PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910914

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910914

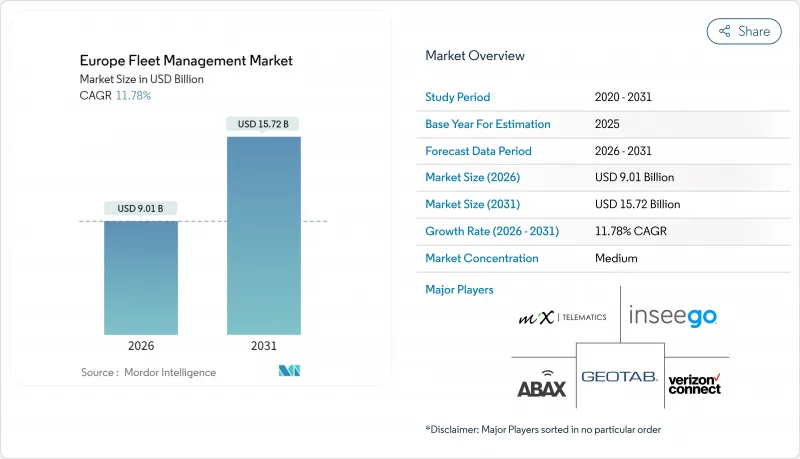

Europe Fleet Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe fleet management market was valued at USD 8.06 billion in 2025 and estimated to grow from USD 9.01 billion in 2026 to reach USD 15.72 billion by 2031, at a CAGR of 11.78% during the forecast period (2026-2031).

Rising regulatory pressure, the spread of connected-vehicle architectures, and intensifying last-mile logistics are together expanding addressable demand. The EU smart-tachograph Phase II rule that starts in 2025 compels real-time data transmission, turning telematics from an optional efficiency tool into a compliance requirement. E-commerce volume growth elevates urban delivery mileage, pushing operators toward granular route optimization and driver behaviour analytics. At the same time, falling cellular-IoT tariffs and eSIM adoption lower connectivity costs while 5G coverage enables high-bandwidth applications such as AI video safety monitoring. OEMs are opening application programming interfaces to monetize in-vehicle data streams, giving fleets a direct path to embedded telematics. Finally, national carbon-reduction targets and low-emission zones speed up electrification, which requires tighter energy and asset coordination.

Europe Fleet Management Market Trends and Insights

EU Smart-Tachograph Phase II Mandate Creates Compliance Imperative

The mandate enforced from June 2025 forces every commercial vehicle above 3.5 t to transmit location and driver-hours data continuously, replacing periodic data downloads with real-time oversight. Automatic fines structured between EUR 1,500 and EUR 15,000 leave operators' little choice but to install integrated telematics suites. Large German logistics firms have already completed rollouts to avoid service disruption, and suppliers report that small fleets now request multi-vehicle subscriptions rather than standalone tachographs. Because operators prefer a single pane of glass across all classes of vehicles, demand is spilling into light vans and company-car pools, lifting total platform adoption.

E-Commerce Growth Intensifies Last-Mile Delivery Optimization

Online retail penetration climbed to 13.4% of European sales in 2024, and last-mile costs swallow 41% of logistics spend for parcel operators. Light vans now cover 23% more mileage than in 2024 as consumers expect next-day delivery. Operators such as Seur cut route-related costs by 15% after introducing AI-based scheduling, demonstrating tangible return on telematics. Low-emission zones in Barcelona, Madrid, and Paris add further complexity by restricting time-window access, making real-time regulatory data essential. The Europe fleet management market, therefore benefits from converging e-commerce and environmental pressures that require constant location, traffic, and compliance feeds.

GDPR Compliance Creates Implementation Complexity

Under GDPR, employee consent for GPS tracking must be explicit and revocable, and several German court cases in 2024 confirmed that blanket monitoring infringes worker rights. For medium fleets, annual spending on legal review, data-protection officers, and software redesign totals about EUR 125,000. Multinational operators must sometimes deactivate features such as driver-cam streaming when crossing borders with stricter rules, diluting the efficiency promise of telematics and extending deployment timelines.

Other drivers and restraints analyzed in the detailed report include:

- Cellular-IoT Cost Reductions Enable Mass-Market Adoption

- OEM Telematics Platforms Monetize Connected Vehicle Data

- AI Video Telematics Capital Requirements Limit SME Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud services captured 63.55% of Europe fleet management market share in 2025 and are climbing at a 14.56% CAGR through 2031, propelled by pay-as-you-go pricing and automatic software updates. Deutsche Telekom observes that a multi-tenant architecture trims total cost of ownership by 34% relative to on-premises hosting because operators avoid server procurement and maintenance obligations. For fleet managers, elastic data storage accommodates seasonal volume swings without manual scaling. Data-sovereignty concerns confined some critical infrastructure fleets to private servers, yet cloud providers have responded with EU-based data centers that carry GDPR certification, closing the compliance gap.

