PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937428

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937428

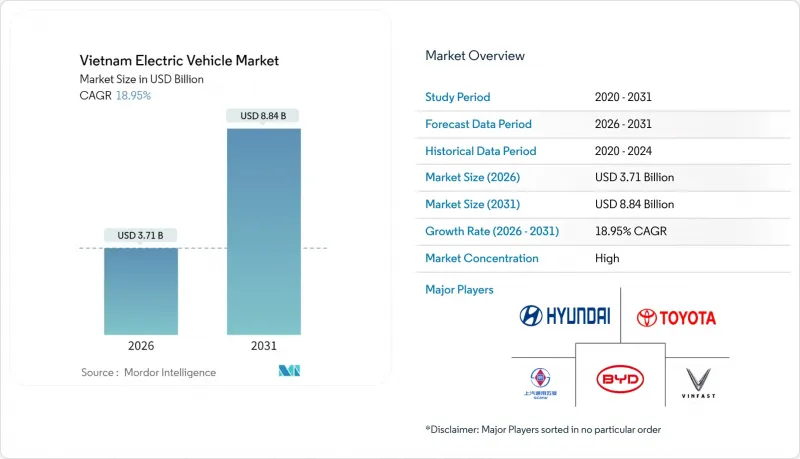

Vietnam Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Vietnam electric vehicle market size in 2026 is estimated at USD 3.71 billion, growing from 2025 value of USD 3.12 billion with 2031 projections showing USD 8.84 billion, growing at 18.95% CAGR over 2026-2031.

Demand is propelled by firm government targets that mandate 50% EV penetration in urban areas by 2030 and net-zero emissions by 2050. VinFast's localization drive, foreign OEM factory commitments, and preferential electricity tariffs collectively reduce the total cost of ownership, amplifying adoption. Rapid two-wheeler electrification creates consumer familiarity and shared charging infrastructure that spills over to four-wheelers, while falling battery pack prices allow LFP technology to dominate value-conscious segments. Competition remains moderate because VinFast's dominance deters price wars, yet Chinese brands and global mass-market OEMs are entering with cost-competitive models, nudging the ecosystem toward wider model variety and lower pricing.

Vietnam Electric Vehicle Market Trends and Insights

Domestic Manufacturing Scale-up

VinFast aims for 80% domestic content by 2026, with a goal to produce 500,000 vehicles by 2027 and reach 1 million vehicles annually by 2030, a scale that compresses component costs and mitigates exchange-rate exposure. Complementary commitments from Chery and Geely reinforce Vietnam's standing as a regional assembly hub, yet sophisticated electronics and battery management systems remain import-reliant. Guaranteed offtake contracts from VinFast give local suppliers demand visibility, prompting new capital investment that accelerates localisation.

Government Incentives and Tax Rebates

The incentive package waives registration fees for EVs until February 2027 and keeps import duties at zero on ASEAN-built cars, trimming purchase prices by more than VND 100 million per unit. Preferential charging tariffs of 2,204 VND/kWh further tilt the total cost of ownership in favor of electric models. Provincial add-ons, such as Ho Chi Minh City's proposed tax holidays and soft loans for its 400,000-unit motorcycle conversion program, underscore multi-tier policy coordination. Continuity beyond 2027 depends on reaching cost parity, exposing the market to fiscal-policy rollover risk.

Sparse Public Charging Infrastructure

Although dense in tier-one cities, the network thins rapidly in rural corridors, restricting inter-city travel and segment growth beyond sub-200 km models. V-Green has earmarked USD 404 million to deploy additional stations, yet lead times mean near-term bottlenecks persist. Grid stress surfaces during high-demand months, prompting government directives that prioritize power supply resilience.

Other drivers and restraints analyzed in the detailed report include:

- Rising Environmental Awareness and Net-zero Targets

- Electric Two-wheeler Ecosystem Spill-over

- High Up-front Vehicle Cost vs Average Income

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars contributed 67.65% of overall revenue in 2025, while buses registered the quickest expansion at a 33.11% CAGR. The Vietnam electric vehicle market size for buses is projected to double between 2025 and 2028 as provincial mandates trigger large tender volumes. Private car buyers account for much of today's stock, yet commercial fleets tip the growth curve; Ho Chi Minh City's 37-route electric bus roll-out and Hanoi's 100% core-area bus electrification agenda inject predictable bulk demand.

Intense fleet utilisation magnifies total-cost benefits, making commercial buyers early adopters of newer battery chemistries and fast-charging solutions. Conversely, two-wheelers retain vitality through rural-urban commuter demand, indirectly bolstering charging-hub economics that benefit four-wheeler deployment. Over the forecast horizon, passenger-car share will erode modestly even as volumes rise, because buses and vans gain policy-driven ground in public transit and last-mile logistics.

Battery electric vehicles captured 70.82% of the Vietnam electric vehicle market share in 2025, eclipsing hybrid and plug-in alternatives. That dominance deepens as BEV volumes compound at 27.85% CAGR, propelled by a government strategy that leapfrogs transitional powertrains. Hybrids hold niche appeal for peri-urban commuters needing range flexibility, but a lack of tax parity with BEVs caps growth. Fuel-cell vehicles remain experimental due to infrastructure voids.

VinFast's single-minded BEV product map shapes consumer perception, while nationwide charging subsidies reinforce the pure-electric narrative. Foreign OEMs may inject plug-in variants to hedge range anxiety, yet policy signals keep BEVs on the mainstream trajectory. In tandem, battery advancements shorten charging times, shaving practical limitations that once justified hybrid premiums. Altogether, the Vietnam electric vehicle industry stays on a direct-to-BEV path, avoiding the incremental hybrid detour seen in developed markets.

The Vietnamese Electric Vehicle Market Report is Segmented by Vehicle Type (Passenger Cars, Commercial Vehicles, and More), Propulsion (Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, and More), Driving Range (Below 200 Km, 200 To 400 Km, and More), Battery Type (Private Ownership, and More), and Region (Northern Vietnam, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- VinFast Motor Ltd.

- Hyundai Motor Corporation

- Toyota Motor Corporation

- BYD Auto Co. Ltd

- SAIC-GM-Wuling Automobile Co., Ltd.

- Tesla Inc.

- Mercedes-Benz Group AG

- Kia Corporation

- Nissan Motor Co. Ltd

- Honda Motor Co. Ltd

- MG Motor (China)

- Chery Automobile Co.

- Great Wall Motor (Haval)

- Volvo Car AB

- Selex Motors (VN)

- Dat Bike (VN)

- Foxconn EV Charging (VN)

- VinES Battery (VN)

- ABB Vietnam (Chargers)

- Delta Electronics (VN)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Domestic manufacturing scale-up (VinFast and imports)

- 4.2.2 Government incentives and tax rebates

- 4.2.3 Rising environmental awareness and net-zero targets

- 4.2.4 Electric two-wheeler ecosystem spill-over

- 4.2.5 Falling battery pack prices

- 4.2.6 Preferential EV-charging tariff structure

- 4.3 Market Restraints

- 4.3.1 Sparse public charging infrastructure

- 4.3.2 High up-front vehicle cost vs average income

- 4.3.3 Limited mid-range model availability

- 4.3.4 Grid capacity constraints at peak hours

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 EV Charging Infrastructure Development

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.1.3 Two-Wheelers

- 5.1.4 Buses

- 5.2 By Propulsion

- 5.2.1 Battery Electric Vehicles (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicles (PHEV)

- 5.2.3 Hybrid Electric Vehicles (HEV)

- 5.2.4 Fuel-Cell Electric Vehicles (FCEV)

- 5.3 By Driving Range

- 5.3.1 Below 200 km

- 5.3.2 200 to 400 km

- 5.3.3 Above 400 km

- 5.4 By Battery Type

- 5.4.1 LFP

- 5.4.2 NMC/NCA

- 5.4.3 Others

- 5.5 By End User

- 5.5.1 Private Ownership

- 5.5.2 Commercial Fleet/Ride-Hailing

- 5.5.3 Government and Public Transport

- 5.6 By Region

- 5.6.1 Northern Vietnam

- 5.6.2 Central Vietnam

- 5.6.3 Southern Vietnam

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 VinFast Motor Ltd.

- 6.4.2 Hyundai Motor Corporation

- 6.4.3 Toyota Motor Corporation

- 6.4.4 BYD Auto Co. Ltd

- 6.4.5 SAIC-GM-Wuling Automobile Co., Ltd.

- 6.4.6 Tesla Inc.

- 6.4.7 Mercedes-Benz Group AG

- 6.4.8 Kia Corporation

- 6.4.9 Nissan Motor Co. Ltd

- 6.4.10 Honda Motor Co. Ltd

- 6.4.11 MG Motor (China)

- 6.4.12 Chery Automobile Co.

- 6.4.13 Great Wall Motor (Haval)

- 6.4.14 Volvo Car AB

- 6.4.15 Selex Motors (VN)

- 6.4.16 Dat Bike (VN)

- 6.4.17 Foxconn EV Charging (VN)

- 6.4.18 VinES Battery (VN)

- 6.4.19 ABB Vietnam (Chargers)

- 6.4.20 Delta Electronics (VN)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment