PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936480

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936480

US 800V Electric Vehicle Architecture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

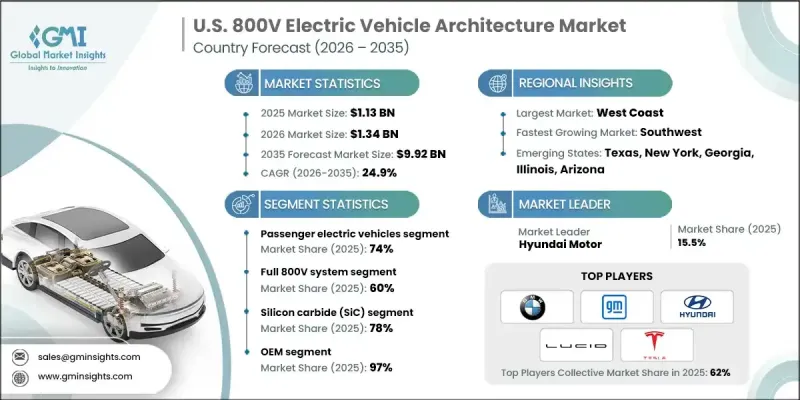

US 800V Electric Vehicle Architecture Market was valued at USD 1.13 billion in 2025 and is estimated to grow at a CAGR of 24.9% to reach USD 9.92 billion by 2035.

Market growth is fueled by rising consumer demand for EVs with ultra-fast DC charging capabilities, extended driving ranges, and enhanced energy efficiency. Automakers are increasingly integrating the 800-volt Electric City architecture into their vehicles to reduce charging time, improve thermal efficiency, and provide better acceleration. Consumer concerns around range anxiety and convenience have accelerated the development of high-voltage systems and ultra-fast charging stations compatible with next-generation electric vehicles (NG-EVs). Leading US-based manufacturers, including Lucid Motors, Tesla, and Stellantis, have begun introducing and ramping up production of 800V-capable EV models, highlighting high-performance attributes while enabling OEMs to differentiate products in premium segments and strengthen competitiveness in an increasingly crowded EV market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.13 Billion |

| Forecast Value | $9.92 Billion |

| CAGR | 24.9% |

Federal initiatives, such as the National Electric Vehicle Infrastructure (NEVI) Program and the broader electrification incentives under the Inflation Reduction Act, are further supporting EV adoption. These programs are indirectly promoting the adoption of 800V architectures with ultra-fast charging systems, creating opportunities for new manufacturers to enter the market.

The passenger EVs segment held a 74% share in 2025 and is expected to grow at a CAGR of 24.4% through 2035, driven by the growing preference for high-performance, energy-efficient, and connected vehicles. OEMs are targeting both luxury and urban consumer segments, offering battery electric vehicles (BEVs) that combine performance, sustainability, and connectivity.

The Full 800V systems segment held a 60% share in 2025 and is forecast to grow at a CAGR of 23.8% through 2035. OEMs are increasingly adopting full 800V architectures in premium and performance EVs to enable ultra-fast charging, longer driving ranges, and improved battery efficiency. These systems also provide superior thermal management and allow integration of high-powered drivetrains across both passenger and commercial EV configurations.

Northeast US 800V Electric Vehicle Architecture Market reached USD 179.1 million in 2025. Manufacturers are leveraging strong incentives and regulatory support for zero-emission vehicles, while metropolitan areas prioritize the installation of ultra-fast DC charging stations and the electrification of major highways. Public transportation agencies and commercial fleet operators in states like New York, Massachusetts, and New Jersey are actively transitioning to battery-powered electric buses and delivery vehicles to align with sustainability goals and reduce operational costs.

Key players in the US 800V Electric Vehicle Architecture Market include Lucid Motors, Tesla, Stellantis, Audi, BMW, General Motors, Hyundai Motor, Porsche (Volkswagen Group), Proterra, and Thomas Built Buses. Companies in the US 800V EV architecture market are pursuing strategies such as increasing R&D investment to enhance battery performance and thermal management, expanding production capacities for high-voltage EVs, and forming strategic alliances with charging infrastructure providers. OEMs are focusing on differentiating their premium EV offerings through ultra-fast charging and extended range capabilities. Market players are also strengthening their regional presence by targeting fleet and public transportation segments, participating in government incentive programs, and establishing partnerships for next-generation EV technology integration. Continuous innovation in high-voltage systems and battery efficiency remains central to maintaining competitiveness and market leadership.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.3 GMI AI policy & data integrity commitment

- 1.4 Research trail & confidence scoring

- 1.4.1 Research trail components

- 1.4.2 Scoring components

- 1.5 Data collection

- 1.5.1 Partial list of primary sources

- 1.6 Data mining sources

- 1.6.1 Paid sources

- 1.7 Base estimates and calculations

- 1.7.1 Base year calculation

- 1.8 Forecast model

- 1.9 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Architecture

- 2.2.4 Technology

- 2.2.5 Propulsion

- 2.2.6 Application

- 2.2.7 Component

- 2.2.8 End use

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in demand for faster charging and extended driving range

- 3.2.1.2 Surge in production of high-performance electric vehicles

- 3.2.1.3 Increase in government incentives and regulatory support for EVs

- 3.2.1.4 Growth in collaboration between OEMs and semiconductor suppliers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of 800V components and integration

