PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937354

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937354

ASEAN Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

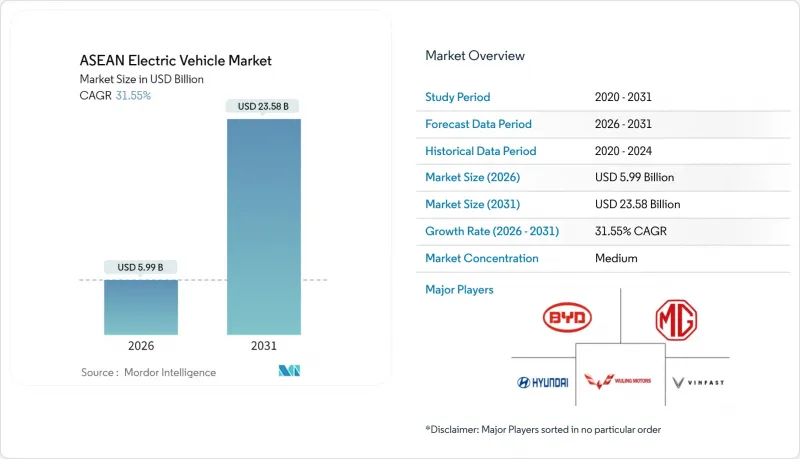

The ASEAN electric vehicle market is expected to grow from USD 4.55 billion in 2025 to USD 5.99 billion in 2026 and is forecast to reach USD 23.58 billion by 2031 at 31.55% CAGR over 2026-2031.

Spirited government incentives, abundant nickel reserves that underpin local battery supply chains, and the rapid build-out of public and private charging infrastructure anchor this trajectory. Thailand's EV3.5 subsidy program, Indonesia's luxury-tax exemptions, and Vietnam's multi-year registration-fee waivers widen consumer access while compelling original-equipment manufacturers (OEMs) to localize production. Chinese automakers leverage aggressive pricing and early-mover manufacturing investments to dominate early market share positions while Japanese, Korean, and regional brands accelerate catch-up strategies. Grid integration initiatives under the ASEAN PowerGrid and maturing battery-swap ecosystems for two-wheelers open fresh revenue pools across services, software, and second-life battery streams.

ASEAN Electric Vehicle Market Trends and Insights

Government Purchase and Excise-Tax Incentives

Aggressive fiscal programs underpin early adoption across the ASEAN electric vehicle market. Thailand channels 34 billion baht in subsidies that require local assembly for eligibility, a policy mirrored by Indonesia's 0% luxury tax and 1% VAT on battery electric vehicles through 2025. Vietnam has extended registration-fee exemptions until 2027, while Malaysia targets a 20% EV sales mix by 2030 via purchase-tax relief and import-duty waivers. The Philippines mandates a 5% EV share in government and corporate fleets under the Electric Vehicle Industry Development Act, further reducing landed costs through zero-tariff imports. These coordinated instruments have lifted Thailand's EV sales and turbocharged Vietnam's electric-motorcycle sales volumes.

OEM Localization Commitments

The ASEAN electric vehicle market is shifting from import-led to locally manufactured supply. BYD's USD 1 billion Indonesian hub coming online in late 2025 will produce 150,000 vehicles annually, while Hyundai's USD 1.55 billion complex near Jakarta adds 250,000-unit capacity. Thailand has secured over USD 3 billion in Chinese OEM pledges, anchored by Great Wall Motor and Chery. VinFast's outward expansion includes new lines in Indonesia and India, and Geely enters via a joint venture with PT Handal Indonesia Motor to scale 100 retail outlets in three years. These factories meet rising local-content thresholds, compress logistics costs, and seed component ecosystems across batteries, power electronics, and software.

High Retail Price Gap Vs. ICE

Entry-level EVs across ASEAN are often priced at twice that of comparable internal-combustion models, curbing mass-market uptake. Indonesia's penetration reached 9.1% in 1H 2025 despite a 267% sales spike, as the remaining sticker premium deters cost-sensitive buyers. Thailand's premium-car sub-segment experienced softening demand once incentives tapered, revealing elasticity to subsidy removal. Freight operators highlight elevated upfront costs for medium-duty trucks, even though battery-swap pilots hint at 30-40% lifetime savings. Continual price compression depends on localized battery packs and scale economics from new regional plants .

Other drivers and restraints analyzed in the detailed report include:

- Rapid Roll-Out of DC Fast-Charging Corridors

- Nickel-Rich Battery Supply Advantage

- Patchy Charging Outside Tier-1 Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars delivered 46.55% of the ASEAN electric vehicle market in 2025, yet electric motorcycles posted a sales jump in Vietnam in 1H 2025, powered by VinFast's 488% domestic surge. Two- and three-wheelers are rewriting the growth script, projecting a growth of 32.40% CAGR by 2031. Indonesia and Thailand replicate this momentum through ride-hail incentives that waive parking fees and license-plate charges. The light-commercial segment gains traction as e-commerce fulfillment fleets log 20-30% fuel savings, nudging logistics operators toward electrification mandates. Medium and heavy trucks lag while waiting for higher-density batteries and fiscal levers that neutralize upfront differentials.

