PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440280

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440280

Prefabricated Housing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

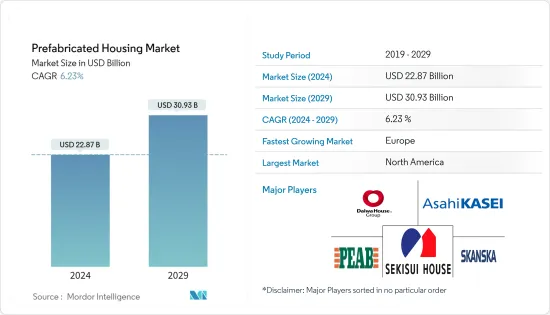

The Prefabricated Housing Market size is estimated at USD 22.87 billion in 2024, and is expected to reach USD 30.93 billion by 2029, growing at a CAGR of 6.23% during the forecast period (2024-2029).

Key Highlights

- The construction industry has also seen delays in finishing projects due to labor shortages and a global supply deficit in several common building materials, including steel, paint, cement, wood, cabinets, and electrical components. Compared to pre-pandemic levels, building material wait times have, at best, doubled and, at worst, increased by more than ten times. Construction projects will experience completion delays and increased cost pressure due to the unfavorable weather affecting the U.S. East Coast since the start of 2022.

- The modular building market expands as demand rises, even though it accounts only for a small portion of the USD 1 trillion construction industry. Prefabrication is becoming increasingly popular because of its on-site effectiveness, increased worker productivity and safety, and cheaper construction costs. In addition to these advantages, modular construction offers fantastic prospects for more responsible use of building materials and environmentally friendly designs. It also marks a significant advancement in environmental sustainability.

- Not all mobile houses are modular. According to the American Housing Survey, 80% of manufactured homes are still at the original location where they were first installed. A manufactured home can be moved for between USD 5,000 and 10,000 or even USD 20,000, depending on the distance, licenses and taxes, and the house size. The U.S. Census Bureau estimates about 7 million prefabricated homes in the country (7.5% of all single-family homes). It is good to see that more than 80% of contractorsalready embraceg off-site building techniques like modularization.

- Due to various causes, including a tight labor market, rising input costs, and increased demand due to government incentives, the construction and building industries have experienced significant price inflation in most U.S. states. However, the problems above are beginning to affect all types of construction. The cost rises traditionally started in residential construction. According to the Australian Bureau of Statistics, the country has witnessed a record amount of construction activity from January 2021 to September 2021, valued at more than USD 141.2 billion.

Prefabricated Housing Market Trends

Expansion of prefabricated housing to drive the market

- Prefabricated housing was once a temporary solution to a problem in recent history, but it soon turned into a long-term fix. Prefab houses are currently seeing a modern comeback throughout Europe, accounting for 23% of the country of Germany's housing stock. The U.K. construction company TopHat is growing and plans to create a massive factory the following year that can produce one modular home per hour.

- In the U.S., there is a clear demand for more housing. At the end of the previous year, the shortage, in our estimation, was around 3.5 million units. The Great Recession caused a more than ten-year underproduction, accompanied by labor shortages and supply chain issues brought on by the pandemic. In five years, it is predicted that the U.S. will need to construct roughly 1.7 million new homes yearly to close the housing gap.

- Humungous preference for project homes, mid-rise residential constructions, and public housing projects will steer the growth of the prefabricated housing industry in Europe. Massive demand for one & two-family houses in countries such as Austria, Germany, Italy, Poland, Switzerland, the U.K., and Scandinavia.

- In Italy, the prefabricated market for wood goods is expanding, as seen by the increased production of cross-laminated timber (CLT). CLT output in the "DACH" region (Germany, Austria, and Switzerland), the Czech Republic, and Italy totals over 750,000 m3 and is increasing at more than 10% annually.

