PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1871066

PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1871066

Modern Card Issuing Platforms Market: 2025-2030

'Modern Card Issuing Platforms Market to Surpass $4.2 Billion by 2030, as Juniper Research Reveals Global Leaders Driving Fintech Innovation'

| KEY STATISTICS | |

|---|---|

| Total transaction value in 2025: | $1.8bn |

| Total transaction value in 2030: | $4.2bn |

| 2025 to 2030 market growth: | 129% |

| Forecast period: | 2025-2030 |

Overview

Our "Modern Card Issuing Platforms Market" research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from banks, financial institutions, fintech companies, and technology vendors to understand future growth, key trends, and the competitive environment.

Modern card issuing platforms are card management systems which utilise an application programming interface (API)-driven approach; allowing businesses to seamlessly integrate card issuance and management capabilities into their services. This provides benefits to card issuers, such as the ability to tokenise virtual cards to both digital and mobile wallets, push provisioning from mobile banking apps, and instant and personalised issuance of physical cards. Furthermore, modern card programmes provide an integrated solution to help banks modernise their financial services without overhauling their legacy systems.

The suite includes several different options that can be purchased separately, including access to data mapping the adoption and future growth of modern card issuing platforms, an insightful study uncovering the latest trends and opportunities within the market, and a document containing extensive analysis of the 22 market leaders in the modern card issuing space. The coverage can also be purchased as a Full Research Suite, containing all these elements, and including a substantial discount.

Collectively, they provide a critical tool for understanding this rapidly emerging market; allowing banks, other card issuers, and modern card issuing platforms to shape their future strategy. Its unparalleled coverage makes this research suite an incredibly useful resource for charting the future of such an uncertain and fast-growing market.

All report content is delivered in the English language.

Key Features

- Market Dynamics: Insights into key trends and market expansion challenges within the modern card issuing platforms market. These address the changing payments landscape; how data can be used to drive customer engagement and loyalty, developments in fraud management, and analysis of the many modern card issuing use cases. The research also features a Country Readiness Index on the current development and segment growth of the modern card issuing platforms market across 8 Key Regions, as well as providing a future outlook.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the modern card issuing platforms market; accompanied by strategic recommendations for stakeholders.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 22 modern card issuing vendors, via the Juniper Research Competitor Leaderboard; featuring market size for major players in the modern card issuing industry.

- Benchmark Industry Forecasts: The modern card issuing dataset includes forecasts for total revenue of modern card issuing platforms, split by credit, debit, and prepaid cards, and commercial and personal cards. It also includes penetration rates for modern card issuing platforms as a proportion of total payment cards being issued.

SAMPLE VIEW

Market Data & Forecasting Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

SAMPLE VIEW

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the "Modern Card Issuing Platforms" market includes access to the full set of forecast data of 48 tables and 18,500 datapoints.

Metrics in the research suite include:

- Total Number of Payment Cards

- Total Number of New Payment Cards Issued by Modern Card Issuing Platforms

- Total Revenue for Modern Card Issuing Markets

These metrics are provided for the following key market verticals:

|

|

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via 5 interactive scenarios.

Market Trends & Strategies Report

This report examines the Modern Card Issuing Platforms market landscape in detail; assessing trends and factors shaping the evolution of this rapidly growing market. The report delivers comprehensive analysis of the strategic opportunities for modern card issuers; addressing key verticals and their developing challenges, and highlighting how stakeholders should navigate these. It also includes evaluation of key country-level opportunities for modern card issuers and card growth.

Competitor Leaderboard Report

This report provides a detailed evaluation and market positioning for 22 leading vendors in the Modern Card Issuing Platforms space. These vendors are positioned as established leaders, leading challengers, or disruptors and challengers based on capacity and capability assessments:

|

|

|

This document is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction and Definitions

- 2.2. History of Card Issuing

- 2.3. Modern Card Issuing Process

- Figure 2.1: The Lifecycle of Card Issuing

- 2.4. Analysis of Technological Capabilities of Modern Card Issuing Platforms

- 2.4.1. Granular Card Controls and Customisation

- 2.4.2. Data Intelligence and Embedded Insights

- 2.4.3. Embedded Payments Infrastructure

- 2.5. What Can Modern Card Issuing Platforms Offer to Cardholders?

- 2.5.1. Personalisation

- 2.5.2. Tailored Rewards & Loyalty Programmes

- 2.5.3. Flexibility in Payments

- 2.6. Which Related Services to Card Issuing Can Card Issuers Provide?

- 2.6.1. Issuer Processing

- 2.6.2. Advanced Data Analytics

- 2.6.3. Chargebacks and Dispute Handling

- 2.6.4. Spending Controls

- 2.6.5. Biometric Cards

- 2.6.6. Real-time Fraud Detection with AI/ML

- 2.6.7. Wearables

- 2.6.8. BIN Sponsorship

3. Key Trends & Drivers

- 3.1. Key Trends & Drivers

- 3.1.1. Hyper-personalisation

- 3.1.2. Visa Flexible Credential and Mastercard's One Credential

- Figure 3.1: Flexible Card Credentials

- 3.1.3. Card-as-a-Service to Transform Non-banking Industries

- 3.1.4. AI-driven Fraud Prevention and Spend Controls

- 3.1.5. Mastercard's and Visa's Click to Pay

- 3.1.6. Sustainability & Eco-friendly Solutions

4. Segment Analysis

- 4.1. Credit and Charge Cards

- 4.2. Debit Cards

- 4.3. Virtual Cards

- 4.4. Cryptocurrency Cards

- 4.5. Prepaid Cards

- 4.5.1. Prepaid Cards in the Public Sector

- 4.5.2. Use Case: Payroll

- 4.6. Credit Unions: The US

5. Country Readiness Index

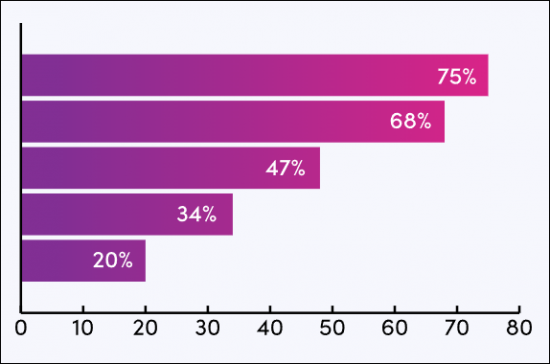

- 5.1. Introduction to Country Readiness Index

- Figure 5.1: Country Readiness Index: Regional Definitions

- Figure 5.2: Juniper Research Country Readiness Index Scoring Criteria: Modern Card Issuing Platforms Market

- Figure 5.3: Juniper Research Country Readiness Index: Modern Card Issuing Platforms Market 2025

- Figure 5.4: Modern Card Issuing Platforms Country Readiness Index: Market Segments

- 5.1.1. Focus Markets

- i. High eCommerce Activity

- Figure 5.5: Number of Payment Cards Issued by Modern Card Issuing Platforms (m), Split by Top Eight Countries in Focus Markets, 2025-2030

- ii. Virtual Cards and Corporate Spend Controls

- iii. United States

- i. High eCommerce Activity

- 5.1.2. Growth Markets

- i. Regulatory Tailwinds Driving Modernisation

- Figure 5.6: Total Number of Payment Cards Issued by Modern Card Issuing Platforms in Growth Markets (m), 2025-2030

- ii. Digitalisation & Smartphone Penetration

- iii. Saudi Arabia

- i. Regulatory Tailwinds Driving Modernisation

- 5.1.3. Saturated Markets

- Figure 5.7: Number of Payments Cards Issued by Modern Card Platforms in Saturated Markets (m), Split by Top Eight Countries, 2025-2030

- 5.1.4. Developing Markets

- i. Prevalence of Mobile Money

- Figure 5.8: Number of Payments Cards Issued by Modern Card Issuing Platforms in Developing Markets (m), Split by Six Key Countries, 2025-2030

- ii. Low Interchange Revenue

- Figure 5.9: Juniper Research Country Readiness Index Heatmap: North America

- Figure 5.10: Juniper Research Country Readiness Index Heatmap: Latin America

- Figure 5.11: Juniper Research Country Readiness Index Heatmap: West Europe (1 of 2)

- Figure 5.11: Juniper Research Country Readiness Index Heatmap: West Europe (2 of 2)

- Figure 5.12: Juniper Research Country Readiness Index Heatmap: Central & East Europe

- Figure 5.13: Juniper Research Country Readiness Index Heatmap: Far East & China

- Figure 5.14: Juniper Research Country Readiness Index Heatmap: Indian Subcontinent

