PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851001

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851001

United Kingdom Retail Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

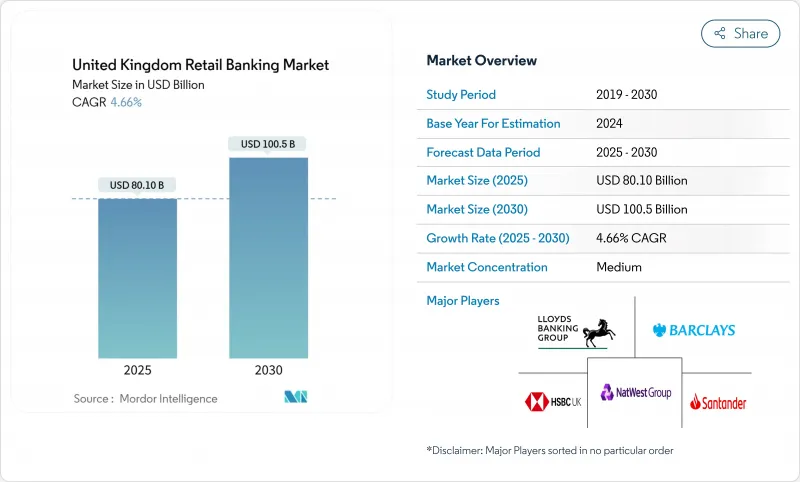

The United Kingdom retail banking market stands at a current value of USD 80.1 billion and is forecasted to reach a market size of USD 100.5 billion by 2030, reflecting a 4.66% CAGR.

Rising digital engagement, pro-innovation regulation, and rapid product diversification are allowing banks to unlock fresh revenue despite continuing macroeconomic pressures such as inflation and interest-rate volatility. Rate cuts delivered by the Bank of England in February and May 2025 are reshaping pricing power across mortgage and savings portfolios, while mandatory open-banking APIs continue to intensify customer mobility. Consolidation moves by large incumbents, paired with swift growth among neobanks, are accelerating a technology arms race that centres on mobile experience, data analytics, and ESG-linked products. Competitive emphasis is therefore shifting toward cost-to-serve efficiency, speed of product rollout, and balance-sheet agility, all of which underpin the medium-term expansion forecast for the United Kingdom retail banking market.

United Kingdom Retail Banking Market Trends and Insights

Bank Rate-Induced Expansion of Net-Interest Margins

The February and May 2025 Bank of England base-rate cuts to 4.5% and 4.25% have widened the spread between lending and funding costs for many institutions. Traditional lenders swiftly repriced new fixed-rate mortgages but moved more slowly on deposit rates, crystallizing a favorable lag that flowed directly into net-interest income. Early-2025 data show mortgage completions climbing 50%, confirming that borrowers still view fixed-rate products as attractive before further rate moves. Banks with large, low-cost retail deposit bases capture the greatest benefit, yet the FCA's Consumer Duty rules obligate clearer disclosure that could compress this advantage over time. As competition for refinances heats up, margin sustainability will hinge on disciplined product pricing and funding-cost optimization.

Mandatory Open-Banking APIs Accelerating Account-Switching & Aggregation

Standardized APIs let fintech platforms move current-account data between providers in minutes rather than weeks, cutting long-standing frictions that once anchored customers. Switch-rate acceleration is steering loyalty toward perceived service quality, pushing 42% of banks to place digital-experience upgrades at the top of their investment agendas. Third-party aggregators simultaneously harvest richer customer data, enabling highly personalized offers that deepen engagement. Institutions with advanced analytics turn this aggregated insight into cross-sell uplift, while laggards risk churn as users gravitate to interface-centric brands. Over a four-year horizon, continued ecosystem build-out is expected to keep customers switching above historic norms, sustaining upward pressure on product innovation across the United Kingdom retail banking market.

Interchange-Fee Caps Compressing Card-Fee Income

Regulation limits debit-card interchange to 0.2% and credit-card interchange to 0.3%, stripping an estimated GBP 480 million of annual income from banking book P&Ls. Larger banks spread the loss across diversified revenue, yet specialist card issuers must tilt toward interest-earning balances and subscription-style fees. Brexit-linked rises on United Kingdom-to-EEA transactions lifted fees as high as 1.5%, but impending PSR caps threaten to reverse those gains. In the near term, pressure on interchange economics complicates digital-wallet monetization strategies and slows credit-card innovation.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Mobile Banking in the United Kingdom

- Fixed-Rate Mortgage Maturity Wave Driving Re-Mortgage Volumes

- Branch Closures Creating Rural Financial Exclusion Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Loans contributed 31.2% to the United Kingdom retail banking market share in 2024, underscoring their central role in interest-income generation. The remortgage surge described earlier supports continued volume expansion, while competitive repricing and diversified mortgage features aim to maintain borrower stickiness. Buy-to-let lending grew 47% in Q4 2024, signaling investor confidence despite higher base-rate volatility. Transactional current accounts remain core relationship anchors but produce limited standalone revenue, motivating cross-sell strategies into higher-yielding credit lines.