- 3.2.2.2 Limited availability of compatible charging infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Surge in investment toward next-generation battery technologies

- 3.2.3.2 Increase in demand for 800V-ready autonomous and connected vehicles

- 3.2.3.3 Expansion of EV manufacturing in emerging economies

- 3.2.3.4 Growth in R&D toward lightweight, efficient power electronics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Northeast

- 3.4.2 Southeast

- 3.4.3 West Coast

- 3.4.4 Midwest & Central

- 3.4.5 Southwest

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technical trends and anticipated challenges

- 3.8 Pricing analysis

- 3.8.1 Pricing by component

- 3.8.2 Pricing by region

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.10.1 Raw material cost analysis

- 3.10.2 Manufacturing and operational cost analysis

- 3.10.3 Total cost of ownership (TCO) and lifecycle cost analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 SiC/GaN packaging and implementation needs

- 3.13.1 Semiconductor adoption trends

- 3.13.2 SiC packaging challenges and needs

- 3.13.3 GaN packaging challenges and needs

- 3.13.4 System-level implementation challenges

- 3.13.5 Opportunity mapping for solution providers

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Northeast

- 4.2.2 Southeast

- 4.2.3 West Coast

- 4.2.4 Midwest & Central

- 4.2.5 Southwest

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger electric vehicles

- 5.3 Commercial electric buses

- 5.4 Commercial trucks and delivery vehicles

- 5.4.1 Light commercial vehicles

- 5.4.2 Medium commercial vehicles

- 5.4.3 Heavy commercial vehicles

- 5.5 Special-purpose and off-highway vehicles

- 5.5.1 Construction equipment

- 5.5.2 Mining vehicles

- 5.5.3 Agricultural equipment

- 5.5.4 Material handling equipment

Chapter 6 Market Estimates & Forecast, By Architecture, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Full 800V System

- 6.3 Hybrid/Boosted System

Chapter 7 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Silicon carbide (SiC)

- 7.3 Gallium nitride (GaN)

- 7.4 Hybrid SiC + GaN systems

Chapter 8 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 Battery electric vehicles (BEV)

- 8.3 Plug-in hybrid electric vehicles (PHEV)

- 8.4 Fuel cell electric vehicles (FCEV)

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Component, 2022 - 2035 ($Mn)

- 10.1 Key trends

- 10.2 Battery pack and thermal management

- 10.3 Power electronics modules

- 10.3.1 Traction inverter

- 10.3.2 DC-DC converter

- 10.3.3 On-board charger

- 10.4 Electric motor and drivetrain

Chapter 11 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Mn, Units)

- 11.1 Key trends

- 11.2 Private

- 11.3 Commercial/Fleet

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 12.1 Key trends

- 12.2 Northeast

- 12.2.1 New York

- 12.2.2 Massachusetts

- 12.2.3 New Jersey

- 12.2.4 Pennsylvania

- 12.2.5 Maryland

- 12.2.6 Connecticut

- 12.3 Southeast

- 12.3.1 Florida

- 12.3.2 Georgia

- 12.3.3 North Carolina

- 12.3.4 Virginia

- 12.3.5 Tennessee

- 12.3.6 South Carolina

- 12.4 West Coast

- 12.4.1 California

- 12.4.2 Oregon

- 12.4.3 Washington

- 12.4.4 Hawaii

- 12.4.5 Nevada

- 12.4.6 Colorado

- 12.5 Midwest & Central

- 12.5.1 Illinois

- 12.5.2 Ohio

- 12.5.3 Minnesota

- 12.5.4 Michigan

- 12.5.5 Wisconsin

- 12.5.6 Missouri

- 12.6 Southwest

- 12.6.1 Texas

- 12.6.2 Arizona

- 12.6.3 New Mexico

- 12.6.4 Utah

- 12.6.5 Oklahoma

- 12.7 Rest of US

Chapter 13 Company Profiles

- 13.1 U.S. EV OEMs

- 13.1.1 Audi

- 13.1.2 BMW

- 13.1.3 General Motors

- 13.1.4 Hyundai Motor

- 13.1.5 Porsche

- 13.1.6 Stellantis

- 13.1.7 Tesla

- 13.2 Electric Bus Manufacturers

- 13.2.1 Thomas Built Buses

- 13.2.2 Proterra

- 13.3 Commercial and Special-Purpose Vehicle OEMs

- 13.3.1 Bollinger Motors

- 13.3.2 Epiroc

- 13.3.3 Komatsu

- 13.3.4 Proterra (Volvo)

- 13.3.5 Sandvik Mining and Rock Solutions

- 13.3.6 Xos Trucks

- 13.4 Emerging/Startup EV OEMs

- 13.4.1 Lucid Motors

- 13.4.2 Polestar

- 13.4.3 Scout Motors

- 13.5 Power Electronics and SiC/GaN Ecosystem Players

- 13.5.1 BorgWarner

- 13.5.2 EPC (Efficient Power Conversion)

- 13.5.3 Navitas Semiconductor

- 13.5.4 Onsemi

- 13.5.5 Texas Instruments

- 13.5.6 Transphorm (Renesas)

- 13.5.7 Wolfspeed