PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850064

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850064

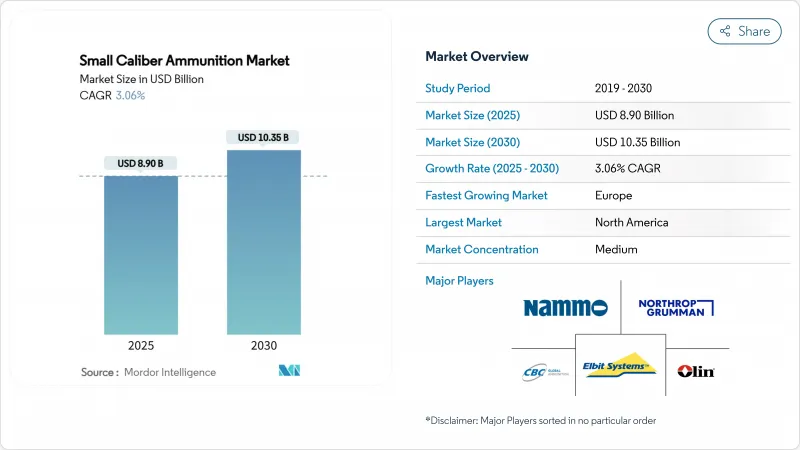

Small Caliber Ammunition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The small caliber ammunition market size was valued at USD 8.90 billion in 2025 and is forecasted to reach USD 10.35 billion by 2030 at a 3.06% CAGR.

Current growth rests on steady defense procurement, a rising civilian shooting base, and the US Army's decision to move from 5.56 mm to 6.8 mm ammunition. This shift is already influencing NATO partners and global supply chains. Near-term demand is underpinned by higher munition budgets in North America and Europe, while Asia-Pacific demand rises fastest as India and other regional militaries seek self-sufficiency. Civilian consumption remains resilient thanks to sustained hunting and target-shooting participation in the United States. Production, however, faces raw-material shortages after Chinese export controls on nitrocellulose and antimony, creating pressure on Western manufacturers to diversify sourcing. Environmental policy is another structural driver, pushing producers toward lead-free bullets and polymer cases.

Global Small Caliber Ammunition Market Trends and Insights

Defense Budget Growth Fueling Sustained Demand for Operational and Training Rounds

A global rise in defense spending is sustaining demand for combat and training ammunition. The US Department of Defense has earmarked USD 29.8 billion for munitions in fiscal-year 2025, including USD 5.9 billion allocated specifically to ammunition purchases. Many European governments have added EUR 5.5 billion (USD 6.38 billion) in new funding since 2021 to expand output capacity, responding to consumption lessons from the Ukraine conflict. Multi-year deals now dominate military procurement, allowing producers to plan capital investments confidently. In the Middle East, a USD 100 billion Saudi arms package underscores how regional tensions diversify demand away from traditional NATO customers.

Rising Civilian Ownership and Sporting Interest Sustaining Commercial Ammunition Sales

Recreational and hunting activity keeps the civilian channel buoyant. The National Instant Criminal Background Check System has processed more than 1 million checks every month for over four straight years, signaling consistent firearm acquisition and underlying ammunition consumption. Manufacturers showcase new premium lines at trade events such as the SHOT Show, while regulatory pilots incentivizing lead-free rounds at wildlife refuges offer compliant producers fresh opportunities. Growth in indoor ranges in densely populated areas also creates steady demand for ammunition engineered for confined-space shooting.

Stricter Firearm and Ammunition Export Controls Limiting International Trade Flows

National-security reviews are lengthening acquisition timelines and constraining cross-border consolidation. US authorities scrutinize every major transaction for supply-chain risk, and European licensing bodies apply similar rigor. These controls shield domestic producers yet limit overseas expansion for exporters, tilting competition toward players with large home markets.

Other drivers and restraints analyzed in the detailed report include:

- Military Ammunition Modernization Anchored in High-Performance Calibers

- Environmental Regulations Accelerating Transition to Lead-Free Ammunition

- Ongoing Supply Chain Disruptions Affecting Primer and Propellant Availability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The small caliber ammunition market size for 5.56 mm stood at 26.76% of global revenue in 2024 and remains significant due to widespread inventory and legacy weapon systems. However, 6.8 mm cartridges will expand at 7.89% CAGR through 2030 as US and allied militaries field new rifles. This growth layer compensates for the tapering procurement of older calibers. Over the forecast window, many NATO members will dual-source 5.56 mm and 6.8 mm ammunition, cushioning any abrupt logistical shift.

SIG Sauer's hybrid-case design illustrates why 6.8 mm is central to future lethality, offering higher chamber pressures without excessive weight or heat. Nordic testing programs and the British Army's caliber evaluations exemplify broader interest in next-generation ballistics. The segment, therefore, splits into legacy-maintenance and future-proof lines, creating rich demand for flexible producers.

Rifle ammunition formed 32.77% of 2024 global sales and remains indispensable for infantry operations and precision sport shooting. Even so, the small caliber ammunition market notices rising orders for compact rounds used in sub-machine guns, projected at a 5.12% CAGR to 2030. Urban counter-terror missions and police units value the shorter barrels and agility these platforms offer.

India's adoption of the Asmi machine-pistol signals the trend among militaries to complement rifles with lighter weapons that retain lethal stopping power. Ammunition companies respond by engineering cartridges with optimized burn rates to match shorter barrels, ensuring reliable cycling and terminal energy.

The Small Caliber Ammunition Market Report is Segmented by Caliber (5. 56 Mm, 6. 8 Mm, 7. 62 Mm, 9 Mm, 12. 7 Mm, and Other Calibers), Weapon Platform (Handguns, Rifles, Light Machine Guns, Sub-Machine Guns, and Shotguns), Bullet Type (Brass, Copper, and More), Lethality (Lethal and Less Lethal), End-Use (Military, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with a 29.89% revenue share in 2024, powered by the United States' USD 849.8 billion defense budget and a vibrant civilian shooting culture. Lake City Army Ammunition Plant alone supplies about 85% of the US military's small-caliber requirements while selling commercial overruns to the market. Federal and state programs promoting lead-free hunting keep product diversity high, forcing local producers to allocate R&D funds toward non-toxic formulas.

Asia-Pacific shows the fastest trajectory at a 4.90% CAGR to 2030. India's Atmanirbhar Bharat policy has directed substantial investment toward indigenous ammunition lines, and procurement delays from traditional suppliers push New Delhi to widen its vendor base. Regional flashpoints in the South and East China Seas further motivate nations to expand stockpiles. South Korea, for instance, maintains one of the world's largest 105 mm inventories and has signaled its willingness to provide ammunition to partners.

Europe is retooling its industrial base after the Ukraine conflict exposed supply shortfalls. Rheinmetall has raised annual artillery shell output by an order of magnitude, and the nine-country SAAT initiative seeks a harmonized ammunition standard to safeguard interoperability. At the same time, the European Chemicals Agency's lead-restriction roadmap compels European manufacturers to retrofit lines for copper-based bullets.

- Northrop Grumman Corporation

- Elbit Systems Ltd.

- Olin Corporation

- CBC Global Ammunition

- Nammo AS

- BAE Systems plc

- Beretta Holding S.A.

- Hornady Manufacturing, Inc.

- Fiocchi Munizioni S.p.A.

- Denel SOC Ltd.

- MESKO S.A.

- PT Pindad

- SIG SAUER, Inc.

- FN HERSTAL (FN Browning Group)

- Sellier & Bellot a.s. (Colt CZ Group SE)

- Barnaul Ammunition

- Prvi Partizan A.D.

- Rheinmetall AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Defense budget growth fueling sustained demand for operational and training rounds

- 4.2.2 Rising civilian ownership and sporting interest sustaining commercial ammunition sales

- 4.2.3 Military ammunition modernization anchored in high-performance calibers

- 4.2.4 Environmental regulations accelerating transition to lead-free ammunition

- 4.2.5 Lightweight polymer and hybrid casings driving multi-nation trials

- 4.2.6 Simulation and indoor training demand boosting specialized rounds

- 4.3 Market Restraints

- 4.3.1 Stricter firearm and ammunition export controls limiting international trade flows

- 4.3.2 Ongoing supply chain disruptions affecting primer and propellant availability

- 4.3.3 Rising raw material costs for copper and antimony inflating manufacturing expenses

- 4.3.4 Gradual defense pivot toward directed-energy weapons and unmanned system lethality reducing long-term demand

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Caliber

- 5.1.1 5.56 mm

- 5.1.2 6.8 mm

- 5.1.3 7.62 mm

- 5.1.4 9 mm

- 5.1.5 12.7 mm

- 5.1.6 Other Calibers

- 5.2 By Weapon Platform

- 5.2.1 Handguns

- 5.2.2 Rifles

- 5.2.3 Light Machine Guns (LMGs)

- 5.2.4 Sub-machine Guns (SMGs)

- 5.2.5 Shotguns

- 5.3 By Bullet Type

- 5.3.1 Brass

- 5.3.2 Copper

- 5.3.3 Steel

- 5.3.4 Others

- 5.4 By Lethality

- 5.4.1 Less Lethal

- 5.4.2 Lethal

- 5.5 By End-Use

- 5.5.1 Military

- 5.5.2 Homeland Security

- 5.5.3 Civilian

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Northrop Grumman Corporation

- 6.4.2 Elbit Systems Ltd.

- 6.4.3 Olin Corporation

- 6.4.4 CBC Global Ammunition

- 6.4.5 Nammo AS

- 6.4.6 BAE Systems plc

- 6.4.7 Beretta Holding S.A.

- 6.4.8 Hornady Manufacturing, Inc.

- 6.4.9 Fiocchi Munizioni S.p.A.

- 6.4.10 Denel SOC Ltd.

- 6.4.11 MESKO S.A.

- 6.4.12 PT Pindad

- 6.4.13 SIG SAUER, Inc.

- 6.4.14 FN HERSTAL (FN Browning Group)

- 6.4.15 Sellier & Bellot a.s. (Colt CZ Group SE)

- 6.4.16 Barnaul Ammunition

- 6.4.17 Prvi Partizan A.D.

- 6.4.18 Rheinmetall AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment