PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437488

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437488

Lifestyle-Related Disease Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

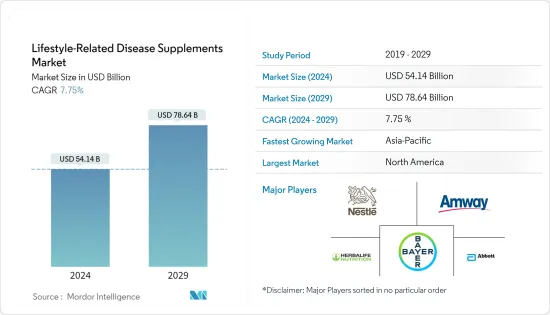

The Lifestyle-Related Disease Supplements Market size is estimated at USD 54.14 billion in 2024, and is expected to reach USD 78.64 billion by 2029, growing at a CAGR of 7.75% during the forecast period (2024-2029).

The pandemic has raised the demand for lifestyle-related diseases due to the growing consumer awareness about health supplements and increasing expenditure on healthcare. Moreover, during the pandemic period consumers are spending more time at home due to the extended lockdown which further induces anxiety, stress, and other types of disease. As a result, it increases, the sales of health supplements in the market. Subsequently, the demand for vitamin C has witnessed massive growth in the market during the pandemic period as it helps to improve immune function. Thus, market players are investing in the category and launching new products to gain market share and increase their market presence. For instance, in 2021, Life Extension unveiled the launch of a new vitamin C supplement which is innovative with 24-hour liposomal hydrogel formula that stays in the system for 24 hours and is seven times more bioavailable than conventional vitamin C supplements. Moreover, the growing importance of health as a lifestyle choice during the pandemic also attracted many companies to enter the health segments of the market studied.

Over the long term, the prevalence of lifestyle-related problems has been increasing among the global consumer owing to the changing lifestyle behaviors including consumption of unhealthy diet, and physical inactivity. As a result, it raises the consumption of health supplements. Therefore, the consumer shift toward preventive health management practices and growing awareness about the burden of lifestyle disease is the major factor driving the growth in the global market.

Furthermore, the demand for cognitive, mental, and mood supplements is increasing due to mental illness and stressful career-focused lifestyles and in turn, fuels the growth of the lifestyle-related disease supplements market.

Lifestyle Related Disease Supplements Market Trends

Growing Demand for Preventive Health Care Products

The changing consumer's lifestyle and its related impact on the dietary metabolism of the body have resulted in the escalating rate of diseases such as diabetes, obesity, heart disease, and stroke among others. Moreover, the growing working population and hectic lifestyle have made an adverse effect on boosting lifestyle diseases. For example, the insufficient physical activity associated with prolonged sitting hours may lead to digestive health issues involving constipation, bloating, and indigestion. As a result, consumers are largely demanding digestive health supplements to overcome these health issues.

Owing to the result of lifestyle diseases, consumers are more inclined toward a healthy lifestyle and increasingly consume dietary supplements in order to maintain their health conditions even after ages. Heart health and bone health supplement are widely consumed among global consumers due to the increasing prevalence of disease rates. For instance, according to World Health Organization, Cardiovascular diseases are the leading cause of death globally taking an estimated 17.9 million lives each year. Thus, the rising healthcare costs and benefits of preventive healthcare solutions have encouraged consumers to take their health into their own hands, equipping themselves with health information and taking well-informed purchasing decisions on lifestyle-related disease supplements.

Asia-Pacific is the Fastest Growing Region

The growth in lifestyle-related disease supplements has largely been driven by the increasing incidence of chronic disease rates coupled with growing consumer awareness about health supplements in the region. The increasing disposable income among the population has raised the consumers' expenditure on health-enhancing products in the region which in turn, drives the market growth. Additionally, the demand for supplements in countries like India, China, and Japan has increased in recent years, owing to the considerable presence of the aging population in such developing countries. For instance, according to the United States Census Bureau, there were an estimated 414 million Asian people age 65 and older, about 20% higher than the total U.S. population (331.4 million) in 2020. The lifestyle-related disease supplements market in the region is anticipated to offer significant investment opportunities, especially for herbal and Ayurveda extract-based products. This is because of the ample availability of raw materials in India and Southeast Asian countries. Moreover, partnerships between old and new players will likely strengthen market growth in these countries.

Lifestyle Related Disease Supplements Industry Overview

The global lifestyle-related disease supplements market includes market player such as Amway Corporation, Bayer AG, Nestle SA, Abbott Laboratories, and Herbalife Nutrition Limited among others. The supplements market has a wide scope, considering the existing companies. With prevalent FDA regulations, the leading players have an upper edge and continue to dominate the market. Also, the major global players have a geographical reach and high brand awareness among consumers, giving them an upper hand. Major players in the region have been focusing on innovation as a strategy to strengthen their product portfolio, to cater a wide range of customers, and expand to new regions. For instance, in March 2022, ByHealth, China's supplement brand, launched a collagen joint health product featuring Bioiberica ingredients. The product features native type II collagen branded ingredient Collavant n2 which has been clinically shown to improve knee discomfort and function.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Heart Health Supplements

- 5.1.2 Bone and Joint Health supplements

- 5.1.3 Digestive Health Supplements

- 5.1.4 Brain Health Supplements

- 5.1.5 Other Supplements

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Capsules

- 5.2.3 Others

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Pharmacies & Drug Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channel

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Abbott Laboratories

- 6.3.2 Bayer AG

- 6.3.3 Amway Corporation

- 6.3.4 Nestle SA

- 6.3.5 Herbalife Nutrition Limited

- 6.3.6 Otsuka Holdings inc.,

- 6.3.7 Swanson Health Products

- 6.3.8 Mega Lifesciences

- 6.3.9 Nordic Naturals

- 6.3.10 NOW Health Group Inc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 IMPACT OF COVID-19 ON THE MARKET

9 DISCLAIMER