PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851562

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851562

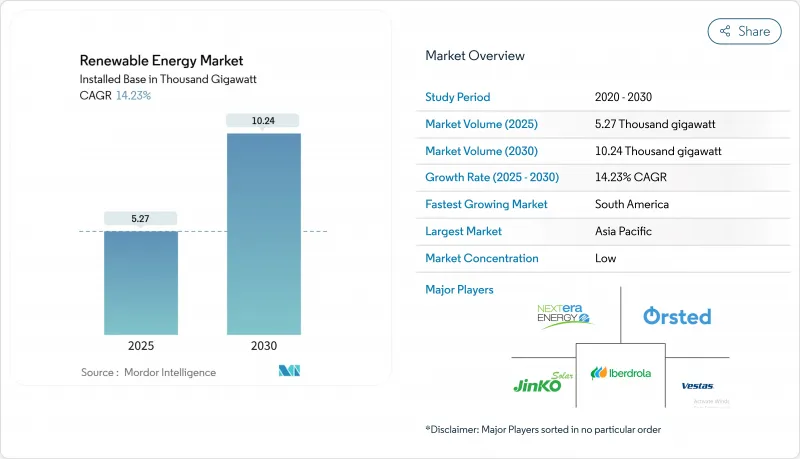

Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Renewable Energy Market size in terms of installed base is expected to grow from 5.08 Thousand gigawatt in 2025 to 7.04 Thousand gigawatt by 2030, at a CAGR of 8.94% during the forecast period (2025-2030).

A sharp fall in technology costs, supportive government policies, and rising corporate demand underpin this expansion. Solar power led the renewable energy market in 2024 with 42% of capacity and is forecast to grow at a 13% CAGR through 2030. Utility-scale projects remain the backbone of growth, but commercial and industrial (C&I) installations are gaining momentum as companies hedge against volatile fossil-fuel prices and tighten sustainability targets. Asia-Pacific holds the largest regional share, while South America is advancing the fastest on the back of pro-investment reforms and plentiful wind and solar resources.

Global Renewable Energy Market Trends and Insights

Corporate power-purchase agreements accelerating utility-scale builds in North America & Europe

Corporate power-purchase agreements (CPPAs) are now central to renewable energy procurement as tech firms and manufacturers lock in clean electricity for AI, cloud, and heavy-industry operations. An example is ENGIE's 85 CPPAs covering 4.3 GW signed in 2024, equal to 136 TWh of supply. Voluntary corporate offtake deals already support around half of new US utility-scale projects, providing developers with bankable revenue and lowering the cost of capital. Flexible "virtual" PPAs let buyers hedge price risk without physical delivery, although rising grid tariffs and complex contracting still deter smaller firms.

Hyperscale data-centre demand boosting solar-wind procurement in the Nordics & Ireland

Data-centre electricity demand is projected to reach 945 TWh by 2030, up from 415 TWh in 2024. Operators gravitate to the Nordics and Ireland for cool climates and abundant renewables. In May 2024 Microsoft signed a long-term CPPA that adds 30 MW of wind power from Lenalea Wind Farm in Ireland sse.com. Workload-shifting lets data centres act as flexible loads that absorb surplus wind power, reducing curtailment and increasing the renewable energy market's integration capability.

Grid congestion & curtailment risks in ERCOT (US) and Inner Mongolia (CN)

Solar and wind curtailment in ERCOT rose 29% in 2024 to 3.4 million MWh. West Texas resources and sparse transmission create bottlenecks that mirror China's Inner Mongolia, where similar constraints slow the renewable energy market. Battery storage and grid-enhancing devices are viable fixes, but deployment lags capacity additions, eroding developer revenue and deterring future projects.

Other drivers and restraints analyzed in the detailed report include:

- Green-hydrogen gigawatt pipelines driving capacity additions in MENA & Australia

- EU 'REPowerEU' fast-track permitting cutting onshore-wind lead times (<12 months) in Southern Europe

- End-of-life blade-waste regulations raising costs in Germany & France

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar commanded 42% of capacity in 2024 and will rise at 13% CAGR to 2030. Utility-scale solar is now the cheapest new generation option in many countries. The renewable energy market size for solar installations is forecast to expand by 80% by 2030, aided by perovskite-silicon tandem cells achieving 31.6% lab efficiencies. Module oversupply, however, is squeezing producer margins, prompting diversification into domestic manufacturing in the United States and Europe to trim reliance on Chinese imports.

Massive installations such as China's desert solar bases and India's ultramega parks illustrate economies of scale that drive cost parity with conventional power. Residential rooftop uptake is also improving through third-party ownership and virtual net metering, easing upfront costs for households. These trends cement solar's role as the leading contributor to renewable energy market capacity.

Onshore and offshore wind add diversity to the renewable energy market, growing at roughly 8% annually. Turbine ratings now exceed 18 MW offshore, lifting energy capture per foundation. Yet inflation and supply-chain stress lifted costs above bid levels, forcing renegotiation and, in some cases, cancellation of power-purchase agreements. The renewable energy market size for offshore wind is forecast to double by 2025, but developers seek greater policy predictability to de-risk capital allocation.

End-of-life blade recycling mandates in Europe and local-content rules in India illustrate how policy can inflate costs if supply chains lag. Competition from low-cost Asian turbines is pushing Western manufacturers to focus on service contracts, digital optimisation, and modular designs to retain market presence.

The Renewable Energy Market Report is Segmented by Technology (Solar Energy, Wind Energy, Hydropower, Bioenergy, Geothermal, and Ocean Energy), End-User (Utility, Commercial and Industrial, and Residential), and Geography (North America, Asia-Pacific, Europe, South America, and Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

Geography Analysis

Asia-Pacific owns 55% of the renewable energy market capacity, led by China's 64% share of new global additions in 2024. India's renewable energy market size is set to quadruple to 62 GW by 2030 under incentive schemes, while Southeast Asian nations tackle storage and grid constraints. Foreign direct investment topped USD 58 billion in 2024, underlining investor confidence despite policy variability.

South America posts the fastest growth at 16% CAGR. Brazil recorded solar and wind additions in 2024, though rising transmission charges and permitting delays temper investor enthusiasm. Chile and Colombia are also scaling up merchant solar projects, helped by growing spot-market liquidity.

North America benefits from US tax credits within the Inflation Reduction Act. Solar capacity will climb 35% by 2025, though grid congestion slows project energisation. Corporate PPAs now dominate procurement in Texas and the Midwest, aligning data-centre needs with abundant wind and solar resources.

Europe is targeting 1,200 GW of renewables by 2030 through REPowerEU. Spain doubled its renewable capacity despite grid bottlenecks, and Italy is piloting capacity-market reforms that reward flexibility. Supply-chain competition with low-cost Chinese manufacturers challenges the European wind sector, though revamped permitting rules are shortening lead times.

MENA leverages cheap solar irradiation for green hydrogen. Saudi Arabia shortlisted 3.7 GW of solar in its 2024 tender round, including the 2 GW Al Sadawi project. Egypt's Benban complex and the UAE's Al Dhafra plant showcase large-scale builds that feed domestic grids and future hydrogen export hubs.

- EPC Developers / Operators / Owners

- Equipment Suppliers

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Renewable Energy Mix, 2024

- 4.3 Market Drivers

- 4.3.1 Corporate Power-Purchase Agreements Accelerating Utility-scale Builds in North America & Europe

- 4.3.2 Hyperscale Data-Centre Demand Boosting Solar-Wind Procurement in the Nordics & Ireland

- 4.3.3 Green-Hydrogen Gigawatt Pipelines Driving Capacity Additions in MENA & Australia

- 4.3.4 EU 'REPowerEU' Fast-Track Permitting Cutting Onshore-Wind Lead-Times (<12 Months) in Southern Europe

- 4.4 Market Restraints

- 4.4.1 Grid Congestion & Curtailment Risks in ERCOT (US) and Inner Mongolia (CN)

- 4.4.2 End-of-Life Blade Waste Regulations Raising Costs in Germany & France

- 4.4.3 Lack of Long-Duration Storage Slowing High VRE Penetration in SE-Asia

- 4.4.4 Local-Content Mandates Inflating Offshore-Wind CAPEX in India & Brazil

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Recent Trends & Developments

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products & Services

- 4.9.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Energy (PV and CSP)

- 5.1.2 Wind Energy (Onshore and Offshore)

- 5.1.3 Hydropower (Small, Large, PSH)

- 5.1.4 Bioenergy

- 5.1.5 Geothermal

- 5.1.6 Ocean Energy (Tidal and Wave)

- 5.2 By End-User

- 5.2.1 Utility

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Nordic Countries

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Australia

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 EPC Developers / Operators / Owners

- 6.4.1.1 NextEra Energy, Inc.

- 6.4.1.2 Orsted A/S

- 6.4.1.3 Iberdrola, S.A.

- 6.4.1.4 EDF Renewables (EDF S.A.)

- 6.4.1.5 Duke Energy Corporation

- 6.4.1.6 Berkshire Hathaway Energy

- 6.4.1.7 Acciona Energia S.A.

- 6.4.1.8 Engie S.A.

- 6.4.1.9 China Three Gorges Corporation

- 6.4.1.10 Enel Green Power S.p.A.

- 6.4.1.11 Statkraft A.S.

- 6.4.1.12 Pattern Energy Group

- 6.4.1.13 Invenergy LLC

- 6.4.1.14 RWE Renewables GmbH

- 6.4.1.15 ACWA Power

- 6.4.1.16 EDP Renovaveis S.A.

- 6.4.1.17 Brookfield Renewable Partners L.P.

- 6.4.1.18 ReNew Energy Global PLC

- 6.4.1.19 Scatec ASA

- 6.4.2 Equipment Suppliers

- 6.4.2.1 First Solar, Inc.

- 6.4.2.2 Vestas Wind Systems A/S

- 6.4.2.3 Siemens Gamesa Renewable Energy S.A.

- 6.4.2.4 GE Vernova (General Electric)

- 6.4.2.5 JinkoSolar Holding Co. Ltd.

- 6.4.2.6 Canadian Solar Inc.

- 6.4.2.7 Longi Green Energy Technology Co., Ltd.

- 6.4.2.8 Goldwind Science & Technology Co., Ltd.

- 6.4.2.9 Trina Solar Co., Ltd.

- 6.4.2.10 Enphase Energy, Inc.

- 6.4.2.11 Sungrow Power Supply Co., Ltd.

- 6.4.2.12 Mitsubishi Power, Ltd.

- 6.4.2.13 Nordex SE

- 6.4.2.14 MHI Vestas Offshore Wind A/S

- 6.4.2.15 Shanghai Electric Group Co., Ltd.

- 6.4.2.16 Hitachi Energy Ltd.

- 6.4.2.17 ABB Ltd.

- 6.4.2.18 Climeon AB

- 6.4.2.19 Pelamis Wave Power Ltd. (in Administration)

- 6.4.2.20 Ocean Power Technologies, Inc.

- 6.4.1 EPC Developers / Operators / Owners

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment