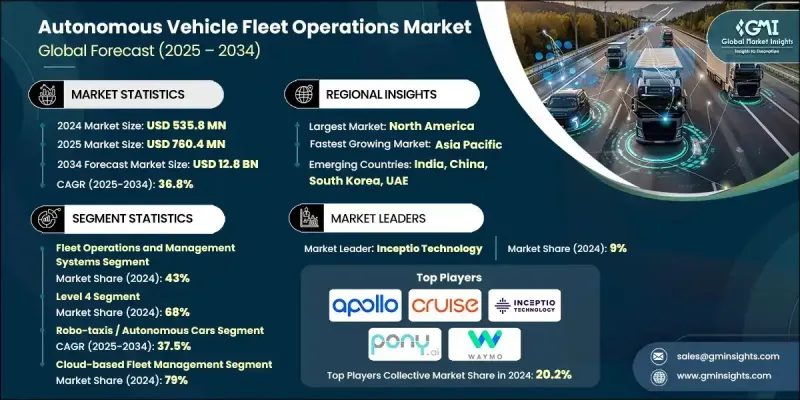

The Global Autonomous Vehicle Fleet Operations Market was valued at USD 535.8 million in 2024 and is estimated to grow at a CAGR of 36.8% to reach USD 12.8 billion by 2034.

The market is rapidly expanding as companies adopt and scale self-driving vehicles across passenger mobility, delivery services, and robo-taxi operations. Advances in Level 4 and Level 5 autonomous systems, coupled with AI-driven, cloud-based fleet management platforms and high-speed 5G connectivity, are transforming fleet operations. Regulatory support in the U.S. provides clear frameworks for commercial deployments, giving fleet operators confidence to scale services while ensuring safety. This shift is moving the industry from pilot programs to widespread commercial operations, creating substantial revenue and serving thousands daily. Economic benefits, operational efficiency, and technological innovation are driving adoption, while urban mobility, freight logistics, and consumer expectations continue to reshape the market landscape, positioning autonomous fleet operations as a cornerstone of modern transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $535.8 Million |

| Forecast Value | $12.8 Billion |

| CAGR | 36.8% |

The fleet operations and management systems segment held a 43% share in 2024 and is expected to grow at a CAGR of 37.1% through 2034. These systems integrate software for centralized monitoring, predictive maintenance, route optimization, and real-time analytics. AI algorithms and cybersecurity protocols enhance efficiency and protect fleet data. Growth is driven by adoption in logistics, freight, and passenger transport, with companies refining platforms through automated scheduling, telematics integration, and analytics to reduce operational costs and increase fleet productivity.

The Level 4 segment held a 68% share in 2024 and is projected to grow at a CAGR of 37.2% through 2034. Level 4 systems deliver full autonomy within defined operational design domains, allowing vehicles to operate without human intervention in specified areas, road types, or environmental conditions. Widespread commercial adoption of Level 4 technology reflects regulatory approvals, economic viability, and operational efficiency, as fleets can reduce labor costs while maintaining safety across varied geographic and weather conditions.

North America Autonomous Vehicle Fleet Operations Market accounted for a 47% share in 2024. The region leads the global market due to significant venture capital, corporate investment, and R&D expenditure. Investments in major AV companies have accelerated fleet expansion and commercialization. Collaboration between government agencies, state transportation departments, and industry consortia is strengthening regional capabilities, establishing safety protocols, teleoperation standards, and infrastructure upgrades, further boosting market growth.

Key players in the Global Autonomous Vehicle Fleet Operations Market include Aurora Innovation, AutoX, Baidu Apollo, Cruise, Inceptio Technology, Mobileye, Plus.ai, Pony.ai, Torc Robotics, and Waymo. Companies in the Autonomous Vehicle Fleet Operations Market are strengthening their presence through heavy investment in R&D to improve autonomy, AI algorithms, and fleet safety systems. Strategic partnerships with governments, regulators, and infrastructure providers help secure regulatory approvals and facilitate large-scale deployment. Firms are expanding pilot programs into commercial operations while integrating cloud-based fleet management platforms for real-time monitoring, predictive maintenance, and route optimization. Investment in high-speed connectivity, including 5G and edge computing, enhances vehicle communication and operational efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Vehicle

- 2.2.4 Autonomy Level

- 2.2.5 Deployment Mode

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising deployment of Level 4 autonomous mobility and delivery fleets

- 3.2.1.2 Growing demand for cost-efficient and driverless transportation operations

- 3.2.1.3 Advancements in AI, edge computing, telematics, and 5G connectivity

- 3.2.1.4 Expansion of robo-taxi, autonomous shuttle, and last-mile delivery services

- 3.2.1.5 Increasing need for real-time fleet monitoring, safety, and predictive maintenance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High infrastructure, hardware, and backend technology costs

- 3.2.2.2 Cybersecurity risks in connected and remotely managed fleets

- 3.2.3 Market opportunities

- 3.2.3.1 Large-scale deployment of robo-taxis and autonomous shuttles in urban mobility

- 3.2.3.2 Automation of last-mile delivery and logistics operations

- 3.2.3.3 Industrial fleet automation in mining, ports, airports, and warehouses

- 3.2.3.4 Development of remote fleet operations centers for global supervision

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global regulatory landscape overview

