PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431555

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431555

Japan Credit Cards - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

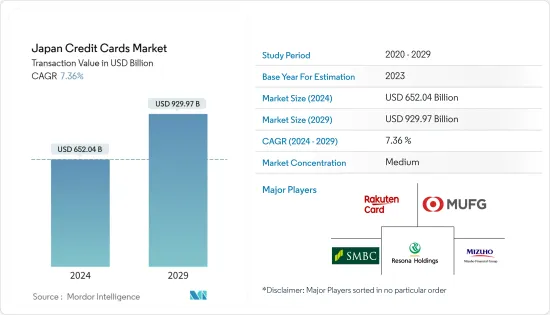

The Japan Credit Cards Market size in terms of transaction value is expected to grow from USD 652.04 billion in 2024 to USD 929.97 billion by 2029, at a CAGR of 7.36% during the forecast period (2024-2029).

Japan has a high credit card penetration rate, with a significant portion of the population using credit cards for their financial transactions. Credit card issuers in Japan offer various rewards and benefits to attract and retain customers. Cashback programs, travel rewards, discounts at partner merchants, and loyalty points are common features credit card providers offer.

JCB, a Japanese payment network, holds a significant share of the credit card market in Japan. Merchants across the country widely accept JCB cards. However, international payment networks like Visa and Mastercard also have a strong presence and are widely accepted. The credit card market in Japan has embraced technological advancements. Contactless payments, mobile payment solutions, and digital wallets, such as Apple Pay and Google Pay, are widely used in the country. Japanese credit card companies have also been at the forefront of developing and implementing security measures to protect against fraud and unauthorized transactions.

The Japanese government has implemented regulations to protect consumers in the credit card market. These regulations aim to ensure fee transparency, safeguard consumer data privacy, and address issues related to debt collection practices. The Japanese credit card market is influenced by cultural factors such as a preference for cash transactions, especially in smaller businesses and rural areas. However, there has been a gradual shift towards cashless payments, driven by government initiatives and consumer adoption of digital payment methods.

During the COVID-19 situation with social distancing measures and restrictions on in-person transactions, there was an accelerated shift towards online shopping and contactless payments in Japan. Consumers increasingly relied on their credit cards for e-commerce transactions and mobile payment solutions, such as digital wallets and QR code payments, to minimize physical contact.

Japan Credit Cards Market Trends

Increasing in Number of Credit Card issued

Credit cards have gained popularity among Japanese consumers, reflecting a shift from traditional cash-based transactions to electronic payment methods. Increased convenience, wider acceptance at merchants, and the availability of various rewards and benefits have contributed to the rising demand for credit cards. The consumption tax rate was raised from eight to ten percent. With the tax increase, the government of Japan introduced the cashless campaign, a rebate program intended to boost the use of cashless payments among consumers. The campaign was planned to run until the end of June 2020 - before the Summer Olympics 2020 in Tokyo, scheduled to start a month later. The rebate program included cashless payment methods like prepaid smart cards, credit and debit cards, and QR code payment services. Credit card issuers often partner with retailers, brands, and organizations to issue co-branded credit cards. These partnerships provide additional incentives and exclusive benefits for cardholders, fostering customer loyalty and driving the issuance of more credit cards. The Japanese government has encouraged cashless transactions and electronic payments as a growth strategy. This has led to initiatives promoting the use of credit cards and digital payment methods, contributing to the increase in the number of credit cards issued.

Credit Cards are the Major Payment Option for Digital Buyers in Japan

Credit cards were indeed a major payment option for digital buyers in Japan. However, it's important to note that the digital payments landscape can evolve quickly, and there may have been changes since then. Credit cards have been widely accepted and used in Japan for various transactions, including online shopping. Major credit card companies such as Visa, Mastercard, American Express, and JCB (Japan Credit Bureau) are well-established in the country and have a significant presence. Many Japanese consumers prefer using credit cards for their convenience, security features, and ability to accumulate reward points. Credit card companies in Japan often provide special deals and partnerships with merchants to incentivize card usage. This further encourages consumers to use credit cards for online purchases. Some credit card companies also offer installment payment options, making it easier for customers to manage larger purchases.

Japan Credit Cards Industry Overview

The credit card market in Japan is highly competitive, with a wide range of credit card options available to consumers. Credit cards are widely accepted, and the market continues to evolve with technological advancements and changing consumer preferences. Major banks and credit card companies dominate the credit card market in Japan. There are some prominent banks in Japan that provide credit card services. It's worth noting that some of these banks may collaborate with credit card companies or issue cards under their brand names.

Additionally, other regional and specialized banks in Japan offer credit cards to their customers. Companies leverage their existing customer base and banking relationships to provide credit card options to their customers. Technological advancements influence the competitive landscape. Mobile payment services, digital wallets, and contactless payment options are gaining popularity in Japan. Credit card companies and financial institutions are adapting to these trends by integrating mobile payment solutions or offering their digital wallet services. Following is the list of credit card companies in Japan: Rakuten Card, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, Mizuho Financial Group, and Resona Holdings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Usage of Credit Card give the bonus and reward points

- 4.3 Market Restraints

- 4.3.1 Interest rates on Credit Card

- 4.4 Insights on Various Regulatory Trends Shaping the Market

- 4.5 Insights on impact of technology in the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of High Inflation on Credit Card Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Card Type

- 5.1.1 General Purpose Credit Cards

- 5.1.2 Specialty & Other Credit Cards

- 5.2 By Application

- 5.2.1 Food & Groceries

- 5.2.2 Health & Pharmacy

- 5.2.3 Restaurants & Bars

- 5.2.4 Consumer Electronics

- 5.2.5 Media & Entertainment

- 5.2.6 Travel & Tourism

- 5.2.7 Other Applications

- 5.3 By Provider

- 5.3.1 Visa

- 5.3.2 MasterCard

- 5.3.3 Other Providers

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Rakuten Card

- 6.2.2 Mitsubishi UFJ Financial Group

- 6.2.3 Sumitomo Mitsui Financial Group

- 6.2.4 Mizuho Financial Group

- 6.2.5 Resona Holdings

- 6.2.6 Japan Post Bank

- 6.2.7 Aozora Bank

- 6.2.8 Norinchukin Bank

- 6.2.9 Shizuoka Bank

- 6.2.10 JCB (Japan Credit Bureau)*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US