PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936509

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936509

Nanocellulose in Composites and Coatings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

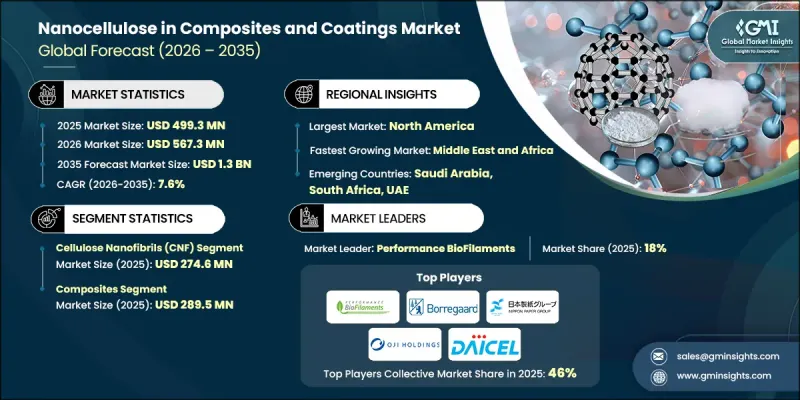

The Global Nanocellulose in Composites and Coatings Market was valued at USD 499.3 million in 2025 and is estimated to grow at a CAGR of 7.6% to reach USD 1.3 billion by 2035.

Nanocellulose refers to cellulose materials that feature at least one dimension at the nanometer scale and are commonly sourced from plant fibers, bacteria, or algae. The material portfolio includes cellulose nanocrystals, cellulose nanofibrils, and bacterial cellulose, each defined by variations in size, structure, and crystallinity. Nanocellulose offers a unique combination of high mechanical strength, low density, large surface area, biodegradability, and adaptable surface chemistry. These characteristics position it as a valuable reinforcement agent in advanced composites and as a functional additive in coating systems. Even at low loadings, nanocellulose enhances mechanical, thermal, and barrier performance. Its ability to strengthen polymer matrices while preserving lightweight characteristics supports demand across packaging, construction, and industrial material applications. Sustainability considerations further accelerate adoption as industries increasingly favor renewable and biodegradable material solutions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $499.3 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 7.6% |

Nanocellulose also delivers strong performance benefits within coating formulations by supporting film formation, improving barrier efficiency, and enhancing rheological control. The material reduces permeability to oxygen, moisture, and oils, expanding its relevance in protective and functional coating applications. Its compatibility with various coating systems allows manufacturers to achieve improved surface uniformity and durability without compromising environmental performance. These functional advantages continue to support consistent demand growth across multiple end-use sectors.

The cellulose nanofibrils segment reached USD 274.6 million in 2025. Cellulose nanofibrils and microfibrillated cellulose remain widely adopted due to their long, flexible fiber networks that significantly improve reinforcement, toughness, and viscosity control in composites and coatings. These materials disperse efficiently within polymer and coating systems, enabling uniform structure formation and enhanced surface consistency. Their relatively straightforward processing requirements further support their broad adoption across diverse material formulations.

The composites segment generated USD 289.5 million in 2025. Nanocellulose strengthens composite systems by improving stiffness, durability, and load distribution while maintaining low material weight. Its natural origin enables the development of more sustainable composite alternatives to traditional synthetic reinforcements. Compatibility with multiple matrix types allows nanocellulose to support both structural and semi-structural composite applications across a wide range of industries.

North America Nanocellulose in Composites and Coatings Market captured USD 283.3 million in 2025. Growth is supported by advanced industrial infrastructure, high adoption of sustainable materials, and consistent demand from transportation, aerospace, and packaging sectors. Continued investment in research and material innovation further strengthens the regional outlook. Government incentives encouraging environmentally responsible materials accelerate adoption, while the US leads the region through scaled production capabilities, advanced manufacturing technologies, and growing consumer awareness regarding sustainable products.

Key companies active in the Global Nanocellulose in Composites and Coatings Market include Borregaard AS, Anomera Inc., Nippon Paper Industries Co., Ltd., Melodea Ltd., Kruger Inc., Kao Corporation, Performance BioFilaments, Daicel Corporation, CelluComp Ltd., Blue Goose Biorefineries Inc., Seiko PMC Corporation, Oji Holdings Corporation, and GranBio Technologies. Companies operating in the market focus on expanding production capacity and improving material consistency to strengthen their competitive position. Strategic investments in process optimization help reduce costs and enable large-scale commercialization. Many players prioritize partnerships with composite and coating manufacturers to accelerate application development and market penetration. Continuous research into surface modification and performance enhancement supports product differentiation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product Type

- 2.2.2 Application

- 2.2.3 Regional

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable materials

- 3.2.1.2 Technological advancements in production

- 3.2.1.3 Enhanced mechanical and barrier properties

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Dispersion and compatibility issues

- 3.2.3 Market opportunities

- 3.2.3.1 Development of high-performance composites

- 3.2.3.2 Integration with smart materials

- 3.2.3.3 Circular economy initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cellulose nanocrystals (CNC)

- 5.3 Cellulose nanofibrils (CNF)

- 5.4 Bacterial nanocellulose (BNC)

- 5.5 Microfibrillated cellulose (MFC/CMF)

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Composites

- 6.2.1 Polymer matrix composites

- 6.2.2 Automotive composites

- 6.2.3 Construction & building materials

- 6.2.4 Packaging composites

- 6.2.5 Electronics & advanced materials

- 6.3 Coatings

- 6.3.1 Paper & packaging barrier coatings

- 6.3.2 Textile coatings & surface treatments

- 6.3.3 Functional & protective coatings

- 6.3.4 Agricultural films & smart coatings

Chapter 7 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Anomera Inc.

- 8.2 Blue Goose Biorefineries Inc.

- 8.3 Borregaard AS

- 8.4 CelluComp Ltd.

- 8.5 Daicel Corporation

- 8.6 GranBio Technologies

- 8.7 Kao Corporation

- 8.8 Kruger Inc.

- 8.9 Melodea Ltd.

- 8.10 Nippon Paper Industries Co., Ltd.

- 8.11 Oji Holdings Corporation

- 8.12 Performance BioFilaments

- 8.13 Seiko PMC Corporation