- 3.4.2 UNECE regulations & international harmonization

- 3.4.3 Federal vs state jurisdiction in the United States

- 3.4.4 EU type-approval framework & implementation

- 3.4.5 Asia-Pacific regulatory fragmentation analysis

- 3.4.6 Testing & pilot program requirements by region

- 3.4.7 Safety certification & validation standards

- 3.4.8 Data privacy & cybersecurity regulations

- 3.4.9 Liability & insurance framework evolution

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Sensor technology evolution (LiDAR, radar, camera systems)

- 3.7.1.2 AI & machine learning for autonomous driving

- 3.7.1.3 HD mapping & localization technologies

- 3.7.1.4 V2X communication standards & deployment

- 3.7.2 Emerging technologies

- 3.7.2.1 Remote operations & teleoperation technologies

- 3.7.2.2 Edge computing & onboard processing

- 3.7.2.3 Cybersecurity technologies for fleet protection

- 3.7.2.4 OTA software update capabilities

- 3.7.1 Current technological trends

- 3.8 Pricing analysis & cost structure

- 3.8.1 Vehicle acquisition costs by type

- 3.8.2 Retrofitting vs purpose-built vehicle economics

- 3.8.3 Fleet management technology costs

- 3.8.4 Remote operations center staffing & infrastructure costs

- 3.8.5 Maintenance & operating expense analysis

- 3.8.6 Insurance & liability cost trends

- 3.8.7 Total cost of ownership (TCO) comparison

- 3.8.8 Pricing models for fleet services

- 3.9 Patent analysis

- 3.9.1 Patent filing trends by technology area

- 3.9.2 Key patent holders & innovation leaders

- 3.9.3 Fleet management technology patents

- 3.9.4 Remote operations & dispatch system patents

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Carbon footprint considerations

- 3.12 Customer adoption & user experience analysis

- 3.12.1 Commercial robotaxi adoption metrics

- 3.12.2 Public transit agency adoption intentions

- 3.12.3 User experience quality & satisfaction factors

- 3.12.4 Operational reliability & service disruption analysis

- 3.12.5 Accessibility & inclusive design user experience

- 3.12.6 Commercial freight & logistics user adoption

- 3.12.7 Mining industry adoption & operational acceptance

- 3.13 Economic impact & industry transformation

- 3.13.1 Labor cost reduction potential

- 3.13.2 Capital investment & infrastructure requirements

- 3.13.3 Fleet utilization & operational efficiency economics

- 3.13.4 Industry consolidation & market restructuring

- 3.13.5 Public sector investment & economic development

- 3.13.6 Insurance & liability market transformation

- 3.14 Risk assessment & market headwinds

- 3.14.1 Safety incidents & regulatory enforcement actions

- 3.14.2 Regulatory fragmentation & compliance complexity

- 3.14.3 Technology limitations & operational design domain constraints

- 3.14.4 Cybersecurity threats & data privacy risks

- 3.14.5 Capital intensity & path to profitability uncertainty

- 3.14.6 Public acceptance & trust barriers

- 3.14.7 Workforce displacement & labor opposition

- 3.15 Comparative analysis of key performance indicators (KPIs) across operators

- 3.15.1 Fleet scale & deployment metrics

- 3.15.2 Operational efficiency & utilization metrics

- 3.15.3 Reliability & service disruption metrics

- 3.15.4 Safety performance metrics

- 3.15.5 Economic performance metrics

- 3.15.6 Technology maturity metrics

- 3.15.7 Regulatory compliance & approval metrics

- 3.15.8 Customer adoption & market penetration metrics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

- 4.6.4.1 Venture capital & private equity investment trends

- 4.6.4.2 Government grant programs & public funding

- 4.6.4.3 OEM investment in AV fleet technologies

- 4.6.4.4 Merger & acquisition activity analysis

- 4.6.4.5 Funding challenges & capital requirements

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Fleet operations and management systems

- 5.3 Safety, compliance and monitoring systems

- 5.4 Connectivity and communication systems

- 5.5 Navigation and vehicle software systems

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Robo-taxis / autonomous cars

- 6.3 Autonomous shuttles

- 6.4 Autonomous trucks

- 6.5 Autonomous delivery vans

- 6.6 Delivery robots / sidewalk robots

- 6.7 Autonomous industrial vehicles

Chapter 7 Market Estimates & Forecast, By Autonomy Level, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Level 3

- 7.3 Level 4

- 7.4 Level 5

Chapter 8 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Cloud-based fleet management

- 8.3 On-premises solutions

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Passenger mobility operators

- 9.3 Freight and logistics operators

- 9.4 Industrial and off-highway operators

- 9.5 Commercial and institutional sectors

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aurora Innovation

- 11.1.2 AutoX

- 11.1.3 Baidu Apollo

- 11.1.4 Cruise

- 11.1.5 General Motors

- 11.1.6 Inceptio Technology

- 11.1.7 Mobileye

- 11.1.8 Plus.ai

- 11.1.9 Pony.ai

- 11.1.10 Scania

- 11.1.11 Torc Robotics

- 11.1.12 Waymo

- 11.1.13 Zoox

- 11.2 Regional Players

- 11.2.1 ComfortDelGro

- 11.2.2 Pinellas Suncoast Transit Authority

- 11.2.3 Valley Metro (Phoenix)

- 11.2.4 WeRide

- 11.3 Emerging Technology Innovators

- 11.3.1 Forterra

- 11.3.2 Kodiak Robotics

- 11.3.3 LILEE Systems

- 11.3.4 Motional

- 11.3.5 Perrone Robotics