PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851856

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851856

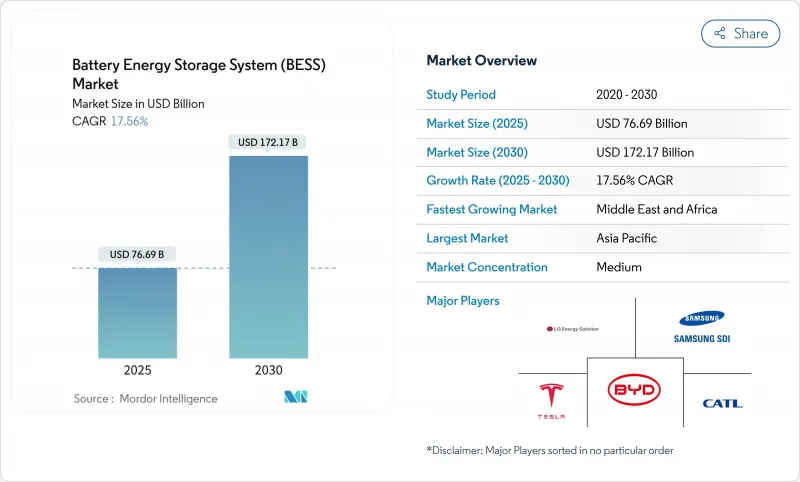

Battery Energy Storage System (BESS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Battery Energy Storage System Market size is estimated at USD 76.69 billion in 2025, and is expected to reach USD 172.17 billion by 2030, at a CAGR of 17.56% during the forecast period (2025-2030).

Rapid cost declines in lithium-ion cells, supportive procurement mandates, and rising grid-modernization spending are turning large-scale storage from a niche reliability tool into mainstream infrastructure. Policy tailwinds such as the Inflation Reduction Act in the United States and the Net-Zero Industry Act in the European Union have anchored multi-gigawatt project pipelines, while grid-forming inverter requirements are expanding revenue streams beyond energy arbitrage. Simultaneously, price parity for solar-plus-storage power purchase agreements (PPAs) in Australia and Chile proves that four-hour batteries can offer firm, evening-peak supply at competitive rates. Growing data-center electricity demand and politically driven supply-chain reshoring further reinforce the sector's momentum.

Global Battery Energy Storage System (BESS) Market Trends and Insights

Utility-scale procurement mandates in the United States, China, and the European Union

Mandated procurements are reshaping the development landscape. California's long-duration solicitation targets 2 GW, Power China tender seeks 16 GWh, and South Korea awarded 540 MW/3,240 MWh, giving developers visibility on revenue and bankability. In Europe, the Net-Zero Industry Act incentivizes domestic content, while recent Chinese reforms removed rigid allocation rules, letting market fundamentals guide economics. Such programs lower financing costs and channel volume to qualified integrators who meet grid-service performance guarantees.

Grid-forming inverter adoption unlocking co-location value

Moving from grid-following to grid-forming architectures lets batteries deliver synthetic inertia and voltage support, services that grid operators historically procured from synchronous generation. Transgrid's study showing 4.8 GW of grid-forming needs and Fluence's 300 MW Australian project highlight commercial viability. European operator TenneT foresees 5.2-12.7 GW storage by 2030, underscoring broad applicability. Added revenue from inertia products and strengthened interconnection terms improve project economics and favor hybrid solar-storage development.

Lithium and graphite processing bottlenecks

China processes 90% of global graphite, and Indonesia's nickel export bans push domestic refining, introducing concentration risk. Material shortages threaten cell production just as multi-gigawatt auctions surge. Start-ups such as Group14 are piloting silicon-rich anodes, but commercial volumes remain years away. Recycling programs can ease primary demand, yet logistic hurdles limit immediate impact for utility-scale projects that require high-purity inputs.

Other drivers and restraints analyzed in the detailed report include:

- PV-plus-storage PPA price parity in Australia and Chile

- EU and US supply-chain acts catalyzing domestic manufacturing

- Fire-safety code tightening under UL-9540A and NFPA-855

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium-ion maintained 88.6% battery energy storage system market share in 2024. Yet LFP's cost and thermal-stability advantages drive its 19% CAGR, exemplified by BYD's 40 GWh 2024 installations. NMC chemistries remain relevant where energy density matters, while vanadium flow and sodium-ion technologies attract niche interest for long-duration or high-cycle use. Lithium-ion variants' battery energy storage system market size is projected to widen as scaling lowers per-kilowatt-hour costs. Diversification across chemistries reduces supply-chain risk and opens project financing to asset-specific hedging structures.

Implementation tactics vary by region. Chinese players offer ultra-low-priced LFP racks, European utilities test sodium-ion for cold-weather resilience, and U.S. grid operators pilot zinc-bromine flow batteries for eight-hour services. These parallel pathways illustrate how chemistry choice is increasingly optimized for duty cycle rather than a one-size-fits-all paradigm.

On-grid systems captured 78% of 2024 deployments, supported by standardized interconnection and robust merchant revenue opportunities. The off-grid segment, however, is accelerating at 18.5% CAGR owing to rural electrification and industrial resilience requirements. Pakistan's import projection of 8.75 GWh by 2030 typifies emerging-market demand for microgrids that bypass weak national infrastructure.

Hybrid configurations that switch between grid and islanded mode are a rising subset, offering customers demand-charge reduction plus backup power. These flexible assets partake in wholesale markets through virtual-power-plant aggregation, a trend now codified in several U.S. independent system operators' tariff updates.

The Battery Energy Storage System (BESS) Market Report is Segmented Into Battery Type (Lithium-Ion, Lithium Iron Phosphate, and Others), Connection Type (On-Grid and Off-Grid), Components (Battery Pack and Racks, Power Conversion System, and Others), Energy Capacity Range (Below 100 MWh, and Others), End-User Application (Utility, Residential, and Others), and Geography (North America, Europe, Asia-Pacific, and Others).

Geography Analysis

Asia-Pacific retained a 50.4% share in 2024, powered by China's 70 million kW installed base that doubled yearly. India reached an inflection point with SECI's 1 GW/2 GWh auction, and Japan's 1.67 GW capacity-market awards validated storage's role in capacity adequacy. South Korea advanced a 540 MW tender, and LG Energy Solution exported multi-GWh systems to Europe and Japan, underscoring the region's manufacturing clout.

The Middle East and Africa are the fastest-growing regions at 19.5% CAGR. Saudi Arabia's 7.8 GW partnership with Sungrow and Egypt's 200 MWh AfDB-financed project illustrate large-scale commitments. South Africa's 1 GW awards highlight how storage addresses chronic grid instability. Moreover, the United Arab Emirates integrates 19 GWh with a 5.2 GW solar plant, pioneering baseload renewables in desert climates.

North America and Europe continue to post high absolute volumes. The United States hosts USD 100 billion in announced investments but suffers four-year interconnection queues for 2,600 GW of projects. Europe's Net-Zero Industry Act seeks to localize supply chains, yet over half of announced gigafactories face financing delays. Regional policy diversity-capacity markets in the United Kingdom, fleet mandates in Italy, and production credits in Canada-produces a mosaic of revenue models that sophisticated developers arbitrage.

- BYD Company Limited

- Contemporary Amperex Technology Co. Ltd. (CATL)

- LG Energy Solution Ltd.

- Panasonic Holdings Corp.

- Tesla Inc.

- Samsung SDI Co. Ltd.

- Fluence Energy Inc.

- ABB Ltd.

- Siemens Energy AG

- GE Vernova

- Hitachi Energy Ltd.

- Mitsubishi Power

- Sungrow Power Supply Co.

- Eaton Corporation plc

- Toshiba Corp.

- EVE Energy Co.

- VARTA AG

- Saft SAS (TotalEnergies)

- CellCube Energy Storage Systems Inc.

- Enphase Energy Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Methodology Scope

- 1.2 Market Definition

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Recent Trends & Innovations

- 4.3 Market Drivers

- 4.3.1 Utility-Scale Procurement Mandates in U.S., China & EU Accelerating Gigawatt-Scale Orders

- 4.3.2 Grid-Forming Inverter Requirements Unlocking Co-Location Value Stacks

- 4.3.3 PV-Plus-Storage PPA Price Parity in Australia & Chile

- 4.3.4 EU & U.S. Battery Supply-Chain Acts Creating Domestic Manufacturing Pull-Through

- 4.3.5 Data-Center & AI Load Growth Driving 4-Hr Storage Demand in North America

- 4.3.6 Second-Life EV Battery Availability Reducing CapEx in Asia

- 4.4 Market Restraints

- 4.4.1 Lithium & Graphite Processing Bottlenecks in Indonesia and Africa

- 4.4.2 Fire-Safety Code Tightening (UL-9540A, NFPA-855) Inflating Balance-of-Plant Costs

- 4.4.3 Long Interconnection Queues in U.S. ISOs Delaying FTM Project Revenues

- 4.4.4 High Interest-Rate Environment Compressing Merchant Revenue Stacks

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory and Policy Outlook

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lithium Iron Phosphate (LFP)

- 5.1.3 Nickel-Manganese-Cobalt (NMC)

- 5.1.4 Lead-acid

- 5.1.5 Others [Flow Batteries (Vanadium, Zinc-Br), Sodium-based (NaS, Na-ion)]

- 5.2 By Connection Type

- 5.2.1 On-Grid (Utility Interconnected)

- 5.2.2 Off-Grid (Micro-Grid, Hybrid)

- 5.3 By Component

- 5.3.1 Battery Pack and Racks

- 5.3.2 Power Conversion System (PCS)

- 5.3.3 Energy Management Software (EMS)

- 5.3.4 Balance-of-Plant and Services

- 5.4 By Energy Capacity Range

- 5.4.1 Below 100 MWh

- 5.4.2 101 to 500 MWh

- 5.4.3 Above 500 MWh

- 5.5 By End-user Application

- 5.5.1 Residential

- 5.5.2 Commercial and Industrial

- 5.5.3 Utility

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Nordic Countries

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Malaysia

- 5.6.3.6 Thailand

- 5.6.3.7 Indonesia

- 5.6.3.8 Vietnam

- 5.6.3.9 Australia

- 5.6.3.10 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 BYD Company Limited

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 LG Energy Solution Ltd.

- 6.4.4 Panasonic Holdings Corp.

- 6.4.5 Tesla Inc.

- 6.4.6 Samsung SDI Co. Ltd.

- 6.4.7 Fluence Energy Inc.

- 6.4.8 ABB Ltd.

- 6.4.9 Siemens Energy AG

- 6.4.10 GE Vernova

- 6.4.11 Hitachi Energy Ltd.

- 6.4.12 Mitsubishi Power

- 6.4.13 Sungrow Power Supply Co.

- 6.4.14 Eaton Corporation plc

- 6.4.15 Toshiba Corp.

- 6.4.16 EVE Energy Co.

- 6.4.17 VARTA AG

- 6.4.18 Saft SAS (TotalEnergies)

- 6.4.19 CellCube Energy Storage Systems Inc.

- 6.4.20 Enphase Energy Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment