PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690893

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690893

ASEAN Lifestyle-Related Disease Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

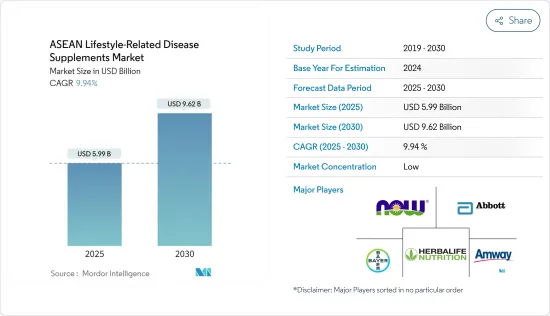

The ASEAN Lifestyle-Related Disease Supplements Market size is estimated at USD 5.99 billion in 2025, and is expected to reach USD 9.62 billion by 2030, at a CAGR of 9.94% during the forecast period (2025-2030).

The COVID-19 has increased the demand for various lifestyle-related disease supplements in the region on account of growing awareness and increasing expenditure on healthcare. Also, the consumers were spending more time at home which induced stress, anxiety, and others diseases. As the immune-health market soared in 2020, the demand for vitamin C witnessed massive growth across the region. The dramatic rise in vitamin C consumption was largely due to COVID-19. Thus, the extreme focus on the preventive healthcare systems, coupled with tough endorsements and marketing efforts of lifestyle enhancement products, is boosting the collagen supplements market.

Over the medium term, the high prevalence of lifestyle-related problems has resulted in an increasing number of consumers seeking health supplements on regular basis. The paradigm shift toward preventive health management practices, amid rising healthcare costs and the increasing burden of lifestyle diseases, is the major factor driving the market studied.

Furthermore, probiotics is a driving force within the booming digestive health supplement category, followed by enzymes/prebiotics. Additionally, according to the Malaysian Dietary Supplement Association (MADSA), the demand for cognitive, mental, and mood supplements is increasing due to mental illness and stressful career-focused lifestyles. Additionally, the increasing demand for plant-based/halal options is expected to push manufacturers to bring organic and clean-label products across the market channels.

ASEAN Lifestyle-Related Disease Supplements Market Trends

Increasing Demand for Preventive Health Care Products

The changing human lifestyle and its related impact on the body's dietary metabolism have impacted a lot over the period, resulting in an escalating rate of diseases, especially heart disease, stroke, diabetes, obesity, among others. Growing emphasis and awareness on the need to stay healthy and fit are the key drivers contributing to the growth of the market studied. These diseases are linked by the four most common preventable risk factors related to lifestyle, namely tobacco use, unhealthy diet, lack of physical activity, and alcohol use. Moreover, the growing working population and hectic lifestyle have made an adverse effect on boosting lifestyle-related diseases. Furthermore, the International Diabetes Federation reported that the mean overall diabetes-related expenditure per person with diabetes, in Southeast Asian countries increased, indicating a growing financial burden. Thus, the rising healthcare costs and benefits of preventive healthcare solutions have encouraged consumers to take their health into their own hands, equipping themselves with health information and taking well-informed purchasing decisions on lifestyle-related disease supplements.

Increasing Undernutrition and Geriatric Population is Propelling the Market Growth

The cumulative effect of undernutrition and the ascending aging population rate is acting as the largest target segments for lifestyle-related disease manufacturers across ASEAN countries. Singapore is currently one of the most rapidly aging societies in Asia, along with Japan. For instance, according to the Singapore Department of Statistics in 2020, consumers aged 65 years and above made up 15.2% of the total population in Singapore. Furthermore, the consumers are aware of their bone health while aging and try to support it by substantial bone and joint health supplements available in the market. Thereby, manufacturers are investing heavily in R&D to enhance their product portfolios and brand positioning through product differentiation. The increasing rate of the geriatric population and the prevalence of undernutrition among various demographic would offer a large opportunity for companies focused on developing products targeting health conditions.

ASEAN Lifestyle-Related Disease Supplements Industry Overview

The ASEAN lifestyle-related disease supplements market includes leading players such Amway, Bayer AG, Herbalife Nutrition Ltd, Now Foods, and Abbott. Players in the region are experimenting with their portfolios to meet the different forms, tastes, and size requirements of the ever-evolving consumers across the regions. Additionally, the increasing demand for plant-based/halal options is expected to push manufacturers to bring organic and clean-label products across the market channels. The global players dominate the ASEAN market with their wide range of offerings. Also, the major global players have the geographical reach and high brand awareness among consumers, which gives them an upper hand. Major players in the region have been focusing on mergers and acquisitions as a strategy to strengthen their product portfolio, so as to cater to a wide range of customers and expand to new regions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Heart Health Supplements

- 5.1.2 Bone and Joint Health Supplements

- 5.1.3 Digestive Health Supplements

- 5.1.4 Brain Health Supplements

- 5.1.5 Other Supplements

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Pharmacies and Drug Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

- 5.3 Country

- 5.3.1 Indonesia

- 5.3.2 Malaysia

- 5.3.3 Thailand

- 5.3.4 Vietnam

- 5.3.5 Singapore

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Positioning Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer AG

- 6.3.2 Amway Corporation

- 6.3.3 Mega Life Sciences

- 6.3.4 NOW Health Group Inc.

- 6.3.5 Herbalife Nutrition Ltd.

- 6.3.6 Abbott Laboratories

- 6.3.7 Reckitt Benckiser Group PLC

- 6.3.8 Blackmores Group

- 6.3.9 Nestle SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 IMPACT OF COVID-19 ON THE MARKET