Urban delivery riders cite the convenience of battery-swap networks that compress refueling to under two minutes. Vietnam targets 1 million zero-emission motorcycles by 2030, an ambition linked to congestion-charge exemptions in Hanoi. Singapore pilots electric ride-hail permits that prioritize emissions-free vehicles at high-density airport ranks, enhancing driver economics. Buses and coaches benefit from municipal procurement targets, with Singapore aiming for 50% electric buses by 2030 and Vietnam's Nghe An province mandating fully electric additions from 2025. Collectively, these policies accelerate modal diversification within the ASEAN electric vehicle market.

Battery electric vehicles maintained 85.70% ASEAN electric vehicle market share in 2025 and anchor most OEM roadmaps through 2031. Lower battery prices, rising energy density, and expanded charging corridors reinforce consumer confidence. Plug-in hybrids carve out a transition niche in Thailand where public skepticism over highway charger availability lingers. Toyota leverages brand equity by bundling home-charger installation and extended warranties, insulating hybrid residual values.

Fuel-cell electric vehicles register the highest 2026-2031 CAGR at 38.90% from a small base. Indonesia's PLN opened the sub-region's first hydrogen station in Jakarta in 2024 and plans 22 green-hydrogen plants producing 203 tons yearly. Singapore tests hydrogen buses on dedicated lanes near port zones, and Malaysia's Petronas evaluates blue-hydrogen blending for commercial fleets. A pan-ASEAN working group is drafting fuel-cell safety codes to align with UN Regulation 134, a prerequisite for scaled imports. This technology pluralism cushions the ASEAN electric vehicle market against raw-material volatility.

The ASEAN Electric Vehicle Market Report is Segmented by Vehicle Type (Two and Three Wheelers, Passenger Cars, and More), Drive-Train Technology (Battery Electric Vehicles (BEV), Plug-In Hybrid Electric Vehicles (PHEV), and More), Charging Level (AC Slow/Level-2, DC Fast), End-User Type, and Country (Indonesia, Thailand, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- BYD Co. Ltd.

- SAIC Motor / MG Motor

- Hyundai Motor Company

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- Mitsubishi Motors Corporation

- Nissan Motor Corporation

- VinFast Auto Ltd.

- Wuling Motors

- Great Wall Motor

- GAC Aion

- Chery Automobile

- Tesla Inc.

- BMW Group

- Mercedes-Benz Group

- Kia Corp.

- Isuzu Motors

- BAIC Group

- Stellantis NV

- UD Trucks

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Purchase and Excise-Tax Incentives

- 4.2.2 OEM Localization Commitments

- 4.2.3 Rapid Roll-Out of DC Fast-Charging Corridors

- 4.2.4 Nickel-Rich Battery Supply Advantage

- 4.2.5 Cross-Border Zero-Tariff EV Trade

- 4.2.6 Two-Wheeler Battery-Swap Ecosystems Scaling

- 4.3 Market Restraints

- 4.3.1 High Retail Price Gap Vs. ICE

- 4.3.2 Patchy Charging Outside Tier-1 Cities

- 4.3.3 Grid Instability and Peak-Load Limits

- 4.3.4 Cultural Preference for Diesel Pick-Ups

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Two and Three Wheelers

- 5.1.2 Passenger Cars

- 5.1.3 Light Commercial Vehicles

- 5.1.4 Medium and Heavy Commercial Vehicles

- 5.1.5 Buses and Coaches

- 5.2 By Drive-train Technology

- 5.2.1 Battery Electric Vehicles (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicles (PHEV)

- 5.2.3 Fuel-Cell Electric Vehicles (FCEV)

- 5.2.4 Hybrid Electric Vehicles (HEV)

- 5.3 By Charging Level

- 5.3.1 AC Slow / Level-2

- 5.3.2 DC Fast (>= 50 kW)

- 5.4 By End-User Type

- 5.4.1 Personal / Household

- 5.4.2 Commercial Fleet and Logistics

- 5.4.3 Government and Public Transport

- 5.5 By Country

- 5.5.1 Indonesia

- 5.5.2 Thailand

- 5.5.3 Malaysia

- 5.5.4 Vietnam

- 5.5.5 Philippines

- 5.5.6 Singapore

- 5.5.7 Myanmar

- 5.5.8 Cambodia

- 5.5.9 Laos

- 5.5.10 Brunei

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 BYD Co. Ltd.

- 6.4.2 SAIC Motor / MG Motor

- 6.4.3 Hyundai Motor Company

- 6.4.4 Toyota Motor Corporation

- 6.4.5 Honda Motor Co., Ltd.

- 6.4.6 Mitsubishi Motors Corporation

- 6.4.7 Nissan Motor Corporation

- 6.4.8 VinFast Auto Ltd.

- 6.4.9 Wuling Motors

- 6.4.10 Great Wall Motor

- 6.4.11 GAC Aion

- 6.4.12 Chery Automobile

- 6.4.13 Tesla Inc.

- 6.4.14 BMW Group

- 6.4.15 Mercedes-Benz Group

- 6.4.16 Kia Corp.

- 6.4.17 Isuzu Motors

- 6.4.18 BAIC Group

- 6.4.19 Stellantis NV

- 6.4.20 UD Trucks

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment