PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445709

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445709

Germany Prefabricated Housing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

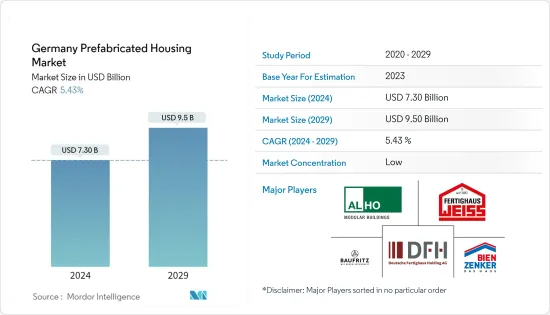

The Germany Prefabricated Housing Market size is estimated at USD 7.30 billion in 2024, and is expected to reach USD 9.5 billion by 2029, growing at a CAGR of 5.43% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic slightly impacted the prefabricated housing market in Germany. Due to COVID-19 restrictions, many construction projects were delayed or canceled. However, despite the pandemic, 5,564 prefabricated houses were approved in Q1 2020, 12.8% more than in the same period last year. The overall market grew by just 2.1% to 24,108 newly approved one- and two-family houses.

- The rise in the overall construction industry and increasing prices are contributing to the increasing turnover of the prefabricated housing industry in Germany. In 2022, along with the general boom in residential construction in the country, the share of prefabricated housing solutions in residential construction increased, standing at more than 23%. Additionally, the high demand for turnkey or prefabricated houses and energy-efficient buildings contributes to the market's growth.

- Meanwhile, an increasing labor shortage is another factor driving the prefab construction role in the German residential market. In addition, industry experts say that modular production, coupled with modern digital processes, offers the opportunity to build a faster and more efficient structure while saving resources at the same time.

- In 2022, Saint-Gobain Germany acquired Bruggemann, a company specializing in the production of prefabricated wood-based solutions, to provide a complete range of sustainable solutions in the country. Thus, growing labor shortages, construction costs, and increasing concern about sustainability may drive prefabricated housing in Germany.

Germany Prefabricated Housing Market Trends

Prefabricated Buildings are Witnessing Significant Growth

Prefabrication construction has been growing over the past few years, with more than 30% penetration of prefabs in the country compared to the United States. In addition, Germany is utilizing prefabrication to renovate outdated apartments and achieve net zero targets. One of the German factories is utilizing robots to assemble panels and mold them to fit precisely over the walls of an old apartment building. These panels have built-in insulation, which helps the building reduce energy usage significantly.

The renovation of the old building is gaining traction in the country, posing a major challenge in achieving net zero transitions. In addition, many outdated, inefficient buildings, which are a major source of global climate emissions, are driving prefab retrofitting in the country. In 2022, a German start-up named Ecoworks created a new system that takes a 3D scan of an old building, both inside and out, and creates a digital twin of the structure. This digital twin expedites the prefab panels manufacturing as per the requirement.

In addition, the factory produced prefab panels, including windows, ventilation, and channels for pipes. Also, manufacturers provide modular roofs with built-in solar panels, which can be installed in less than 20 minutes and convert the entire building into energy-efficient structures free from fossil fuels. Thus, the sustainability goals set by the country are driving prefab adoption. In 2021, there were more than 334,000 tons of prefabricated buildings (whether complete or already assembled), at a growth rate of 5% compared to the previous year.

Increasing Costs of Construction Driving the Market

The residential building construction costs continuously rose in Germany, driven by high international demand. In addition, construction material prices are spiking in the country due to limited transportation capacities. In November 2021, according to the Federal Statistical Office statistics, conventional residential building construction witnessed a growth rate of 14.4% compared to the same month in the previous year. The rising costs of conventional construction are driving the adoption of prefabricated structures in the country.

The major reason behind the construction prices spiking was the rise in prices of building materials. In January 2022, wood, steel, and insulation materials became expensive compared to the previous year. In addition, in terms of structural work, the prices for carpentry and wood construction witnessed a growth rate of more than 38%. Additionally, roofing and roof waterproofing (17%), plumbing (16%), and concrete work (16%) rose significantly.

The high demand for land and shortage of materials are also increasing construction costs. Currently, prices are growing more sharply than in over five decades. In addition, most of the construction and civil engineering companies experienced supply shortages. Thus, the supply shortages in construction materials and rising costs are fuelling the prefab structure market in the country.

Germany Prefabricated Housing Industry Overview

The prefab housing market in Germany is fragmented, with several international and domestic companies operating in the prefab housing market. The market is expected to grow during the forecast period due to the increase in the prefabricated housing construction investments and upcoming major projects in the country. Major players are Deutsche Fertighaus Holding, Bien Zenker, ALHO Systembau GmbH, Baufritz, and Fertighaus Weiss GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Insights on Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis of the Prefabricated Housing Industry

- 4.4 Cost Structure Analysis of the Prefabricated Housing Industry

- 4.5 Insights on Different Types of Materials Used in Prefabricated Housing Construction

- 4.6 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single-family

- 6.1.2 Multi-family

7 COMPETITIVE LANDSCAPE

- 7.1 Overview

- 7.2 Company Profiles

- 7.2.1 Deutsche Fertighaus Holding

- 7.2.2 Bien Zenker

- 7.2.3 ALHO Systembau GmbH

- 7.2.4 Baufritz

- 7.2.5 Fertighaus Weiss GmbH

- 7.2.6 Huber & Sohn

- 7.2.7 Luxhaus

- 7.2.8 Regnauer Fertigbau GmbH

- 7.2.9 Daiwa House Modular Europe Ltd

- 7.2.10 Budenbender Hausbau GmbH

- 7.2.11 Living Haus*

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Marcroeconomic Indicators (GDP Breakdown by Sector, Contribution of Construction to Economy, etc.)

- 9.2 Key Production, Consumption, Exports, and Import Statistics of Construction Materials