- Legal & General Modular Homes, in particular, formed a strategic collaboration with affordable housing provider Vivid in December 2022, with plans to produce 1,000 prefabricated homes annually in the United Kingdom.

Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry

- Real estate values continued to increase globally in the first quarter of 2022, increasing 4.6% annually. This was due to the robust nominal house price growth (+11.2%), the first double-digit rate since the Great Financial Crisis (GFC), offset by the sharp increase in consumer price indices. (CPIs).

- EPACK PREFAB, a manufacturer of pre-engineered building solutions, is expanding its manufacturing footprint with an investment of INR198 crore (USD 23.75 Million) to set up a new facility spread over 25 acres in Andhra Pradesh.

- PEB structures are used in many industries, including aviation, to construct small airports, stadiums, and commercial and residential projects. It has two manufacturing plants in Rajasthan and Greater Noida, with a total capacity to produce 1,00,000 metric tonnes of prefabricated material annually, which will increase to 200,000 metric tonnes with the third plant.

- In Saudi Arabia, luxury resorts built as part of the Red Sea project will include prefabricated overwater and beach villas. In January 2023, Red Sea Global, the developer, also announced that the first batch of 73 prefabricated villas had arrived at the site. The installation of these units, along with many more that are to come in the future, will keep supporting the growth of the prefabricated construction market in Saudi Arabia.

- UAE-based construction developer ALEC also announced that the firm is expanding its ALEC Data Center Solution, the subsidiary firm that builds prefabricated facilities, in Saudi Arabia. The expansion is part of the strategy to capitalize on the growing demand for cloud services in the Middle East and Africa region.

- In the United States, Plant Prefab announced that the firm had raised USD 42 million in a mix of debt and equity rounds in December 2022. The firm is planning to use the funding to boost its manufacturing capabilities.

- In the United Kingdom, ilke Homes also announced that the firm had raised POUND 100 million in December 2022. Like Plant Prefab, Homes is also planning to invest part of the funding towards expanding its manufacturing capabilities, thereby supporting its growth plans.

Prefabricated Housing Industry Overview

The Global prefabricated housing market is fragmented and highly competitive without dominant players. Daiwa House Industry, Sekisui House, Asahi Kasei Corporation, Skanska AB, Peab AB, and many others are major players. Companies use environmentally friendly materials and manufacturing techniques to differentiate their products from competitors. Companies implement effective production technologies to minimize product costs and reduce related risks. High capital requirements and rapid technological advancement are important barriers to entry for new participants.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis of the Prefabricated Housing Industry

- 4.4 Cost Structure Analysis of the Prefabricated Housing Industry

- 4.5 Impact of COVID-19 on the Market

- 4.6 Insights on Different Types of Materials used in Prefabricated Housing Construction

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Increase FDI in construction in Asia-Pacific region

- 5.1.2 Minimized construction wastage

- 5.2 Restraints

- 5.2.1 Availability of skilled labour

- 5.3 Opportunities

- 5.3.1 Growth in E-commerce and online shopping

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single Family

- 6.1.2 Multi Family

- 6.2 By Region

- 6.2.1 North America

- 6.2.2 Asia-Pacific

- 6.2.3 Europe

- 6.2.4 GCC

- 6.2.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Overview

- 7.2 Company Profiles

- 7.2.1 Daiwa House Industry

- 7.2.2 Sekisui House

- 7.2.3 Asahi Kasei Corporation

- 7.2.4 Skanska AB

- 7.2.5 Peab AB

- 7.2.6 Ichijo

- 7.2.7 Swietelsky AG

- 7.2.8 Panasonic Homes

- 7.2.9 Laing O'Rourke

- 7.2.10 Champion Home Builders Inc.

- 7.2.11 Bouygues Batiment International

- 7.2.12 Derome AB*

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Marcroeconomic Indicators (GDP breakdown by sector, Contribution of construction to economy, etc.)

- 9.2 Key Production, Consumption,Exports & import statistics of construction Materials