- Figure 5.15: Juniper Research Country Readiness Index Heatmap: Rest of Asia Pacific

- Figure 5.16: Juniper Research Country Readiness Index Heatmap: Middle East Africa

- i. Prevalence of Mobile Money

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report

- Table 1.1: Juniper Research Competitor Leaderboard: Modern Card Issuing Vendors Included & Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard for Modern Card Issuing Platforms

- Table 1.3: Juniper Research Modern Card Issuing Platforms: Vendors & Positioning

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap: Modern Card Issuing Vendors (Part 1 of 2)

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap Modern Card Issuing Vendors (Part 2 of 2)

2. Company Profiles

- 2.1. Vendor Profiles

- 2.1.1. ACI Worldwide

- i. Corporate

- Table 2.1: ACI Worldwide Financial Performance Snapshot ($m), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.2: ACI Issuing Solution

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.2. Adyen

- i. Corporate

- Table 2.3: Adyen Financial Performance Snapshot ($bn), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.3. CR2

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. Enfuce

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.4: Enfuce's Product Innovation

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. Entrust

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. FIS

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. Fiserv

- i. Corporate

- Table 2.5: Fiserv Financial Information Snapshot ($bn), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.8. Galileo

- i. Corporate

- Table 2.6: Galileo Revenue and Total Accounts Snapshot, 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.9. G+D

- i. Corporate

- Table 2.7: G&D Financial Information Snapshot ($m), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.8: G+D's Innovative Cards Portfolio

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.10. Hips

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. i2c

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.12. IDEMIA

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.13. Marqeta

- i. Corporate

- Table 2.9: Marqeta Financial Information Snapshot ($m), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.14. Modulr

- i. Corporate

- Table 2.10: Modulr Financial Information Snapshot ($m), 2020-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.15. Nexi

- i. Corporate

- Table 2.11: Nexi Group Financial Snapshot (m), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.16. NymCard

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.17. Paymentology

- i. Corporate

- Table 2.12: Paymentology Financial Snapshot ($m), 2020-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.18. Paynetics

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.19. Pismo

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.20. Stripe Issuing

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.21. Thales

- i. Corporate

- Table 2.13: Thales Financial Information Snapshot ($bn), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.14: Thales Group's Card Programme

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.22. Zeta

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. ACI Worldwide

- 2.2. Juniper Research Competitor Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretations

- Table 2.15: Juniper Research Competitor Leaderboard Scoring Criteria - Modern Card Issuing

- 2.2.1. Limitations & Interpretations

- 2.3. Related Research

Data & Forecasting

1. Market Overview

- 1.1. Introduction

- 1.2. Methodology & Assumptions

- Figure 1.1: Modern Card Issuing Platforms Market Forecast Methodology

2. Market Summary

- 2.1. Total Volume of Payment Cards in Issue

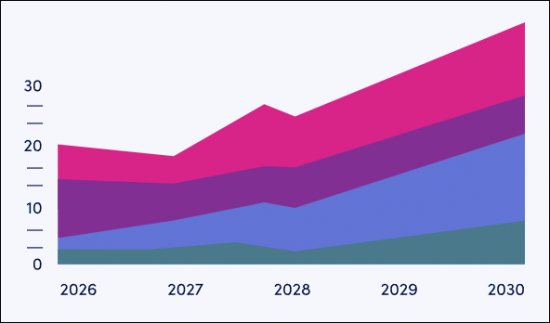

- Figure & Table 2.1: Total Volume of Payment Cards in Issue (m), Split by 8 Key Regions, 2025-2030

- 2.2. Total Volume of Payment Cards Issued per annum by Modern Card Issuing Platforms

- Figure & Table 2.2: Total Number of Payment Cards Issued by Modern Card Issuing Platforms (m), Split by 8 Key Regions, 2025-2030

- 2.2.1. Total Volume of Payment Cards Issued by Modern Card Issuing Platforms per annum, Split by Card Type

- Figure & Table 2.3: Total Number of Payment Cards Issued by Modern Card Issuing Platforms (m), Split by Segment

- 2.2.2. Total Volume of Payment Cards Issued by Modern Card Issuing Platforms per annum, Split by Card Application

- Figure & Table 2.4: Total Number of Payment Cards Issued by Modern Card Issuing Platforms (m), Split by Card App, 2030