The Other Products category is forecast to compound at 6.8% annually through 2030, outpacing core lending growth. ESG-linked deposits, mass-affluent wealth solutions, and embedded payments reinforce revenue resilience as margins narrow on traditional products. Debit-card volumes climbed to 2.2 billion transactions worth GBP 66.5 billion in March 2024. Savings instruments such as Bank of Scotland's 5.50% Monthly Saver attract funds that can be recycled into lending, lowering wholesale funding reliance. Collectively, product-line diversification is broadening the revenue base of the United Kingdom retail banking market.

Online channels held 52.4% of the United Kingdom retail banking market size in 2024, with digital transactions growing 7.2% annually. Every major institution now positions mobile as the default service gateway, blending payments, budgeting tools, and marketplace offers into a single interface. The 18% of adults who still visit branches monthly value face-to-face advisory for complex needs, illustrating that bricks-and-clicks integration remains essential.

Traditional networks are rationalizing footprints, yet post-office partnerships and video-banking kiosks sustain physical reach. Investment priorities skew toward cloud migration, API microservices, and cyber-resilience to safeguard the expanding digital perimeter. Over the forecast horizon, omnichannel fluency will be a defining competitive lever within the United Kingdom retail banking market.

The United Kingdom Retail Banking Market is Segmented by Product (Transactional Accounts, Savings Accounts, and More), Channel (Online Banking and Offline Banking), Customer Age Group (18-28 Years, 29-44 Years, and More), and Bank Type (National Banks, Regional Banks, and Neobanks & Others). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Lloyds Banking Group PLC

- Barclays Bank UK PLC

- HSBC UK Bank plc

- NatWest Group PLC

- Santander UK PLC

- Nationwide Building Society

- TSB Bank plc

- Virgin Money UK plc

- Metro Bank plc

- Starling Bank Limited

- Monzo Bank Limited

- Revolut Ltd.

- Atom Bank plc

- First Direct

- The Co-operative Bank plc

- Yorkshire Building Society

- Coventry Building Society

- OneSavings Bank (Kent Reliance)

- Tandem Bank Limited

- ClearBank Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Bank Rate-Induced Expansion of Net-Interest Margins

- 4.2.2 Mandatory Open-Banking APIs Accelerating Account-Switching & Aggregation

- 4.2.3 Rapid Adoption of Mobile Banking in the United Kingdom

- 4.2.4 Fixed-Rate Mortgage Maturity Wave Driving Re-Mortgage Volumes

- 4.2.5 Regulated 'Buy-Now-Pay-Later' Boosting Unsecured Lending Penetration

- 4.2.6 Rise of ESG-Linked Deposit Products under United Kingdom Green Finance Strategy

- 4.3 Market Restraints

- 4.3.1 Interchange-Fee Caps Compressing Card-Fee Income

- 4.3.2 Branch Closures Creating Rural Financial Exclusion Risk

- 4.3.3 FCA Consumer Duty Escalating Compliance & Product-Design Costs

- 4.3.4 Loan-Impairment Spike from Cost-of-Living Squeeze

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Transactional Accounts

- 5.1.2 Savings Accounts

- 5.1.3 Debit Cards

- 5.1.4 Credit Cards

- 5.1.5 Loans

- 5.1.6 Other Products

- 5.2 By Channel

- 5.2.1 Online Banking

- 5.2.2 Offline Banking

- 5.3 By Customer Age Group

- 5.3.1 18-28 Years

- 5.3.2 29-44 Years

- 5.3.3 45-59 Years

- 5.3.4 60 Years and Above

- 5.4 By Bank Type

- 5.4.1 National Banks

- 5.4.2 Regional Banks

- 5.4.3 Neobanks & Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Lloyds Banking Group PLC

- 6.4.2 Barclays Bank UK PLC

- 6.4.3 HSBC UK Bank plc

- 6.4.4 NatWest Group PLC

- 6.4.5 Santander UK PLC

- 6.4.6 Nationwide Building Society

- 6.4.7 TSB Bank plc

- 6.4.8 Virgin Money UK plc

- 6.4.9 Metro Bank plc

- 6.4.10 Starling Bank Limited

- 6.4.11 Monzo Bank Limited

- 6.4.12 Revolut Ltd.

- 6.4.13 Atom Bank plc

- 6.4.14 First Direct

- 6.4.15 The Co-operative Bank plc

- 6.4.16 Yorkshire Building Society

- 6.4.17 Coventry Building Society

- 6.4.18 OneSavings Bank (Kent Reliance)

- 6.4.19 Tandem Bank Limited

- 6.4.20 ClearBank Limited

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment