PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928942

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928942

Telematics Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

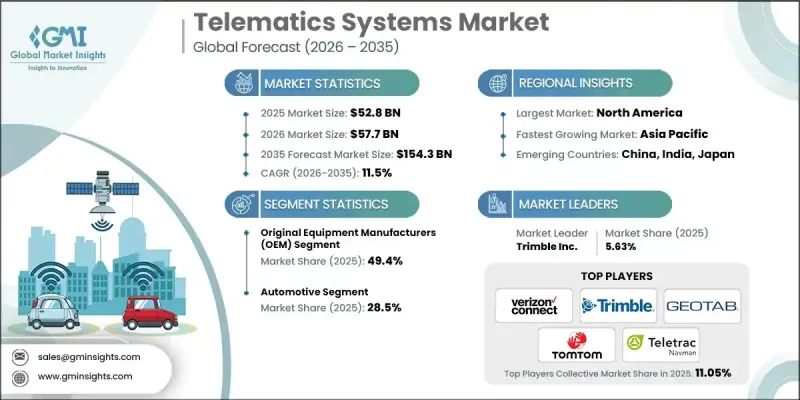

The Global Telematics Systems Market was valued at USD 52.8 billion in 2025 and is estimated to grow at a CAGR of 11.5% to reach USD 154.3 billion by 2035.

Market growth is driven by rising demand for digital connectivity across vehicles and assets, increasing reliance on data-driven fleet operations, and the accelerating transition toward electric mobility. Organizations are prioritizing solutions that reduce operating expenses while improving visibility, safety, and efficiency. Regulatory frameworks and safety requirements are also encouraging broader adoption of integrated telematics platforms. The market continues to benefit from rapid innovation in connected technologies, which enable seamless data exchange between vehicles, infrastructure, and cloud-based systems. As transportation networks become more intelligent, telematics is evolving into a foundational component for mobility ecosystems. The growing focus on real-time insights, predictive analytics, and centralized monitoring is strengthening demand across multiple industries. Continuous improvements in data transmission, system scalability, and platform integration are further supporting adoption. These factors collectively position telematics systems as a critical technology for modern transportation, logistics, and mobility management worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $52.8 Billion |

| Forecast Value | $154.3 Billion |

| CAGR | 11.5% |

Rising adoption of connected vehicles remains a major growth catalyst for the telematics systems market. Advanced communication frameworks enable continuous interaction between vehicles and their surroundings, improving operational intelligence and decision-making. The rapid expansion of electric mobility is further strengthening demand, as telematics platforms support vehicle performance monitoring and enhance overall user experience. Progress in cloud-based architectures and connected devices is improving data accuracy, system flexibility, and scalability, creating new growth opportunities across global markets.

The original equipment manufacturer channel accounted for 49.4% share in 2025. This segment benefits from strong integration capabilities, efficient supply networks, and close alignment with end-user requirements. OEMs are well-positioned to deliver scalable and cost-effective solutions across diverse application areas through strategic alliances and technology integration.

The automotive sector held a 28.5% share in 2025, making it the leading application segment. Growth in this segment is supported by advancements in vehicle technology, evolving mobility preferences, and the increasing focus on efficiency, safety, and sustainability. Automotive stakeholders continue to prioritize innovation and regulatory alignment to deliver next-generation mobility solutions.

North America Telematics Systems Market accounted for 32.5% share in 2025. Regional growth is supported by regulatory compliance requirements, infrastructure modernization initiatives, and rapid adoption of advanced vehicle technologies. Rising demand for digitally managed transportation services and emission reduction efforts continues to reinforce market expansion across the region.

Key companies operating in the Global Telematics Systems Market include Geotab Inc., Trimble Inc., Verizon Connect, TomTom International BV, Continental AG, Robert Bosch GmbH, Harman International Industries, HERE Technologies, Mix Telematics, AT&T Inc., Octo Telematics, Intel Corporation, Teletrac Navman, PTC Inc., and Sierra Wireless. Companies in the Global Telematics Systems Market are strengthening their competitive position through continuous technology development and strategic expansion. Many players are investing in cloud-based platforms, advanced analytics, and artificial intelligence to enhance data accuracy and service reliability. Partnerships with automotive manufacturers, mobility providers, and enterprise customers support long-term revenue growth. Firms are also expanding their geographic presence and tailoring solutions to regional regulatory and operational requirements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot, 2022-2035

- 2.2 Key market trends

- 2.2.1 Offering trends

- 2.2.2 Technology trends

- 2.2.3 Vehicle type trends

- 2.2.4 Channel trends

- 2.2.5 Application trends

- 2.2.6 End-use industry trends

- 2.2.7 Regional trends

- 2.3 TAM analysis, 2026-2035 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for connected vehicles

- 3.2.1.2 Increasing demand for fleet management

- 3.2.1.3 Emerging electric vehicle market

- 3.2.1.4 Cost reduction and operational efficiency

- 3.2.1.5 Government regulations and safety standards

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Data security concerns

- 3.2.2.2 High initial investment

- 3.2.3 Market Opportunities

- 3.2.3.1 Integration with autonomous vehicles

- 3.2.3.2 Telematics in smart cities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.11 Consumer sentiment analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit Margin

- 4.3.1.3 R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1 Product Range Breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1 Global Footprint Analysis

- 4.3.3.2 Service Network Coverage

- 4.3.3.3 Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.4.7 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates and Forecast, By Offering, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Technology, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Global Positioning System (GPS)

- 6.3 Cellular

- 6.4 Satellite

- 6.5 Wi-Fi

- 6.6 Bluetooth

Chapter 7 Market Estimates and Forecast, By Vehicle Type, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Two-wheelers

- 7.3 Passenger Cars

- 7.4 Light Commercial Vehicles (LCVs)

- 7.5 Heavy Commercial Vehicles (HCVs)

- 7.6 Off-highway Vehicles

Chapter 8 Market Estimates and Forecast, By Channel, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Original Equipment Manufacturers (OEM)

- 8.3 Aftermarket

Chapter 9 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 Fleet Management

- 9.3 Vehicle Tracking

- 9.4 Satellite Navigation

- 9.5 Vehicle Safety Communication

- 9.6 Insurance Telematics

- 9.7 Infotainment

- 9.8 Remote Diagnostics

- 9.9 Others

Chapter 10 Market Estimates and Forecast, By End Use Industry, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Transportation and Logistics

- 10.4 Insurance

- 10.5 Healthcare

- 10.6 Media and Entertainment

- 10.7 Government and Utilities

- 10.8 Others

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AT&T Inc.

- 12.2 Continental AG

- 12.3 Geotab Inc.

- 12.4 Harman International Industries, Inc. (Samsung)

- 12.5 HERE Technologies

- 12.6 Intel Corporation

- 12.7 Mix Telematics

- 12.8 Octo Telematics

- 12.9 PTC Inc.

- 12.10 Robert Bosch GmbH

- 12.11 Sierra Wireless

- 12.12 Teletrac Navman

- 12.13 TomTom International BV

- 12.14 Trimble Inc.

- 12.15 Verizon Connect (Verizon Communications Inc.)