- 2.3. Total Revenue of Modern Card Issuing Platforms, Split by Region

- Figure & Table 2.5: Total Revenue of Modern Card Issuing Platforms ($m), Split by 8 Key Regions, 2025-2030

- 2.3.1. Total Revenue of Modern Card Issuing Platforms, Split by Card Type

- Figure & Table 2.6: Total Revenue From Modern Card Issuing Platforms ($), Split by Card Type, 2025-2030

- 2.3.2. Total Revenue of Modern Card Issuing Platforms, Split by Card Application

- Figure & Table 2.7: Total Revenue From Modern Card Issuing Platforms ($m), Split by Application, 2025-2030

3. Segment Split

- 3.1. Credit Card Issuance

- 3.1.1. Total Number of Credit Cards in Issue

- Figure & Table 3.1: Total Number of Credit Cards in Issue (m), Split by 8 Key Regions, 2025-2030

- 3.1.2. Number of Credit Cards Issued by Modern Card Issuing Platforms

- Figure & Table 3.2: Total Number of Credit Cards Issued by Modern Card Issuing Platforms (m), Split by 8 Key Regions, 2025-2030

- 3.1.3. Total Revenue From Credit Cards Issued by Modern Card Issuing Platforms

- Figure & Table 3.3: Total Revenue From Credit Cards Issued by Modern Card Issuing Platforms, ($), Split by 8 Key Regions, 2025-2030

- 3.1.1. Total Number of Credit Cards in Issue

- 3.2. Prepaid Cards

- 3.2.1. Total Number of Prepaid Cards in Issue

- Figure & Table 3.4: Total Number of Prepaid Cards in Issue, (m), Split by 8 Key Regions, 2025-2030

- 3.2.2. Number of Prepaid Cards Issued by Modern Card Issuing Platforms

- Figure & Table 3.5: Total Number of Prepaid Cards Issued by Modern Card Issuing Platforms (m), Split by 8 Key Regions, 2025-2030

- 3.2.3. Total Revenue From Prepaid Cards Issued by Modern Card Issuing Platforms

- Figure & Table 3.6: Total Revenue From Prepaid Modern Card Issuance ($m), Split by 8 Key Regions, 2025-2030

- 3.2.1. Total Number of Prepaid Cards in Issue

- 3.3. Debit Cards & Other

- 3.3.1. Total Number of Debit & Other Payment Cards in Issue

- Figure & Table 3.7: Total Number of Debit & Other Payment Cards in Issue (m), Split by 8 Key Regions, 2025-2030

- 3.3.2. Number of Debit & Other Cards Issued by Modern Card Issuing Platforms per annum

- Figure & Table 3.8: Total Number of Debit & Other Payment Cards in Issue (m), Split by 8 Key Regions, 2025-2030

- 3.3.3. Total Revenue From Debit & Other Cards Issued by Modern Card Issuing Platforms

- Figure & Table 3.9: Total Revenue From Debit & Other Cards Modern Card Issuance ($m), Split by 8 Key Regions, 2025-2030

- 3.3.1. Total Number of Debit & Other Payment Cards in Issue

- 3.4. Commercial Cards

- 3.4.1. Number of Commercial Payment Cards Issued by Modern Card Issuing Platforms

- Figure & Table 3.10: Number of Commercial Payment Cards Issued by Modern Card Issuing Platforms (m), Split by 8 Key Regions, 2025-2030

- 3.4.2. Total Revenue From Commercial Payment Cards Issued by Modern Card Issuing Platforms

- Figure & Table 3.11: Total Revenue From Commercial Cards Issued by Modern Card Issuing Platforms, ($m), Split by 8 Key Regions, 2025-2030

- 3.4.1. Number of Commercial Payment Cards Issued by Modern Card Issuing Platforms

- 3.5. Personal Application

- 3.5.1. Number of Personal Payment Cards Issued by Modern Card Issuing Platforms

- Figure & Table 3.12: Total Number of Personal Payment Cards Issued by Modern Card Issuing Platforms (m), Split by 8 Key Regions, 2025-2030

- 3.5.2. Total Revenue From Personal Payment Cards Issued by Modern Card Issuing Platforms

- Figure & Table 3.13: Total Revenue From Personal Payment Cards Issued by Modern Card Issuing Platforms ($), Split by 8 Key Regions, 2025-2030

- 3.5.1. Number of Personal Payment Cards Issued by Modern Card Issuing Platforms