PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690867

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690867

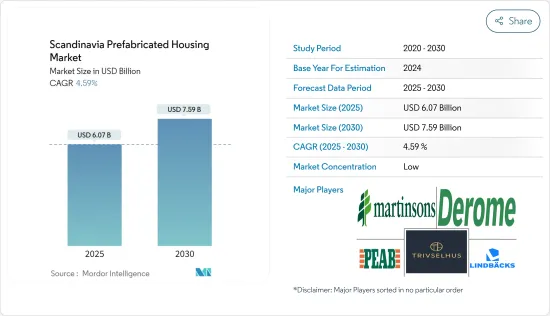

Scandinavia Prefabricated Housing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Scandinavia Prefabricated Housing Market size is estimated at USD 6.07 billion in 2025, and is expected to reach USD 7.59 billion by 2030, at a CAGR of 4.59% during the forecast period (2025-2030).

The COVID-19 pandemic in 2020 plunged the global economy into recession and led to declines in prefabricated housing construction in Europe, as the lockdown measures and the need to adjust construction practices to accommodate greater social distancing stopped or slowed down projects in the country.

In Scandinavia, several prefabricated building types have flourished in many advanced countries like Norway, Sweden, and Denmark. Modular construction is ideal for construction projects with deadlines, due to which it is increasingly employed in contractual construction projects, which is aiding the market growth. Further, the aim of green building solutions in this region is to boost the demand for modular construction and encourage large construction companies to ramp up investments in cutting-edge building technologies.

The market is driven by the government's plans to upgrade infrastructure. Emerging trends, which directly impact the dynamics of the prefabricated housing industry, include increased usage of cigarette butt bricks in the prefabricated housing industry and increased usage of fly-ash in concrete in prefabricated housing.

Sweden is one of the most developed markets for prefabricated construction in the world, with a high penetration rate. Sweden is widely regarded as a leading country in offsite manufacturing, leading the world in terms of the sheer number of panelized single-dwelling residences, representing over 80 percent of the country's overall housing market. Norway is in Northern Europe, where it borders Sweden, Finland, and Russia. The urban population in Norway is increasing. Today, over 80% of Norway's population lives in the cities, and the number is increasing.

Scandinavia Prefabricated Housing Market Trends

Prefabricated Home Building Expertise of Sweden Driving the Market

Sweden is the world leader in prefabricated building. As many as 84% of Swedish detached homes have prefabricated elements, compared with about 15% in Japan and 5% in the U.S., U.K. and Australia. Prefab and modular home-builders in Sweden have pioneered off-site construction and have figured out how to make it successful on a scale that few other places have matched. Sweden stands out as the foremost innovator in homebuilding process and energy performance in Europe. 96% of Swedish Housing is built using an off-site process, and on average Swedish houses consume less than 50% of the energy of American Homes.

Rapid urbanization and the need to overcome housing shortages have provided market space for prefabricated structures. Sweden is widely regarded as the leading country of offsite manufacturing, leading the world in terms of the sheer number of panelized single dwelling residences, which represent over 80% of the country's overall housing market. Sweden has the world's highest percentage of factory-built wooden houses in the world, mainly using closed wall panels and the trend is set to continue, with contemporary market stressors providing grist to the prefab mill.

Increase in Norway Prefabricated Housing Demand

Norway is located in Northern Europe, where it borders Sweden, Finland, and Russia. The urban population in Norway is increasing. Today, over 70% of Norway's population lives in the cities, and the number is increasing. Oslo is one of Europe's fastest-growing cities, and the population is expected to rise by 30% in 2030. In 2021, Norway's population was 5.4 million a 0.43% increase compared to the previous year. The highest number of urban residents can be found in the country's capital, Oslo, with approximately 1 million Norwegians living there. The statistic shows the degree of urbanization in Norway from 2018 to 2021. Urbanization means the share of the urban population in the total population of a country. In 2021, 71.37% of Norway's total population lived in urban areas and cities.

Due to the rising urban population, there is an increase in demand for prefabricated houses in the country. Many people are demanding prefabricated houses because of low cost and the less built time as compared to on-site built houses. In January 2022, the number of new home construction projects in Norway increased by 72% compared to the same month last year 2021. The construction of a total of 26,118 new buildings was started in the year 2021 which is 11% higher than in the previous year.

Scandinavia Prefabricated Housing Industry Overview

Scandinavia's prefabricated housing market is highly competitive with none of the players occupying the major share due to the trends of progressed urbanization and updated economic outlook. The market is fragmented, and it is expected to grow during the forecast period. In the Scandinavia region, in many advanced countries like Norway, Sweden, and Denmark several prefabricated building types have flourished. Some companies are making direct investments in housing construction through joint ventures or partnerships. Major players are Peab AB, Derome AB, Martinson Group AB, Lindbacks, and Trivselhus AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Background

- 1.2 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

- 2.5 Project Process and Structure

- 2.6 Engagement Frameworks

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis of the Prefabricated Housing Industry

- 4.4 Cost Structure Analysis of the Prefabricated Housing Industry

- 4.5 Impact of COVID-19 on the Market

- 4.6 Insights on Different Types of Materials used in Prefabricated Housing Construction

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints/Challenges

- 5.3 Market Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single Family

- 6.1.2 Multi Family

- 6.2 By Country

- 6.2.1 Sweden

- 6.2.2 Norway

- 6.2.3 Denmark

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Peab AB

- 7.2.2 Derome AB

- 7.2.3 Martinson Group AB

- 7.2.4 Lindbacks

- 7.2.5 Trivselhus AB

- 7.2.6 Gotenehus AB

- 7.2.7 Alvsbyhus AB

- 7.2.8 Anebyhusgruppen AB

- 7.2.9 Eksjohus AB

- 7.2.10 Astel Modular*

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX