Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693664

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693664

Asia-Pacific Fuel Cell Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 209 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

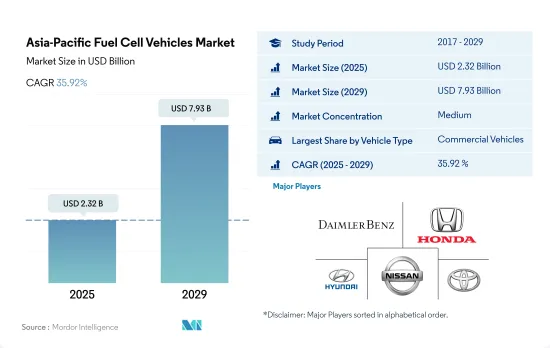

The Asia-Pacific Fuel Cell Vehicles Market size is estimated at 2.32 billion USD in 2025, and is expected to reach 7.93 billion USD by 2029, growing at a CAGR of 35.92% during the forecast period (2025-2029).

Demonstrates the region's advanced approach to implementing fuel cell technology in various vehicle types, indicating strong potential for hydrogen as a clean energy source in transportation

- The Asia-Pacific region is witnessing a surge in sustainable transportation, evident in its robust growth across diverse segments. From passenger cars to commercial vehicles, spanning light commercial pick-up trucks, vans, medium to heavy-duty trucks, and buses, the region is steadfastly embracing green mobility. Notably, the rising sales of fuel cell electric vehicles (FCEVs) in the passenger car segment highlight the region's leadership in adopting clean transportation. These sales saw a significant increase from 2017 to 2023, and the trend is projected to persist till 2030.

- In the commercial vehicle arena, both light and heavy-duty segments are poised for substantial growth, driven by a strategic emphasis on hydrogen fuel cell technology. Sales of light commercial pick-up trucks and vans have witnessed a remarkable surge, signaling a shift toward zero-emission vehicles tailored for the logistics and transportation sectors. This transition is bolstered by investments in hydrogen infrastructure and government incentives aimed at curbing carbon emissions.

- Medium and heavy-duty commercial trucks, alongside FCEV-powered buses, are also on a rapid growth trajectory, with sales volumes set to soar by 2030. The optimism surrounding FCEVs in the Asia-Pacific region underscores a significant move toward a hydrogen-based economy, setting a global precedent for clean energy adoption. Government initiatives, technological advancements, and the declining cost of green hydrogen production are pivotal factors in this transition, rendering FCEVs increasingly attractive for both commercial and passenger transportation.

The Asia-Pacific fuel cell vehicles market is gaining momentum, with specific countries leading the charge toward hydrogen fuel technology adoption

- These initiatives taken by governments across the world to adopt green energy mobility in order to curtail and curb transportation pollution are among the key factors that are projected to drive the fuel cell commercial vehicle market in the near future. In November 2019, the government-backed Chinese business, Beiqi Foton Motor, a truck and bus manufacturer, announced that it would invest USD 2.6 billion in alternative energy vehicles, including fuel cell engines. The company plans to deploy 200,000 new energy commercial vehicles by 2025.

- Several major OEM players are investing heavily in research and development, and they are entering strategic partnerships to enhance their technologies for commercial vehicles. In January 2020, Japan's Honda Motor and Isuzu Motors announced that they would jointly conduct research on the use of hydrogen fuel cells to power heavy-duty trucks, looking forward to expanding fuel-cell usage by applying zero-emission technology to larger vehicles. Such developments are expected to enhance the electric commercial vehicles market across Asia-Pacific.

- In 2020, South Korea extended the purchase subsidy for electric vehicles for passenger cars until 2024, and for buses and trucks, it was extended until 2025. The bonus is tied to a price cap. EVs priced below KRW 60 million are eligible for full subsidies, but vehicles priced between KRW 60 million and 90 million may receive only 50% of the full amount. Previously, up to KRW 8 million in subsidies were available per vehicle.

Asia-Pacific Fuel Cell Vehicles Market Trends

Asia-Pacific's auto loan interest rates reflected varying national economic strategies, with some countries emphasizing stimulation while others took a more conservative stance

- Over the past few years, there have been noticeable changes in these figures. Indonesia and India notably reduced their auto loan rates, signaling potential efforts to bolster the automotive sector in the face of fluctuating sales. Japan, adhering to its legacy, sustained its nominal rates, an indicator of its persistent ultra-loose monetary policy. Malaysia, after a sharp dip in 2021, seemed to regain its footing in 2022, hinting at an adaptive economic recalibration. New Zealand and the Philippines, meanwhile, navigated a descending path. Thailand, with a plunge in 2020, retraced some steps upward by 2022. Australia's journey was intriguing, with a steady climb each year, possibly indicating a blend of economic resilience and strategic divergence from its regional peers.

- During 2017-2023 period, Asia-Pacific showcased a panorama of fluctuating interest rates for auto loans. Indonesia stood out with the steepest rates oscillating between 10% and11%, clearly underlining its economic landscape. In stark contrast, Japan's rates remained consistently below 1%, reflecting its long-standing policy of low-interest rates to boost economic activity. Australia and New Zealand moved along a more stable trend with a slight increase by 2019. Meanwhile, the Philippines, though starting from a moderate base in 2017, marked a dramatic ascent, peaking over 7% in 2019. India maintained a steady rhythm, keeping within the 9-10% bracket, while Malaysia's course was slightly upward. Conversely, Thailand embraced a gentle downward slope.

The surging demand for electric vehicles (EVs) in Asia is prompting global automakers to introduce new offerings, thereby expanding the EV and battery pack market

- In response to the escalating demand for electric vehicles (EVs) in the Asia-Pacific region, numerous automakers are aligning their strategies to unveil innovative products tailored to this burgeoning market. One important instance is the announcement made by Skoda in January 2023, where it shared plans to introduce a cutting-edge electric SUV in India. This vehicle stands out due to its formidable 82-kWh battery, boasting an impressive range exceeding 500 kilometers on a singular charge. With its launch slated for late 2023, Skoda's move is emblematic of the broader trend sweeping across the region. Such introductions are poised to not only fuel the EV demand but also drive the proliferation of battery packs in various Asia-Pacific countries.

- As public transportation becomes increasingly integral to urban life in the Asia-Pacific, it is inspiring a new generation of manufacturers to debut novel, eco-friendly models. In a significant move in April 2022, the pioneering India-based startup, GreenCell Mobility, unveiled its electric mobility bus service brand, NueGo. GreenCell has plans to revolutionize intercity commutes by deploying 750 premium electric buses across three key regions in India, encompassing the South, North, and West. While the initial phase will witness the rollout of 250 buses across 24 cities, the long-term vision underscores the company's commitment to enhancing green public transportation. Such initiatives signal a promising surge in electric public transit solutions, setting the pace for broader adoption across Asia-Pacific in the coming years.

Asia-Pacific Fuel Cell Vehicles Industry Overview

The Asia-Pacific Fuel Cell Vehicles Market is moderately consolidated, with the top five companies occupying 60%. The major players in this market are Daimler AG (Mercedes-Benz AG), Honda Motor Co. Ltd., Hyundai Motor Company, Nissan Motor Co. Ltd. and Toyota Motor Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93064

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Logistics Performance Index

- 4.12 Used Car Sales

- 4.13 Fuel Price

- 4.14 Oem-wise Production Statistics

- 4.15 Regulatory Framework

- 4.16 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.1 Commercial Vehicles

- 5.2 Country

- 5.2.1 Australia

- 5.2.2 China

- 5.2.3 India

- 5.2.4 Indonesia

- 5.2.5 Japan

- 5.2.6 Malaysia

- 5.2.7 South Korea

- 5.2.8 Thailand

- 5.2.9 Rest-of-APAC

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ballard Power Systems

- 6.4.2 Daihatsu Motor Co. Ltd.

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Dongfeng Motor Corporation

- 6.4.5 Honda Motor Co. Ltd.

- 6.4.6 Hyundai Motor Company

- 6.4.7 Mazda Motor Corporation

- 6.4.8 Nissan Motor Co. Ltd.

- 6.4.9 Toyota Motor Corporation

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.