Edge computing now operates as an extension of the cloud model rather than a replacement. Time-sensitive driver-assistance calculations run on in-vehicle processors, while aggregate analysis, reporting, and over-the-air updates flow through centralized hubs. This hybrid approach satisfies both latency and governance requirements, cementing cloud as the default architecture for new deployments within the Europe fleet management market.

Asset management held 26.72% of Europe fleet management market size in 2025 because every operator values location and utilization data. Safety and compliance tools, however, are advancing at a 14.34% CAGR because regulators and insurers tie monetary incentives to incident prevention. Allianz provides up to 15% premium discounts when fleets demonstrate proactive driver monitoring, accelerating adoption among high-mileage courier services. The EU Vision Zero program, which aims for zero road fatalities by 2050, positions AI-enabled fatigue detection and blind-spot alerts as pre-requisites for operating licenses in several member states. Vendors now bundle safety dashboards with tachograph files, ensuring compliance submissions are seamless and verifiable.

The Europe Fleet Management Market Report is Segmented by Deployment Type (On-Demand Cloud, On-Premises), Application (Asset Management, Information Management, and More), End-User Vertical (Transportation and Logistics, Energy and Utilities, and More), Fleet Size, Vehicle Type (Light Commercial Vehicles, Heavy Commercial Vehicles, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- TomTom N.V. (WEBFLEET)

- Verizon Communications Inc. (Verizon Connect)

- Bridgestone Mobility Solutions B.V. (WEBFLEET)

- Masternaut Ltd. (MICHELIN Connected Fleet)

- Geotab Inc.

- MiX Telematics Ltd.

- Trimble Inc.

- Samsara Inc.

- Powerfleet Inc. (incl. Fleet Complete)

- ABAX Group AS

- Teletrac Navman (Vontier Corp.)

- AT&T Inc.

- Chevin Fleet Solutions Ltd.

- Gurtam ( Wialon )

- Avrios International AG

- Mapon SIA

- Fleetster GmbH

- Shiftmove GmbH

- Transpoco Telematics Ltd.

- Fleetio ( RareStep Inc. )

- Teltonika Telematics UAB

- Ruptela UAB

- Motive Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU smart-tachograph Phase II mandate (2025)

- 4.2.2 E-commerce-driven LCV mileage surge

- 4.2.3 Falling cellular-IoT tariffs and eSIM adoption

- 4.2.4 OEM open-API telematics monetisation

- 4.2.5 EU ETS-2 credits for low-CO? fleets

- 4.2.6 5G C-V2X micro-platooning pilots

- 4.3 Market Restraints

- 4.3.1 GDPR and ePrivacy compliance burden

- 4.3.2 High cap-ex for AI video telematics

- 4.3.3 Patchwork low-emission city zones

- 4.3.4 Telematics-chip supply disruptions

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Type

- 5.1.1 On-Demand (Cloud)

- 5.1.2 On-Premises

- 5.2 By Application

- 5.2.1 Asset Management

- 5.2.2 Information Management

- 5.2.3 Driver Management

- 5.2.4 Safety and Compliance Management

- 5.2.5 Risk Management

- 5.2.6 Operations Management

- 5.3 By End-user Vertical

- 5.3.1 Transportation and Logistics

- 5.3.2 Energy and Utilities

- 5.3.3 Construction

- 5.3.4 Manufacturing

- 5.3.5 Other End-Users Verticals

- 5.4 By Fleet Size

- 5.4.1 Small (1-50 vehicles)

- 5.4.2 Medium (51-250)

- 5.4.3 Large (251 +)

- 5.5 By Vehicle Type

- 5.5.1 Light Commercial Vehicles

- 5.5.2 Heavy Commercial Vehicles

- 5.5.3 Bus and Coach

- 5.6 By Geography (Country)

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Spain

- 5.6.5 Italy

- 5.6.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level overview, market-level overview, core segments, financials, strategic information, market rank/share, products and services, recent developments)

- 6.4.1 TomTom N.V. (WEBFLEET)

- 6.4.2 Verizon Communications Inc. (Verizon Connect)

- 6.4.3 Bridgestone Mobility Solutions B.V. (WEBFLEET)

- 6.4.4 Masternaut Ltd. (MICHELIN Connected Fleet)

- 6.4.5 Geotab Inc.

- 6.4.6 MiX Telematics Ltd.

- 6.4.7 Trimble Inc.

- 6.4.8 Samsara Inc.

- 6.4.9 Powerfleet Inc. (incl. Fleet Complete)

- 6.4.10 ABAX Group AS

- 6.4.11 Teletrac Navman (Vontier Corp.)

- 6.4.12 AT&T Inc.

- 6.4.13 Chevin Fleet Solutions Ltd.

- 6.4.14 Gurtam ( Wialon )

- 6.4.15 Avrios International AG

- 6.4.16 Mapon SIA

- 6.4.17 Fleetster GmbH

- 6.4.18 Shiftmove GmbH

- 6.4.19 Transpoco Telematics Ltd.

- 6.4.20 Fleetio ( RareStep Inc. )

- 6.4.21 Teltonika Telematics UAB

- 6.4.22 Ruptela UAB

- 6.4.23 Motive Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment