PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936549

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936549

Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

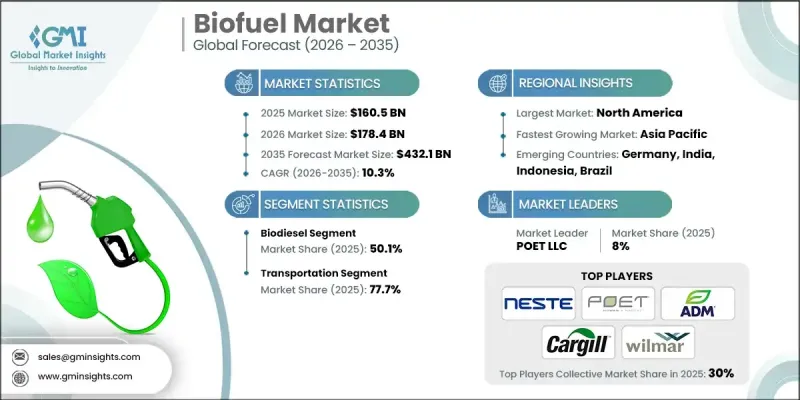

The Global Biofuel Market was valued at USD 160.5 billion in 2025 and is estimated to grow at a CAGR of 10.3% to reach USD 432.1 billion by 2035.

Continuous regulatory mandates aimed at decarbonizing transportation are driving predictable and durable demand for biofuels worldwide. Governments are increasingly embedding lifecycle carbon intensity reductions into fuel policies, creating compliance markets where producers can earn tradable credits for supplying lower-carbon fuels. These regulations standardize verification and traceability, reducing buyer risk and strengthening offtake agreements, which in turn boosts demand for ethanol, biodiesel, renewable diesel (HVO), biogas/CBG, and sustainable aviation fuels across road, aviation, and marine segments. Active policy management, including compliance timelines and waiver mechanisms, maintains market certainty, benefiting farmers, refiners, and fuel blenders who rely on consistent volumes for operational and capital planning. Programs such as Low Carbon Fuel Standards (LCFS) are expanding, incentivizing waste- and residue-based biofuels and broadening credit opportunities for infrastructure and transit, supporting large-scale production from used cooking oil, animal fats, landfill gas, and organic waste streams.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $160.5 Billion |

| Forecast Value | $432.1 billion |

| CAGR | 10.3% |

The biodiesel segment accounted for 50.1% share in 2025 and is projected to grow at a CAGR of 10.5% through 2035. Producers are investing in carbon capture retrofits to reduce lifecycle emissions, improve CI scores under LCFS-like frameworks, and qualify for higher economic returns in both domestic and export compliance markets. Biodiesel continues to benefit from stringent carbon-intensity policies and increasing regulatory incentives, encouraging fleets to adopt fuels derived from waste and residue feedstocks.

The transportation sector represented 77.7% share in 2025 and is expected to grow at a CAGR of 9.5% by 2035. Transport remains the most stable and largest demand center due to regulatory mandates, compliance-driven credit markets, and availability of drop-in renewable fuels. Governments prioritize biofuels in this sector because they achieve immediate emissions reductions without major vehicle or infrastructure modifications, especially in heavy-duty trucking, municipal fleets, and long-haul logistics. Energy security concerns and the need to reduce dependence on imported fossil fuels further reinforce biofuel adoption in developed and emerging economies.

U.S. Biofuel Market held 93% share, generating USD 54.6 billion in 2025. Leadership is driven by a mature regulatory ecosystem, well-developed feedstock supply chains, and compliance mechanisms that reward lower-carbon fuels. Political support is reinforced by energy security priorities, fossil fuel price volatility, and corporate decarbonization commitments from freight, aviation, and maritime industries, which collectively accelerate biofuel consumption.

Key players in the Global Biofuel Market include ADM, Borregaard, BTG Bioliquids, Cargill, Chevron Corporation, Clariant, COFCO, CropEnergies, FutureFuel, Munzer Bioindustrie, My Eco Energy, Neste Corporation, POET, Praj Industries, The Andersons, TotalEnergies, UPM, Verbio, Wilmar International, and Zilor. Companies in the biofuel industry are deploying several strategies to strengthen their market presence. They are investing in R&D to develop low-carbon and waste-based feedstocks, improving efficiency and compliance with regulatory frameworks. Strategic partnerships with local feedstock suppliers and transportation firms expand supply chains and market reach. Businesses are also investing in advanced production infrastructure, including carbon capture retrofits and scale-up of renewable diesel and sustainable aviation fuel capacity. Market penetration is further reinforced through government engagement, lobbying for favorable policies, and participation in compliance credit programs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality commitment

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

- 1.9 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Fuel trends

- 2.1.3 Feedstock trends

- 2.1.4 Application trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Fuel, 2022 - 2035 (USD Million, Mtoe)

- 5.1 Key trends

- 5.2 Biodiesel

- 5.3 Ethanol

- 5.4 Others

Chapter 6 Market Size and Forecast, By Feedstock, 2022 - 2035 (USD Million, Mtoe)

- 6.1 Key trends

- 6.2 Coarse grain

- 6.3 Sugar crop

- 6.4 Vegetable oil

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Million, Mtoe)

- 7.1 Key trends

- 7.2 Transportation

- 7.3 Aviation

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2022 - 2035 (USD Million, Mtoe)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Spain

- 8.3.4 UK

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Indonesia

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ADM

- 9.2 Borregaard

- 9.3 BTG Bioliquids

- 9.4 Cargill

- 9.5 Chevron Corporation

- 9.6 Clariant

- 9.7 COFCO

- 9.8 CropEnergies

- 9.9 FutureFuel

- 9.10 Munzer Bioindustrie

- 9.11 My Eco Energy

- 9.12 Neste Corporation

- 9.13 POET

- 9.14 Praj Industries

- 9.15 The Andersons

- 9.16 TotalEnergies

- 9.17 UPM

- 9.18 Verbio

- 9.19 Wilmar International

- 9.20 Zilor